Flasko’s 3-Year Lock on Team Tokens and a Look at Tokenomics

Token lock or vesting period is vital in decentralized finance (DeFi) investments. The concept refers to a fixed period in which a token of a cryptocurrency project cannot be sold or traded.

Many investors have become victims of massive sell-offs because early token holders and project teams decided to liquidate their position once the crypto asset started trading in the open market.

Similarly, DeFi users have been scammed many times by fraudulent project developers who create worthless tokens, raise funds from investors, and quickly remove all the assets from the liquidity pool, thus making it impossible for traders to sell the tokens.

Thus, to ensure that investors are well protected, many DeFi projects have adopted vesting periods as a security strategy to prevent early holders and project developers from selling their tokens or removing liquidity until the token duration elapses.

As one of the newest projects in the industry, Flasko has adopted a vesting period for its team’s tokens, with plans to lock liquidity for over three decades to protect investors from rug pull. But before diving deeper into the details of the team’s token lock and the project’s tokenomics, let’s take a brief look at what Flasko is trying to achieve.

What is Flasko and How Does it Work?

Flasko is a blockchain-based platform that seeks to bridge the gap between alternative investments and the crypto world.

The platform gives retail investors easy access to the premium beverage market through non-fungible tokens (NFTs). In other words, with Flasko, users can invest in exclusive and luxury whiskeys, wines, and champagnes by trading NFTs.

Investors can purchase a fraction or whole NFTs, and those who buy 100% of NFT will have the assigned whiskey, wine, or champagne delivered to their designated address free of charge.

Flasko also has a VIP club comprising three tiers – the Whiskey Club, the Wine Club, and the Champagne Club. Each level has unique benefits available to a limited number of members.

Flasko Tokenomics

Like many crypto projects, Flasko has a utility token dubbed FLSK. The crypto asset powers the activities of the Flasko ecosystem, including governance.

FLSK has a total supply of 1 billion tokens. Here’s the breakdown of Flasko’s token allocations.

- Presale: 35%

- Marketing: 17.5%

- Development Team Wallet: 14%

- Charity: 1%

- Exchange Listings: 12.5%

- Partnerships: 5%

- Protocol Community Investments: 15%

The project also adopts a taxation system, where users who buy and sell the tokens must pay tax on each transaction. Purchasing the FLSK attracts a 7% tax while selling the asset attracts 14%. The revenue generated from the taxes is shared between marketing, liquidity pool, and burn.

Flasko’s 3-Year Lock on Team Tokens

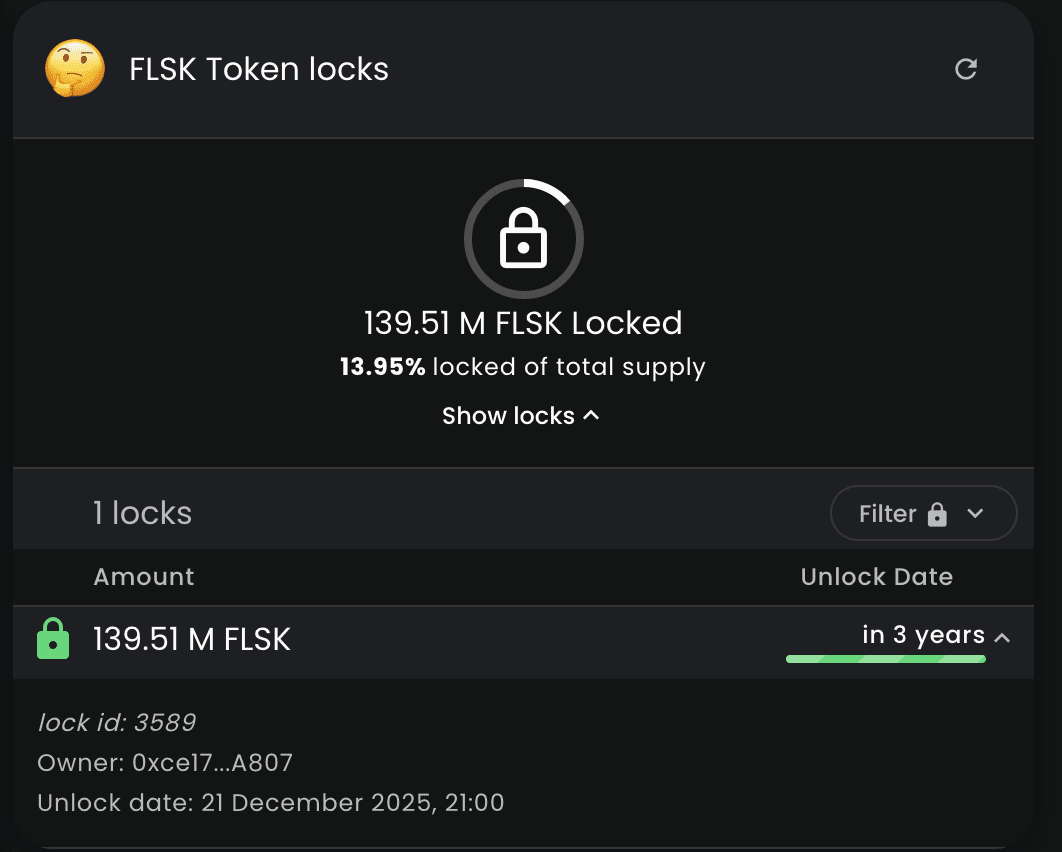

Flasko’s development team gets 140 million FLSK (14% of the token’s supply). However, the team will not be able to sell or transact with the tokens until 2025. This is because the tokens have been locked for three years. The move will ensure that the project’s team does not suddenly dump their tokens on retail investors before the stipulated time.

In addition to the three-year vesting period, the Flasko team intends to lock the project’s liquidity for 33 years. This means the developers cannot dramatically pull the rug out from under the community members.

The post Flasko’s 3-Year Lock on Team Tokens and a Look at Tokenomics appeared first on CryptoPotato.