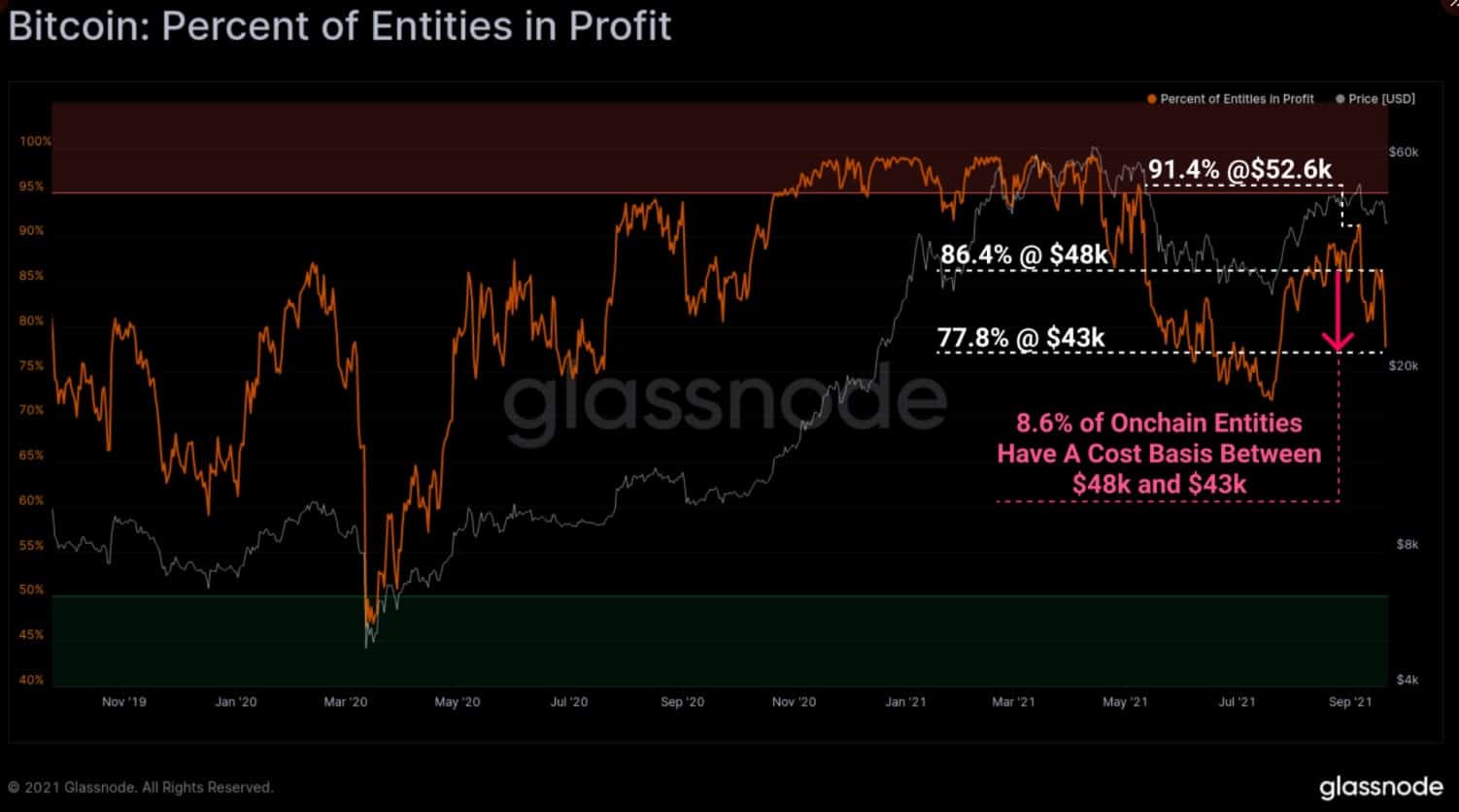

Following Bitcoin’s Drop, Addresses in Profit Slumped From 82% to 70%

Bitcoin’s most recent downturn also took a toll on the addresses that are in profit – they decreased from 82% to 70% in less than a couple of days.

- As CryptoPotato reported yesterday, the entire cryptocurrency market tumbled following a broader collapse of stocks throughout the world amid rising debt crunch fears in China.

- This saw over $800 billion worth of both long and short positions liquidated, and Bitcoin’s price tumbled to as low as $40,200 earlier today.

- The sharp decline also caused a lot of the addresses that were previously in profit – to not be. Precisely, the number of addresses in profit slumped from 82% to 70%.

- Glassnode also made a comment on the sharp move. According to them:

When the Bitcoim market eperiences significant price moves, we can assess the change in profitable on-chain entities to gauge zones of cost basis concentration.

Approximately 8.6% of on-chain entities (wallets with the same owner) have a cost basis between $43K and $48K.

- It’s interesting to see how the market will turn from its current point. Knowing that around 8.6% of on-chain entities have their coins bought between $43K and $48K means that they are currently either underwater or break even.