First Mover: Wacky Bitcoin-to-DeFi Crypto Markets Might Be New Home of Capitalism

New digital markets might be the place where capitalism is getting revived. (“Portraits at the Stock Exchange” by Edgar Degas/Metropolitan Museum of Art, modified by CoinDesk.)

First Mover: Wacky Bitcoin-to-DeFi Crypto Markets Might Be New Home of Capitalism

Price Point

Bitcoin was slightly lower early Friday, leaving the cryptocurrency on track for its first weekly price decline since mid-July.

The largest cryptocurrency broke above $12,000 earlier in the week and failed to hold the gains, though John Willock, CEO of crypto asset manager Tritum, told CoinDesk Thursday that “maybe we’ve got $13,500 in the next phase up in the coming days.”

You’re reading First Mover, CoinDesk’s daily markets newsletter. Assembled by the CoinDesk Markets Team, First Mover starts your day with the most up-to-date sentiment around crypto markets, which of course never close, putting in context every wild swing in bitcoin and more. We follow the money so you don’t have to. You can subscribe here.

European stocks were up and the euro was down early Friday as investors continued to bet on technology shares and a vaccine breakthrough while shrugging off fresh signs that the economic recovery is faltering. The dollar was headed for its first weekly gain since mid-June.

“It does almost seem as if the entire crypto market is taking its cues from the U.S. dollar,” Mati Greenspan, founder of the foreign-exchange and cryptocurrency analysis firm Quantum Economics, told subscribers in an email.

Market moves

Even after growing 100-fold in the past five years, the entirety of the cryptocurrency asset class, which has a total market valuation of $372 billion, is just fraction of the $35 trillion U.S. stock market.

What’s surprising is these still-fledgling digital-asset markets might be more rational and functional these days than Wall Street: The various ups and downs of token prices are sending out bona fide market signals that point to projects and opportunities where capital is warranted, and investors are responding.

Mainstream investment analysts and Wall Street Journal columnists now assert matter-of-factly that the stock market is merely propped up by this year’s $3 trillion of money-printing by the Federal Reserve.

Sure, bitcoin has benefited from the perception that the largest cryptocurrency might benefit from inflation, since many investors see it as a hedge against currency debasement, similar to gold.

Far more fascinating are the capital flows into the semi-autonomous lending and trading systems being built atop the Ethereum and other blockchains under the rubric of “decentralized finance,” or DeFi.

A real market?

Soaring token prices for projects like Aave, Chainlink, Compound and Curve, not to mention good-luck-explaining-this-to-your-friends outliers like Yam and Spaghetti, have indeed attracted capital, at least for stretches. According to DeFi pulse, total value socked away into the platforms has jumped 10-fold this year to $7 billion.

It might all just be speculative hype, but that might actually be preferable to global foreign exchange markets that are heavily influenced if not controlled by central bank officials.

Within the digital-asset ecosystem, investors have figured out how to quickly allocate and reallocate capital whenever new opportunities arise.

CoinDesk’s Daniel Cawrey reported on Thursday that juicy returns in the DeFi market are making some investors shift away, at least temporarily, from putting their money into options contracts on bitcoin.

“Every derivatives trader that was looking for incremental yield and levered returns has been besotted by the magnitude of moves in DeFi,” Viashl Shah, founder of derivatives exchange Alpha5, told Cawrey. “So, naturally, cost of capital dictates at least some attention that way.”

Traders are even are putting their bitcoins into DeFi platforms to take advantage of the higher yields in the fast-growing arena.

Since the start of the year, the number of bitcoin locked in DeFi has grown 34-fold to about 49,000.

It might be a bubble, but at least it’s not a game of trying to anticipate the Fed’s next move. In fact there’s even room for investors to take bets on which projects might become dominant players in the future, without struggling so much to understand what exactly is happening, as often seems to be the case these days in so many traditional markets.

“DeFi long term will revolutionize finance, but this short-term bubble is bound to pop eventually, in my opinion,” Michael Gord, co-founder of trading firm Global Digital Assets, told Cawrey. At that point, the locked-up bitcoins might flow back out of DeFi, and more money might flow back into bitcoin options.

Almost like a real market.

Bitcoin watch

Bitcoin has pulled back more than 5% from the 13-month high above $12,400 reached on Monday.

- Unless buying action comes quick, downwards momentum could push prices down to $11,000, the cryptocurrency trading firm QCP noted earlier this week.

- Open interest in bitcoin options has risen back to near record high levels seen in July.

- However, that is not necessarily a bullish development, as investors have recently sold call options. That is evident from the recent recovery in the one-month put-call skew from -10% to -3%.

- Investors typically sell call options when they expect prices to consolidate or drop.

– Omkar Godbole

Token watch

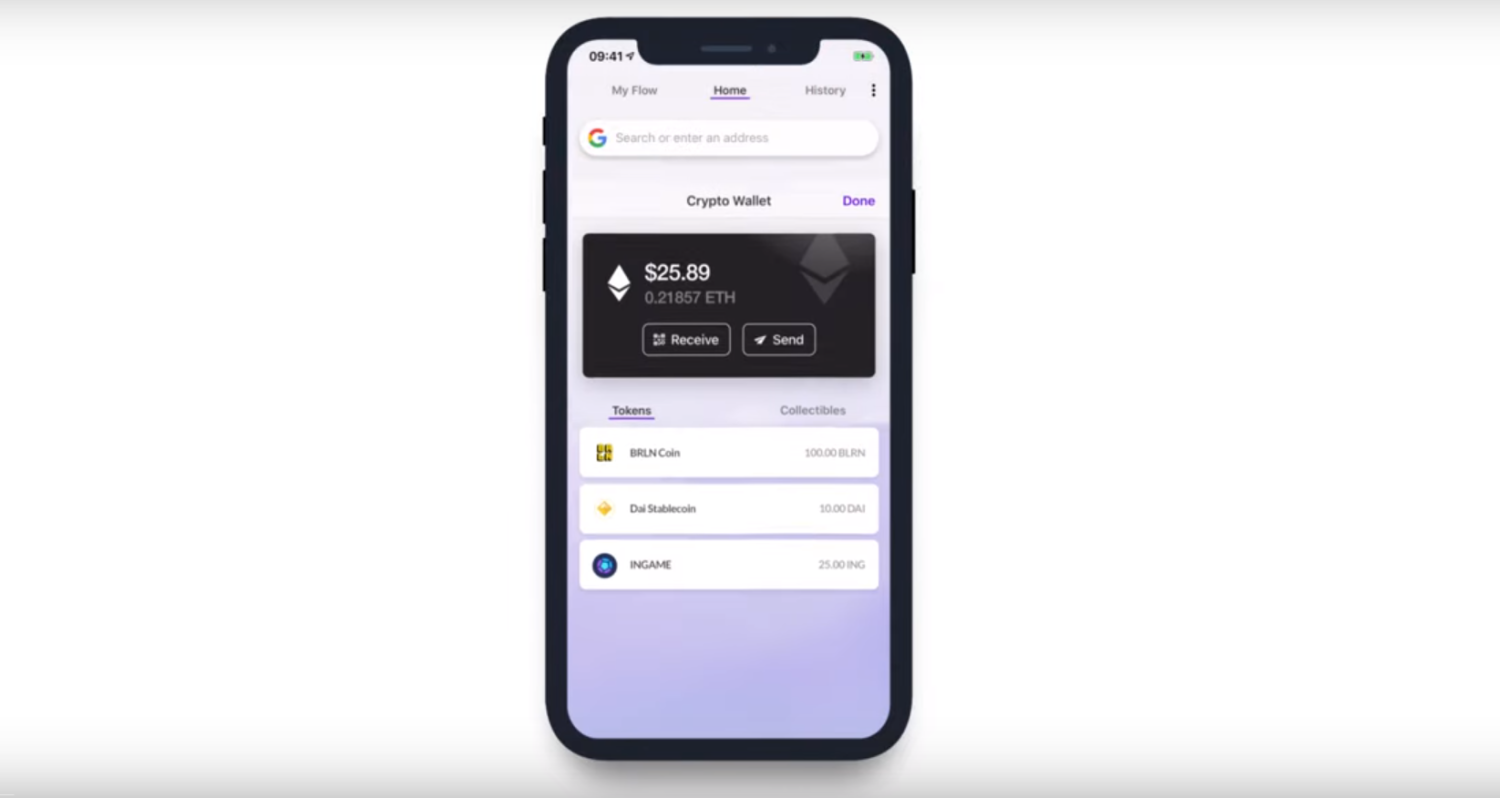

Dai (DAI): Stablecoin gets on Binance’s new DeFi staking platform. Dai, the dollar-linked stablecoin for crypto lending platform MakerDAO, has become the first available digital asset on Binance’s DeFi staking program. The Binance initiative aims to tap into this year’s booming DeFi market by offering users the ability to earn “staking rewards,” similar to interest on a bank deposit. Dai will be used to participate in Compound staking, according to Binance. Compound, another DeFi money market protocol, has more than $993 million worth of dai supply right now, according to its website. As CoinDesk previously reported, users of Compound were rushing to deposit their dai on the platform to maximize yields.

Tether (USDT): 1 billion of the dollar-linked stablecoins are shifted to the Ethereum blockchain from Tron.

Kyber (KNC): DeFi token looks cheap based on a discounted cash flow analysis, and comparison with Synthetix (SNX) and Balancer (BAL), according to a new report by TradeBlock.

Ethereum Classic (ETC): Frequently-attacked blockchain could be in line for upgrades to help protect against more 51% attacks.

OMG (OMG): Token price doubles in past week as record Etherum fees stoke interest in layer 2 solutions.

Analogs – On the economy and traditional finance

TWEET OF THE DAY

What’s hot

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.