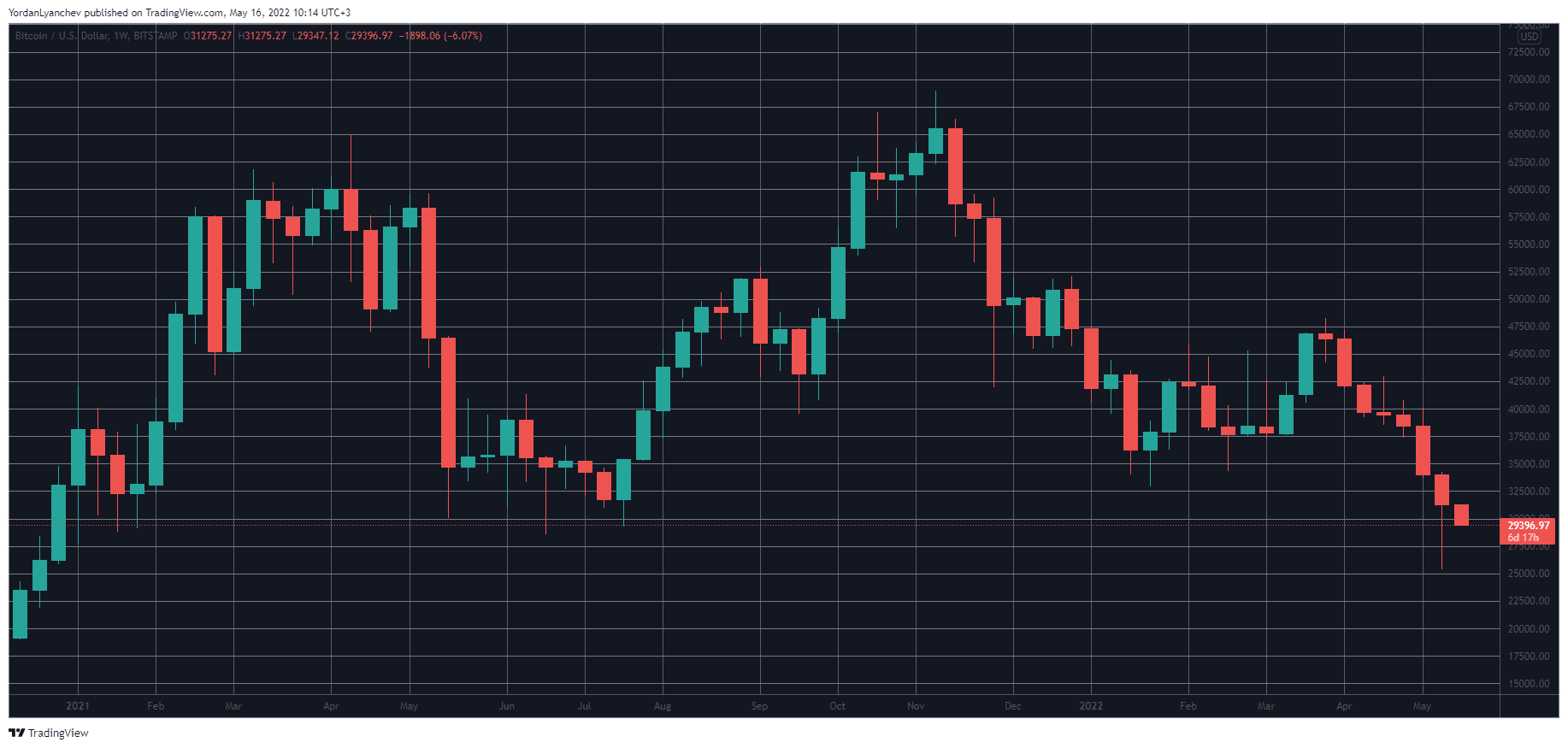

First Time in History: Bitcoin Closes in Red 7 Consecutive Weeks

The rollercoaster that transpired in the past seven days resulted in another weekly candle closed in the red for bitcoin. As such, the cryptocurrency made history in a rather negative week as this is the first time it closed in the red for seven consecutive weeks.

BTC Makes it 7 in a Row

CryptoPotato reported last week the adverse price developments that led to lower weekly closes for bitcoin for six weeks in a row – something the asset hadn’t seen in nearly eight years. However, the past seven days turned out to be even more violent.

The worst trading day came on May 12, when BTC slumped from just over $30,000 to its lowest price position since late December 2020 at $25,300. Despite bouncing off rather immediately and recovering several thousand dollars of value in days, the cryptocurrency still closed the weekly candle lower than the previous one.

This meant that it had created its longest bearish weekly streak with seven consecutive candles in the red (on Bitstamp).

It’s worth noting that the new weekly candle that started hours ago is once again red, but a lot can change in the crypto markets within seven days.

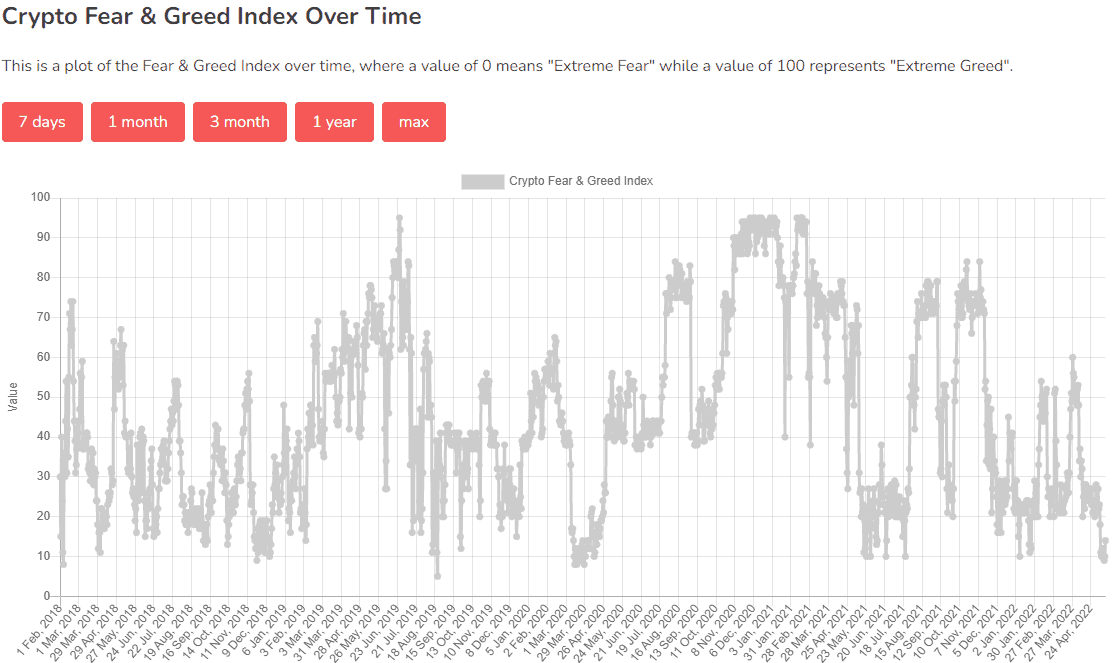

Extreme Fear Everywhere

With the aforementioned negative streak, it’s quite expected that the popular Fear and Greed Index has gone deep into “extreme fear” territory. The metric gauges various data, including surveys, volatility, social media comments, etc., to determine the general sentiment within the community in regards to BTC. The results range from 0 to 100 (extreme fear to extreme greed).

The graph below demonstrates that the Index plunged to its lowest position (extreme fear) since the COVID-19 crash showing 9 during the weekend. Despite recovering to above 10 as of now, the metric is still well within fear levels.

However, it’s worth noting that bitcoin tends to react well in such times of apparent despair. For example, during the COVID-19 drop, the Index went as low as 8 when BTC dumped by more than 50% in a day. In the following weeks and months, though, the cryptocurrency not only recovered all of its losses but went on to register new heights before ultimately charting a new ATH by the end of the year.