Following Massive Volatility, Will BTC Finally Break Above $30K? (Bitcoin Price Analysis)

Bitcoin has received support at the crucial 50-day moving average, located at $27,000. This has led to a rally that aims to break through the significant resistance level of $30K. Despite the cryptocurrency’s overall bullish outlook, there is potential for rejection from this price range.

Technical Analysis

By Shayan

The Daily Chart

Following a short-term correction, Bitcoin found support at the 50-day moving average, presently found at $27,300, resulting in another uptrend. This brought back the bullish sentiment.

However, Bitcoin’s recent price action indicates signs of weakness, as the positive sentiment appears insufficient to break through the next significant resistance region. If BTC manages to claim this crucial price level, an extended bullish rally could likely be anticipated.

The 4-Hour Chart

Bitcoin’s price has entered a critical range which lies between the powerful support level of $25,000 and the significant resistance region of $30,000. In recent times, the price has experienced substantial volatility within this range, resulting in massive red and green candles.

Despite this, the price is expected to consolidate within this crucial area in the short term. A breakout may potentially indicate the direction of Bitcoin’s upcoming trend.

On-chain Analysis

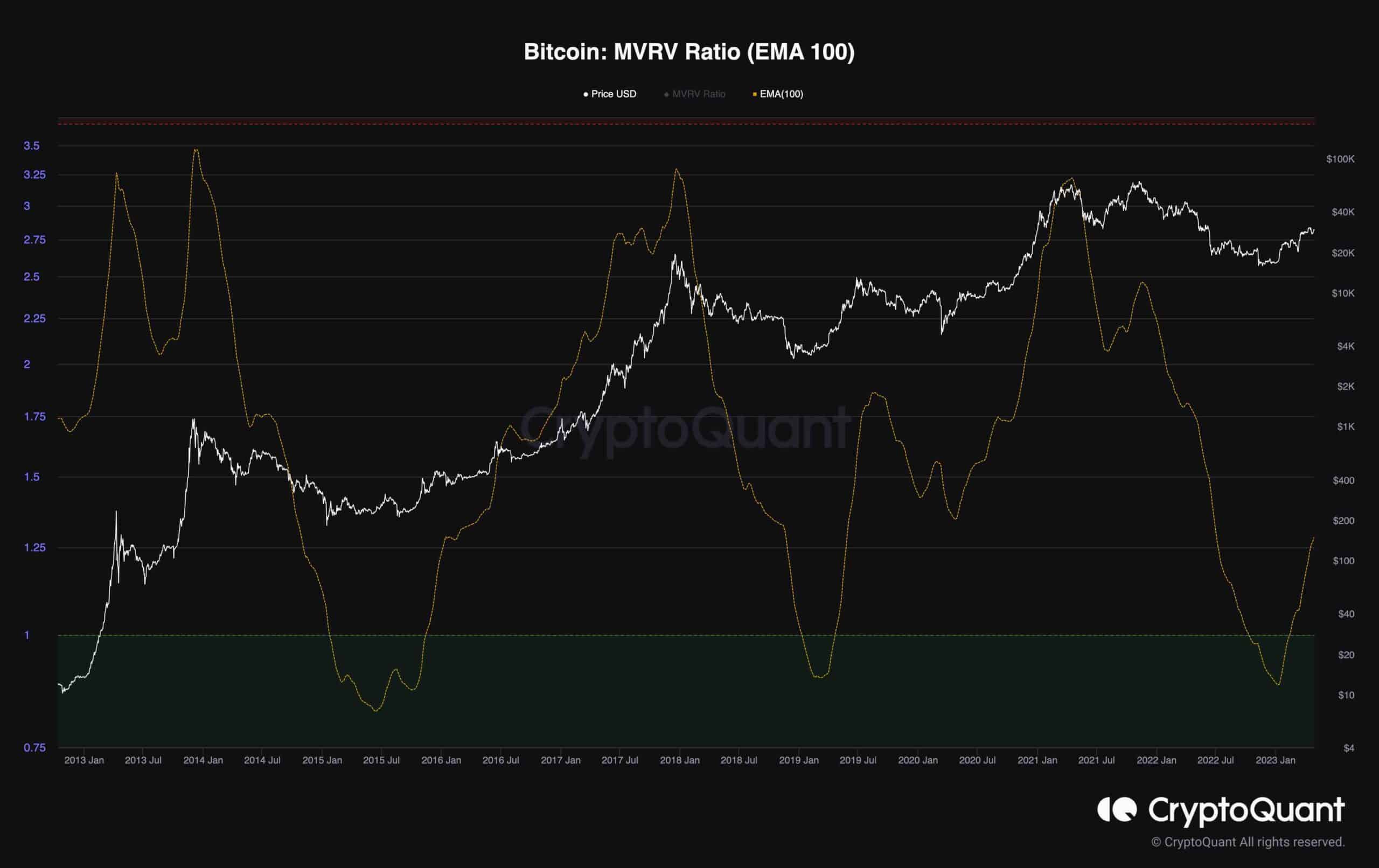

The following chart provides an excellent overview of Bitcoin’s price cycles alongside the MVRV metric, which represents the ratio of the coin’s market cap to its realized cap. This metric is used to determine if the price is overvalued.

Historically, the MVRV metric falls into the green zone during bearish market phases, indicating that Bitcoin is trading in the undervalued section and the cycle’s bottom is forming. However, as the chart clearly demonstrates, each time the MVRV metric has spiked above 1, Bitcoin has experienced a surge, initiating the bull market.

Bitcoin’s recent impulsive rally has caused a sharp increase in the MVRV metric. Therefore, the market may have entered a bullish mid-term stage, which could be followed by unexpected moves and high volatility.

The post Following Massive Volatility, Will BTC Finally Break Above $30K? (Bitcoin Price Analysis) appeared first on CryptoPotato.