First Mover: Stablecoin Surge Might Herald Bitcoin Binge

First Mover: Stablecoin Surge Might Herald Bitcoin Binge

Are crypto traders getting ready to pounce?

It sure looks that way, based on new data showing a rapid increase in the outstanding value of dollar-linked tokens, many of them amassing on cryptocurrency exchanges.

These “stablecoins” – digital tokens whose value is linked to government-issued currencies like U.S. dollars – have become the de facto form of cash in fast-evolving cryptocurrency markets. Unlike actual dollars, they can easily be held or moved around within the digital ecosystem, between exchanges, wallets and lenders that are willing to pay juicy interest rates of 8 percent or more for the deposits.

You’re reading First Mover, CoinDesk’s daily markets newsletter. Assembled by the CoinDesk Markets Team, First Mover starts your day with the most up-to-date sentiment around crypto markets, which of course never close, putting in context every wild swing in bitcoin and more. We follow the money so you don’t have to. You can subscribe here.

In the past month, the outstanding value of the top six dollar-linked tokens has surged by more than 25 percent to about $8 billion, according to CoinDesk Research.

Traders and individuals might have bought the stablecoins in the digital-market equivalent of a flight to cash as the coronavirus wreaked havoc on the global economy – similar to the way traditional investors rushed to liquidate everything from stocks to bonds, choosing to park the proceeds in U.S. dollars until markets stabilize.

But traders also might be flocking to stablecoins as an intermediary step before betting big on cryptocurrencies: First use dollars or other government-issued currencies to buy stablecoins; next, move those stablecoins onto cryptocurrency exchanges; then, when the price is right, trade the digital cash for bitcoin, ether or other tokens.

“The ones that are on exchanges, in theory, are going to be deployed back into cryptocurrency when sentiment changes,” Ryan Watkins, research analyst at the crypto-market data provider Messari, said in a phone interview. “It’s definitely something that investors are looking at.”

Stablecoins have been a hot topic since last year, when Facebook announced plans to launch Libra, a digital token that could be used for payments between the social network’s 2-billion-plus users. Initially, the token was designed to be backed by a basket of government currencies, but on Thursday, the consortium behind Libra said that it now plans to issue stablecoins representing individual currencies, such as the U.S. dollar.

Governments from China to Sweden have explored issuance of digital versions of their own currencies that might address the growing competition from stablecoin issuers, which are essentially building private monetary systems atop blockchain computer networks.

And these stablecoins, including tether (USDT), Circle’s USD Coin (USDC), Paxos standard token (PAX) and Gemini Dollar (GUSD), suddenly appear in high demand.

Tether, the most popular stablecoin by far with an outstanding market value of about $7.2 billion, even trades at a slight premium to its purported $1 par value – an indication of how eager buyers are to accumulate the digital cash:

Greg Cipolaro, co-founder of crypto-market analysis firm Digital Asset Research, says that individuals in some countries, possibly including China, might be trying to move money out of their domestic currencies. And it might be easier to exchange their local currencies for stablecoins than to get their hands on actual dollars.

As the dominant currency used in international finance, dollars have been in high demand as the coronavirus spread, triggering widespread job losses, business disruptions, travel cancellations and energy price slides. The attendant withering of consumer demand tends to push down prices – or, put another way, increases the dollar’s purchasing power.

The Federal Reserve has been trying to offset the deflationary impulse by pumping newly minted dollars into the global financial system.

The U.S. Dollar Index – a measure of the currency’s strength in foreign exchange markets against the euro, British pound, Japanese yen, Canadian dollar, Swedish krona and Swiss franc – has climbed to a reading of 100.10, from 96.50 at the start of the year. Emerging-market currencies have sold off even harder: The Mexican peso has weakened 28 percent against the U.S. dollar so far in 2020.

“That could be one issue,” Cipolaro said in a phone interview. “People are cashing in their fiat.”

So far, the surging stablecoin issuance hasn’t translated to a big surge in prices for bitcoin, the oldest and largest cryptocurrency, which has a total market value of about $129 billion.

After a coronavirus-driven market swoon in late February and early March, followed by a rapid rebound, bitcoin prices appear to have stabilized – stagnated, some bulls might complain – in a range between roughly $6,500 and $7,400.

So a stablecoin-fueled buying spree could jolt the bitcoin market out of the doldrums.

“Maybe it’s just a coiled spring,” Cipolaro said.

According to Glassnode, a blockchain data and intelligence provider, investors have moved some $1 billion of tether onto wallets at cryptocurrency exchanges:

Mati Greenspan, founder of the analysis firm Quantum Economics, suggested in a phone interview that some holders of stablecoins might be looking to get out, after the international Financial Stability Board earlier this week suggested that the grassroots market might need closer scrutiny. One concern was that the wider use of the stablecoins could test “the financing conditions of the wider financial system,” according to a consultation report.

That concern might apply specifically in the case of tether, which mostly operates outside of the U.S. regulatory framework and is under investigation by the New York Attorney General’s office.

“If people are concerned that the government is going to start regulating those assets, they have very few options for what to do,” Greenspan said in an audio chat over Telegram. “They can try to convert it back to fiat money, but my guess is there’s probably a reason they didn’t want to hold it in fiat in the first place.”

Neil Van Huis, director of sales and institutional trading at digital asset financial services firm Blockfills, told CoinDesk’s Daniel Cawrey that “offshore and non-U.S. participation in getting access to [the U.S. dollar] through stablecoins is the culprit” behind the rise in stablecoin issuance.

So where will those holders go when they trade in their stablecoins?

“Most likely into bitcoin,” Greenspan said.

Tweet of the day

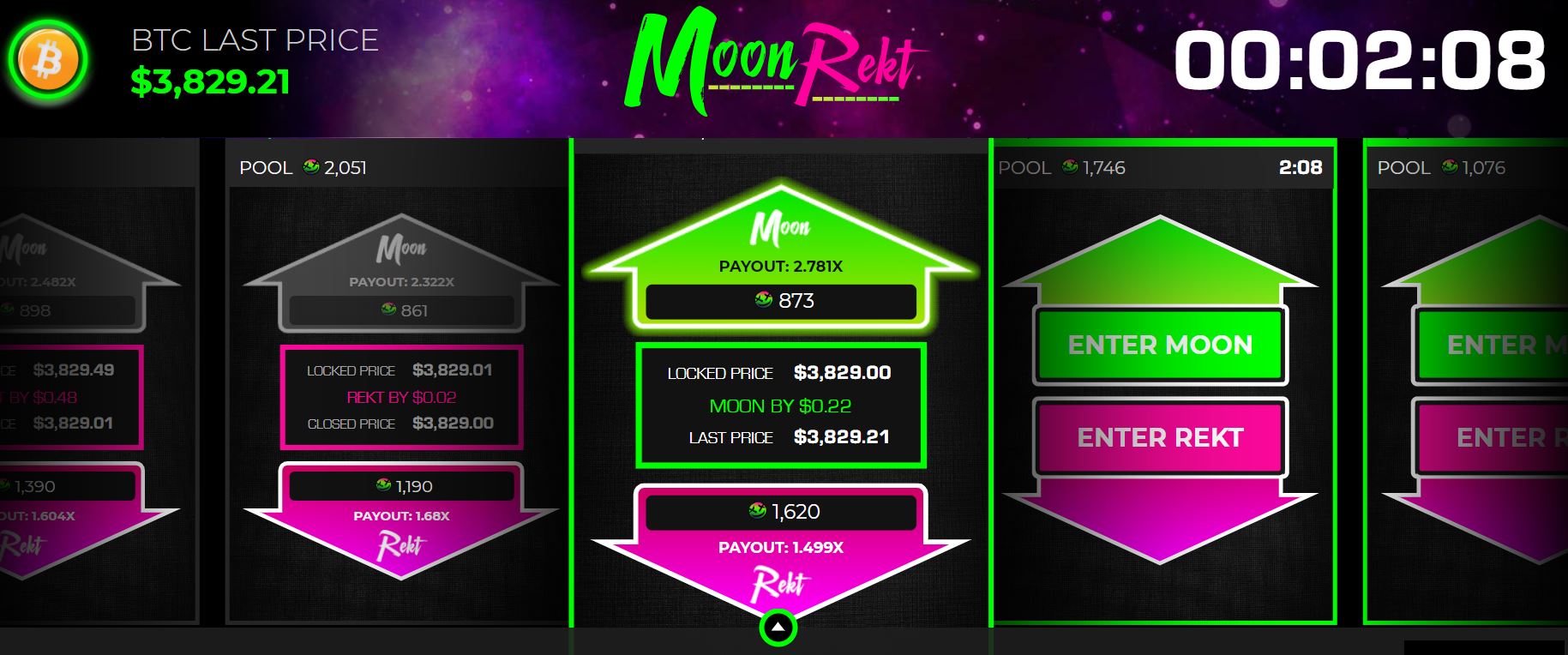

Bitcoin watch

Bitcoin is struggling to extend Thursday’s bullish move amid improved risk appetite in traditional markets.

The top cryptocurrency is trading near $7,100 at press time, slightly down on the day. Meanwhile, futures tied to the S&P 500 are up over 2 percent and major European indices are flashing green, tracking overnight gains in Asian stocks.

The risk reset began during Asian hours after leaked details of U.S.-based Gilead Sciences’ clinical trial of an antiviral drug called Remdesivir that suggest promising results in treating the coronavirus.

The renewed hope of coronavirus treatment overshadowed China’s economic data, which showed the world’s second-largest economy contracted by 6.8 percent in annualized terms in the first quarter.

Bitcoin has closely tracked action in the equity markets over the past several weeks and could soon pick up a strong bid.

Technical charts also indicate the path of least resistance is to the higher side. Bitcoin closed on Thursday (UTC) above the long-held 50-day average hurdle, signaling an end of the price pullback from the recent highs above $7,450 and opening the doors for a re-test of that level. Similar sentiments are being echoed by the descending channel breakout on the 4-hour chart.

First Mover is CoinDesk’s daily markets newsletter. You can subscribe here.

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.