First Mover: Even Bank of America Acknowledges China Winning Digital-Currency Race

First Mover: Even Bank of America Acknowledges China Winning Digital-Currency Race

China’s push to roll out a digital version of its yuan isn’t likely to end the U.S. dollar’s century-long reign as the dominant currency for international payments and central-bank reserves. But it could make a dent.

That’s the conclusion of foreign-exchange analysts at Bank of America, who argue that a Chinese digital currency might be welcomed by regional trading partners as payments become increasingly electronic.

You’re reading First Mover, CoinDesk’s daily markets newsletter. Assembled by the CoinDesk Markets Team, First Mover starts your day with the most up-to-date sentiment around crypto markets, which of course never close, putting in context every wild swing in bitcoin and more. We follow the money so you don’t have to. You can subscribe here.

China appears well ahead of the U.S. in developing a central-bank digital currency, or CBDC, the Bank of America analysts wrote in a June 30 report. Federal Reserve Chair Jerome Powell, who said last year that the U.S. central bank had “not identified potential material benefits” of a general-purpose digital dollar, told Congress in June that officials are “working hard” on the issue.

Yet the Agricultural Bank of China, one of the nation’s four state-owned banking giants, is already trialing a test interface for the digital yuan, CoinDesk reported in April.

It goes without saying that the spread of the coronavirus has inspired a newfound repugnance for germy cash.

“China seems likely to have a clear first-mover advantage in its adoption of CBDCs, both in terms of timing and usage,” the Bank of America analysts wrote. A digital yuan could increase the Chinese currency’s use in international commerce “even if it doesn’t immediately disrupt the USD’s dominant role in global finance.”

The advent of digital-asset technologies has combined with the coronavirus-induced economic crisis to raise nagging questions about whether the dollar’s undisputed reign as the de facto global reserve currency might be due for a reckoning. The dollar accounts for some 62% of global central banks’ foreign-exchange reserves.

As reported by First Mover on Monday, the German lender Deutsche Bank wrote in a report last week that a reelection victory by U.S. President Donald Trump could undermine the dollar’s dominant role in the long term, given his willingness to spurn multilateral organizations like the International Monetary Fund and World Bank.

Such organizations have played a key role in the post-World-War-II order that helped enshrine the dollar’s premier status. The U.S tender is closely watched in digital-asset markets, since it’s the most common price denomination for cryptocurrencies like bitcoinand ether , as well as the backing for a fast-growing breed of digital tokens known as stablecoins.

“The present-day experience is more of discord and less in favor of multilateralism,” the analysts wrote. “We are seeing more rivalry in areas such as trade and technological dominance.”

It’s worth noting that China closely manages the yuan’s exchange rate against the dollar, so a digital version of the nation’s currency – also known as the renminbi, or RMB – could trade similar to a dollar-linked stablecoin.

China has struggled to increase its currency’s usage in international commerce. Since, 2016, when the yuan was incorporated into an IMF international reserve asset, the Chinese currency’s penetration of global foreign-exchange reserves has doubled to a paltry 2%, as noted by the Bank of America analysts.

Some 63% of Chinese banks’ cross-border claims are denominated in dollars, nearly identical to the proportion for U.S. lenders, the analysts wrote.

“The internationalization of the RMB is happening, but the growth rate has been uneven and not as rapid as some may think,” according to the report.

The Bank of America report comes as China’s digital yuan is attracting growing attention from top monetary economists and cryptocurrency-industry executives.

The dollar’s hegemony is also under question, following the foreign-exchange turmoil that has sent emerging-market currencies plunging this year, saddling the world’s poorest countries with rising costs for imported consumer goods and elevated interest payments on international debt. Many bitcoin investors say the Federal Reserve’s roughly $3 trillion of money injections this year – with likely more to come – could end up debasing the dollar’s purchasing power.

Jeremy Allaire, co-founder and CEO of Circle, which backs the dollar-linked stablecoin USDC, said on a podcast last week that China’s development of a digital currency has effectively “created a model where a household, a firm, a nation state can kind of directly transact and settle with China over the internet,” effectively bypassing payment systems in the U.S. sphere of economic influence.

Former U.S. Treasury Secretary Lawrence Summers, a guest on the podcast, said he doubted China would make it the digital yuan flexible enough to allow its citizens to freely move wealth and resources out of the country.

“And I think a system that is so restricted that it isn’t possible to do that isn’t going to be much of a global digital currency,” he said.

The Bank of America analysts noted that several Asian countries, including Thailand, Singapore and South Korea are assessing their own digital currencies, which might become integrated with yuan-based payment systems, “especially if it entails significantly lower transaction costs and real-time transfers.”

“Ultimately, this is likely to be the actual (and more realistic) objective for China than a serious attempt to displace the USD’s status as the global reserve currency,” the analysts wrote.

It might be that the only serious threats to the dollar’s reign would come from within the U.S.

Tweet of the day

Bitcoin watch

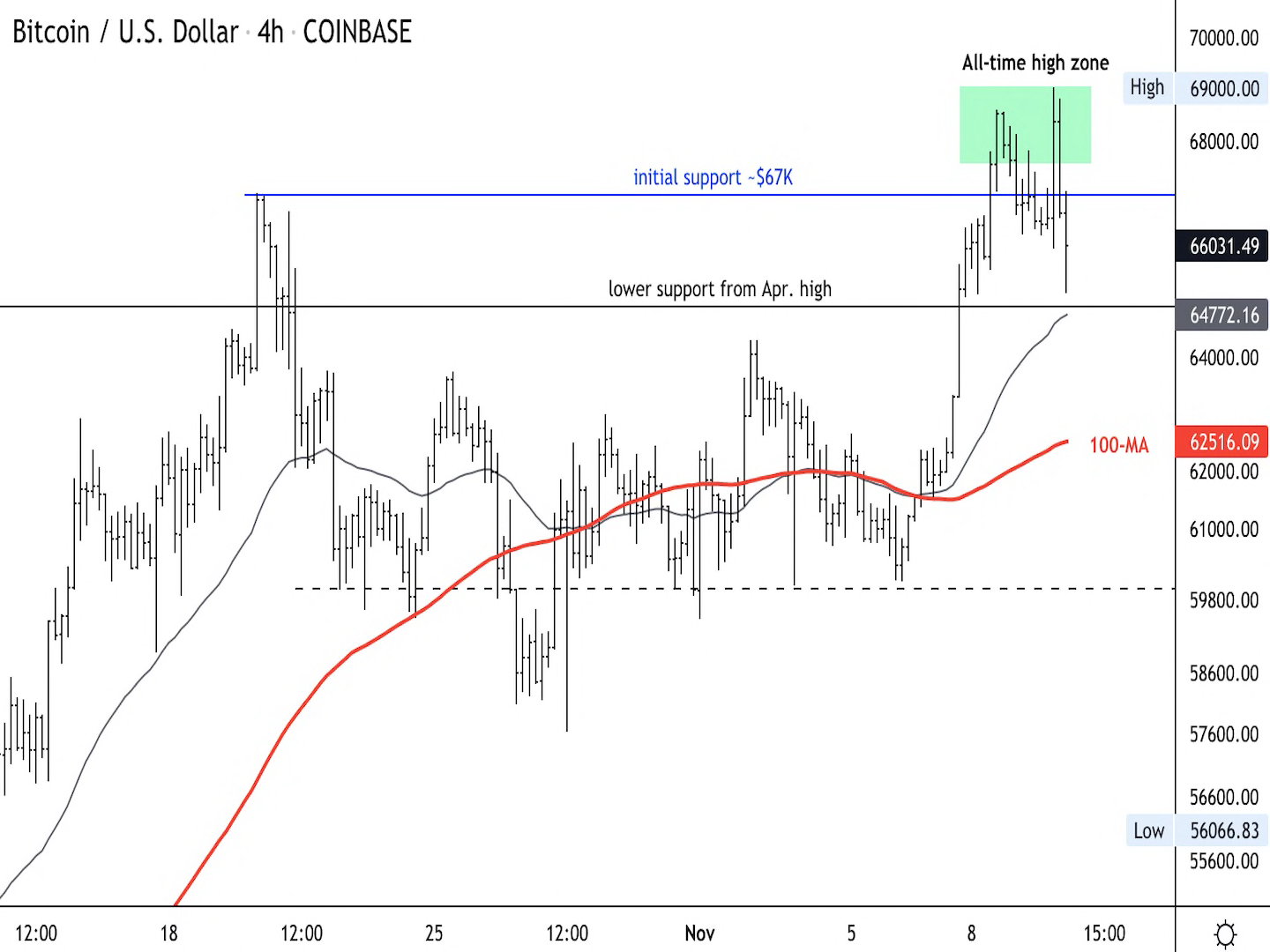

BTC: Price: $9,250 (BPI) | 24-Hr High: $9,374 | 24-Hr Low: $9,192

Trend: Bitcoin is feeling the pull of gravity at press time, having faced rejection at key technical hurdle early on Tuesday.

After prices failed to cut through the 50-day moving average hurdle at $9,385 during the Asian trading hours, the cryptocurrency is now trading at $9,250, representing a 1% decline on the day.

The pullback from the 50-day MA hurdle has neutralized the immediate bullish view put forward by Monday’s 3% gain.

Bitcoin jumped to $9,350 yesterday, confirming an upside break of the narrow trading range of $8,830–$9,300 seen in the nine days to July 5. In addition, Monday’s price gains confirmed signals of potential gains from the repeated dip demand below $9,000 seen over the past two weeks.

A move above the 50-day MA of $8,385 would revive the bullish bias signaled by Monday’s 3% rally and open the doors to $10,000.

On the downside, the weekly opening price of $9,077 is the level to defend for the bulls. A violation there could yield a quick drop to the 50-week MA at $8,632, with the 5- and 10-week MAs having produced a bearish crossover, the first since early March.

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.