FOMO Returns? 620K Retail Bitcoin Addresses Created Since BTC Reclaimed $20K

The start of the year has been highly positive for bitcoin and the entire cryptocurrency market, with BTC exceeding $24,000 for the first time since August 2022.

This came after a months-long bear market and untypical price stability at the end of last year when the asset stood helplessly below $17,000. Somewhat expectedly, though, the price increase has caught the attention of retail traders.

Retail Investors Back at it

2022 turned out to be one of the worst years for bitcoin in terms of price action, with the asset ultimately losing roughly 65% of its USD value by the end of it. There were multiple reasons behind this massive decline. Some included macroeconomic issues, such as the galloping inflation, but also the industry collapses of former giants like Terra and FTX harmed all participants.

Bitcoin had dumped below $17,000 at the end of 2022, and the first week of 2023 saw its inability to overcome that level. However, that finally happened on January 9, and BTC never looked back. Just the opposite, it skyrocketed to roughly $23,000 by the end of January, marking its best month in over a year.

Perhaps the most important moment after breaching $17,000 came when bitcoin jumped above the 2017 ATH of $20,000. This psychological line was also the point where retail investors decided to reenter the space, at least according to the analytics company Santiment.

Its latest tweet reads that addresses holding up to 0.1 BTC had stalled in 2022 but shot up in numbers amid the rally, growing by 620,000.

There have been ~620k small #Bitcoin addresses that have popped back up on the network since #FOMO returned on January 13th when price regained $20k. These 0.1 $BTC or less addresses grew slowly in 2022, but 2023 is showing a return of trader optimism. https://t.co/CUAS0nV23x pic.twitter.com/wo8NBDNXs3

— Santiment (@santimentfeed) February 6, 2023

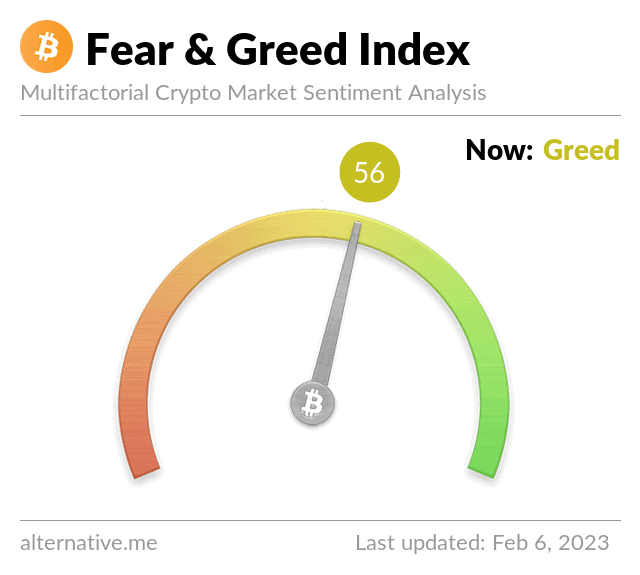

Greed Back in Town

Another natural development that resulted from the price surge was the change in the Fear and Greed Index. The metric, which shows the investors’ general feelings towards the primary cryptocurrency, went into greed territory for the first time in ten months just recently, as CryptoPotato reported.

The Index remained there for the next few weeks and even came close to extreme greed a couple of days ago when it tapped 61 (out of 100).

The post FOMO Returns? 620K Retail Bitcoin Addresses Created Since BTC Reclaimed $20K appeared first on CryptoPotato.