First Mover: Sleepy Fed Meeting Belies Tense Economic Reality (Brrr) That May Buoy Bitcoin

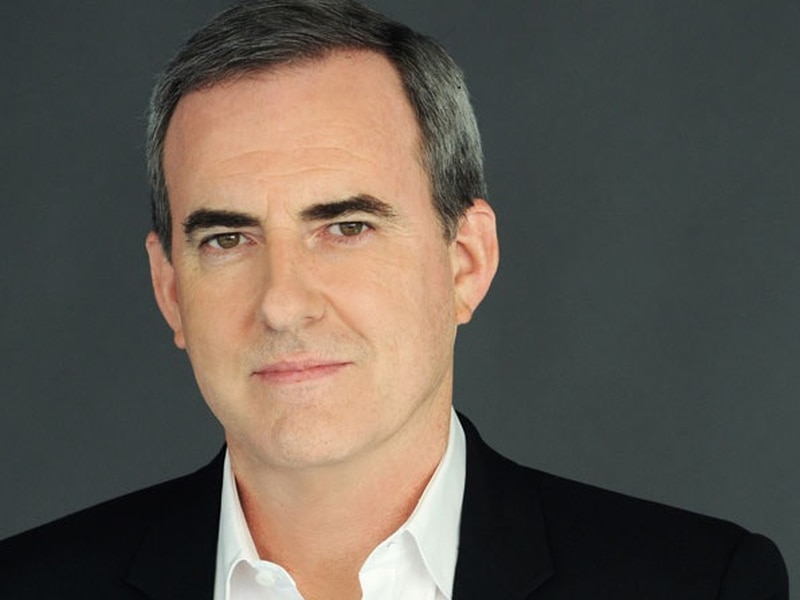

Federal Reserve Chairman Jerome Powell (Wikimedia Commons)

First Mover: Sleepy Fed Meeting Belies Tense Economic Reality (Brrr) That May Buoy Bitcoin

After a two-day closed-door meeting this week, the Federal Reserve issued a six-paragraph statement on Wednesday and held an hour-long press conference.

None of that was news, of course, and neither was anything else emanating from the U.S. central bank, which announced no policy changes.

You’re reading First Mover, CoinDesk’s daily markets newsletter. Assembled by the CoinDesk Markets Team, First Mover starts your day with the most up-to-date sentiment around crypto markets, which of course never close, putting in context every wild swing in bitcoin and more. We follow the money so you don’t have to. You can subscribe here.

But here’s what really happened over the past two days: Another $5 billion of freshly created money was injected into financial markets, based on the $80 billion of bond purchases that the Fed is conducting every month to keep financial markets functioning smoothly as the fast-spreading coronavirus devastates the global economy.

The contrast couldn’t have been starker between the lack of drama at the Fed meeting and investors’ growing anxiety over what is, by all accounts, one of the most excruciatingly tense and fragile moments in modern economic history.

Mati Greenspan, founder of the cryptocurrency and foreign-exchange firm Quantum Economics, told clients in a note late Tuesday that the Fed’s money printer – often known by the purported sound it makes, “Brrr” – was now mostly producing a “yawwwwwwwnnnn.” (That’s six w’s, four n’s.)

“The Fed is doing its best to speak softly (literally) so as not to wake up the markets,” Greenspan wrote. “The more boring, the better.”

Beneath the surface, all is not well, and a recent jump in prices for bitcoin might be one of the best indications of that, since a growing number of investors see the cryptocurrency as a decent hedge against everything from hyperinflation to economic armageddon. Similar to gold, even if not always perfectly in sync.

Bitcoin is up 57% this year, climbing to about $11,261 on Wednesday in an anemic but upward drift that barely twitched from its listless trajectory when the Fed’s statement emerged at 2 p.m. New York time.

U.S. lawmakers are at odds on everything from the specifics of a relief bill likely to cost at least $1 trillion to the possibility of contracting the disease from a mask. The Wall Street firm Goldman Sachs warned earlier this week that the U.S. dollar is at risk of losing its status as the de facto global reserve currency.

Dwindling numbers of big investors are assigning any credibility to the assurances of President Donald Trump’s administration that the economy is headed toward a V-shaped recovery. Pantheon, a macroeconomic forecasting firm, says the U.S. economy in the second quarter probably had its “biggest drop ever recorded, by far.” Jobless claims probably rose to about 16.5 million last week.

Rick Rieder, chief investment officer of global fixed income at money-market giant BlackRock, told CNBC that the U.S. dollar, which is on course to post its worst month in a decade, will likely continue to decline.

“I think we’re in a different regime around the dollar,” Rieder told the channel.

The only thing that seems certain is that the Federal Reserve will keep creating billions of dollars a day and pumping them into global markets. On Wall Street, it’s not even controversial anymore to suggest that the stock market is being propped up by the U.S. central bank.

This week’s Fed meeting “underscored the focus, especially in an election year, that our federal government has in keeping the economy humming,” Joe DiPasquale, CEO of cryptocurrency-focused hedge fund BitBull Capital, told First Mover in a phone interview.

“They’re going to keep the monetary stock flowing, and that should be good for bitcoin as people become more comfortable with an asset that has in the past been seen as more risky,” DiPasquale said.

Fidelity Investments, which oversees $7.3 trillion of customer assets, wrote this month in a report that bitcoin’s “next wave of awareness and adoption could be driven by external factors such as unprecedented levels of intervention by central banks and governments, record low interest rates, increasing fiat money supply, deglobalization and the potential for ensuing inflation, all of which have been accelerated by the pandemic and economic shutdown.”

It’s quite a list. And hard to argue with any of that, which collectively provided the subtext for this week’s Fed meeting.

Powell was candid about the Fed’s willingness to provide further monetary accommodation, even after policy makers earlier this year slashed interest rates close to zero and expanded the central bank’s balance sheet by roughly $3 trillion. The amount represents roughly 75% of the total amount of money previously created in its 107-year history.

One question might be whether the Fed can stimulate markets with more dollars if the U.S. currency is looking weak in foreign-exchange markets. According to Pantheon, the Fed may have to increase the pace of its monthly bond purchases once the “Treasury begins to issue the $1.5 trillion extra debt we reckon will be needed to finance the next relief bill.”

“We are committed to using our full range of tools to support the economy,” Powell said during the press conference, using language nearly identical to language he has used on multiple prior occasions since March, when the Fed first began plying the financial system with emergency loans and liquidity.

“The way Powell emphasizes it, they’re going to continue to pump liquidity and easy money into the markets,” John Todaro, of the digital-asset analysis firm TradeBlock, said Wednesday in a phone interview. “It was just kind of a rehash of, Hey, how dovish are these folks going to get?”

First Mover reported earlier this week that Deutsche Bank Strategist Jim Reid sees the Fed adding another $12 trillion to its balance sheet over the next few years, to the $7.01 trillion of total assets as of last week.

Fed policy makers did their best this week not to make news. That doesn’t mean they’re not doing a lot. Bitcoin traders are more focused on the Brrr than the yawwwwwwnnnn.

Tweet of the day

Bitcoin watch

BTC: Price: $10,955 (BPI) | 24-Hr High: $11,345 | 24-Hr Low: $10,913

Trend: Despite a small drop, bitcoin’s overall trend still looks bullish with longer duration charts showing an upside break of a 2.5-year long descending trendline.

That doesn’t necessarily imply a 90-degree run toward resistance at $12,000. In fact, we could see the cryptocurrency pull back to the former resistance-turned-support at $10,500 (February high) in the next day or so, recent price action suggests.

The cryptocurrency hit a wall during another attempt to establish a foothold above $10,300 during the U.S. hours on Wednesday and has been losing altitude ever since. At the time of writing, bitcoin is changing hands a little below $11,000, representing a 1.7% drop on the day.

A similar pattern was seen on Monday, when the cryptocurrency tagged a multi-month high above $11,300 before making a quick retreat to $11,000.

The consecutive failure to keep gains above $11,300 alongside an overbought reading on the 14-day relative strength index (RSI) may indicate ebbing bullish momentum. The 4-hour chart RSI, too, has breached a bullish trendline, representing the rally from $9,000 to $11,300.

As such, a deeper pullback to $10,500 cannot be ruled out. A violation there would expose the psychological support of $10,000. The broader bullish bias would be invalidated only if prices find acceptance under $9,760 – a trendline falling from December 2017 and June 2019 highs.

The case for deeper retracement would weaken if prices rise above the Asian session high of $11,126. In that case, the bulls will likely have another attempt at breaching the newfound resistance zone above $11,300.

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.