FIS Partners With Fireblocks to Provide Crypto Trading and Defi for Institutional Clients

Israeli crypto custodian Fireblocks has partnered with FIS – the largest processing and payments company in the world – to bring crypto adoption to capital markets. FIS clients can now access a full suite of crypto investment solutions including trading, storage, and Defi.

Bringing Crypto to Institutions

According to a press release from the company, FIS is granting firms of all types “access to the largest crypto trading venues, liquidity providers, lending desks, and Defi applications.”

The announcement references a statistic suggesting that over two-thirds of institutional investors want to include digital assets in their portfolios. Indeed, a recent survey of financial advisors shows similar sentiment, with 72% of respondents showing interest in crypto investment if a US spot ETF is approved.

Investors like Kevin O’Leary and Michael Saylor have repeatedly highlighted the regulatory hurdle institutions need to overcome to access crypto markets. These challenges range from obscurity around government policy to internal company carters restricting investment in the space.

FIS will leverage the Fireblocks platform to let its corporate clients move, store, issue, and self custody their crypto assets. Networks for asset transfer, crypto staking, lending, and Defi will also be provided.

“As digital currencies become more mainstream, capital markets firms will greatly benefit from a single destination that helps them manage many classes of digital assets,” said Nasser Khodri, Head of Capital Markets at FIS. “This exciting new agreement is a proof point of our commitment to invest in growing our digital asset capabilities for our global client base.”

Michael Shaulov, Chief Executive Officer at Fireblocks, explained that the partnership brings their product to “nearly every type” of corporate institution in traditional assets.

A Massive Partnership

According to FIS’s website, the company manages half of the world’s wealth on its systems. FIS already offers money movement services, such as card to crypto, for four of the top five cryptocurrency exchanges.

The Fireblocks platform has seen tremendous growth in its own right. The company was valued at $8 billion in January and acquired First Digital for $100 Million the following month.

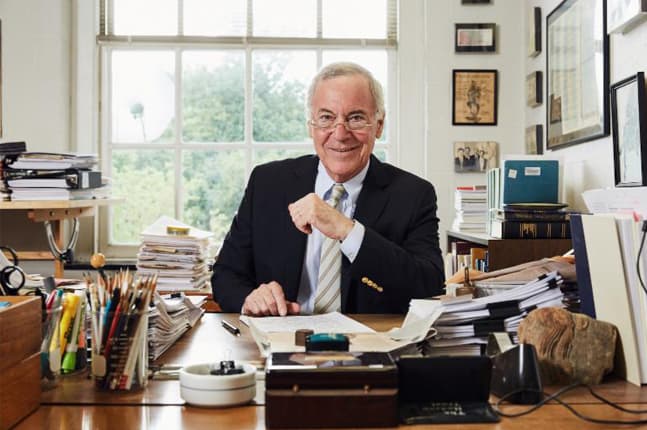

The institution has also been surprisingly popular with major former financial authorities. Previous SEC Chairman Jay Clayton joined the company last year as a regulatory advisor, while the Bank of England’s top executive joined Fireblocks just days ago.