First Mover: Compound Has Been a DeFi Darling. Its New Token Is Priced Accordingly

First Mover: Compound Has Been a DeFi Darling. Its New Token Is Priced Accordingly

This week’s debut of live trading in the autonomous lender Compound’s digital token has provided a new data point on just how frenzied the speculation has become over the future of decentralized finance (DeFi).

Compound, started in 2017, is the second-biggest decentralized lender, with the equivalent of $163.1 million locked in the protocol, behind larger rival Maker’s $487 million, according to the data provider DeFi Pulse.

You’re reading First Mover, CoinDesk’s daily markets newsletter. Assembled by the CoinDesk Markets Team, First Mover starts your day with the most up-to-date sentiment around crypto markets, which of course never close, putting in context every wild swing in bitcoin and more. We follow the money so you don’t have to. You can subscribe here.

But a flurry of bullish trading in Compound’s new COMP tokens, released Monday, has given the project a fully diluted, implied market capitalization of nearly $785 million, well above Maker’s $546.2 million, according to another website, DeFi Market Cap.

Compound’s outsize market cap, relative to the total value locked in the protocol, “may signal the rally went too far,” The Defiant, a newsletter tracking the DeFi sector, wrote on Tuesday.

The COMP digital coins are known as “governance tokens” because they give holders a right to vote on decisions affecting the management of the protocol, such as technical upgrades or whether to incorporate new assets onto the platform. Eventually, according to cryptocurrency research firm Messari, holders might also be able to get a share of fees paid into the system or vote to buy back tokens — similar to stock buybacks.

Over the next four years, some 4.2 million of the tokens will be awarded to users, as part of a pool of 10 million tokens overall that also covers distributions to executives, employees and early investors such as the venture capital firm Andreesen Horowitz.

Trading in the tokens started Monday, when the project began distributing COMP to users of the system, and as of Tuesday they were changing hands at a price of $78.56 each, according to DeFi Market Cap.

But so far, according to a Compound website, only 3,814 of the tokens have been distributed – worth about $300,000 at the current price. So the implied market cap of $785 million is based on trading in that limited set of tokens.

Prices for the tokens had no preset value when they were released, and Compound Founder Robert Leshner, 35, said Tuesday in a phone interview that he really had no idea what to expect from the first few days of trading.

A market in the COMP tokens has sprung up on Uniswap, an automated liquidity protocol, and on the digital-asset exchanges MXC, Hoo and Hotbit, according to Leshner.

“We saw markets emerge for the COMP token and the price shoot up dramatically,” he said. “Because the asset was so new, there was a bit of a speculative fervor.”

CoinDesk’s Brady Dale reported Tuesday that Curve, an automated market maker, saw its 24-hour trading volume jump seven-fold, driven by demand for COMP tokens.

There’s even an application on the website InstaDapp devoted to helping users “Maximize $COMP Mining.”

“This recipe is focused on maximizing your COMP token returns,” the site reads.

The distribution of the governance tokens represents the next step in San Francisco-based Compound’s push to create a fully decentralized lending platform, which allows users to borrow assets contributed by other users, at a market-based interest rate. Leshner described it as a “money market for crypto assets.”

“The distribution will be DeFi’s best case study of `progressive decentralization’ to date,” Messari wrote this week in a report on its website.

Over the past month, Compound (the company) relinquished control over the DeFi project to its 22,000 users, according to Leshner. The COMP tokens were put into a “reservoir contract” that will distribute them over the next four years to users, in proportion to their usage.

“People have sort of watched this underlying protocol grow substantially over the years, and yesterday was day one that the public had a chance to participate,” Leshner said. “We were very deliberate about not setting expectations because we appreciate how uncertain crypto can be.”

The pricing of the tokens provides a glimpse of the potential payday for executives and investors in the project, who will retain tokens now worth hundreds of millions of dollars.

Beyond the 4.2 million tokens allocated to users, some 2.4 million have been distributed to shareholders in Compound Labs Inc., which created the protocol, according to a Medium post. Investors include Andreesen Horowitz, Polychain Capital, Bain Capital Ventures, Coinbase and Paradigm Capital.

Another 2.2 million are allocated to founders and team members, subject to a four-year vesting schedule, according to the Medium post. The remainder are reserved for community members and future hires.

Compound Labs, the company, retains none of its COMP tokens, and currently has no revenue to speak of, said Leshner. It will now turn to other projects that could bring future revenue, he said, declining to describe them.

Leshner said he isn’t worried that regulators might deem the token to be an improper securities sale since the company no longer has a role in building or managing the protocol.

According to Leshner, the venture capital firms also are subject to a vesting period. That means they can’t immediately cash in on the bonanza.

But the point of the token distribution is that the project is no longer controlled by the founding company.

“It’s sort of like this self-organizing anarchy,” he said. “There’s no centralized coordination of the token holders. It’s going to be left entirely to the community to figure out how to govern the protocol.”

In the meantime, traders in COMP tokens might need to put tighter controls on their own animal spirits.

Tweet of the day

Bitcoin watch

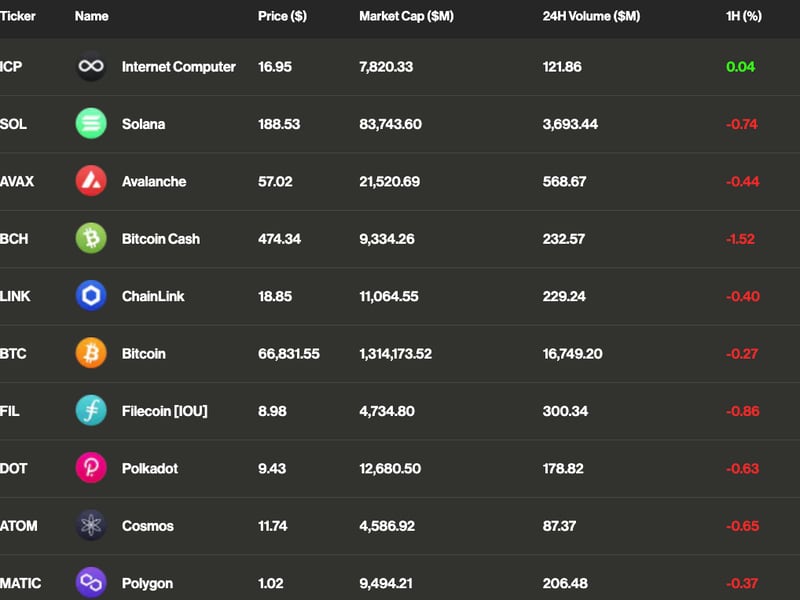

BTC: Price: $9,488 (BPI) | 24-Hr High: $9,595 | 24-Hr Low: $9,421

Trend: Bitcoin’s ongoing sideways crawl may be nearing an end, with a key technical indicator reporting the lowest level of volatility in five months.

The leading cryptocurrency has been restricted largely to a range of $9,000–$10,000 since May 28, except for Monday’s brief dip to $8,900, according to CoinDesk’s Bitcoin Price Index.

As a result, the Bollinger bands width, a price volatility gauge, has declined to 0.09 – its lowest since Jan. 6. Bollinger bands are volatility bands placed two standard deviations above and below the 20-day moving average (MA) of price. Meanwhile, the Bollinger band width is calculated by dividing the spread between the volatility bands by the 20-day MA.

In the past, bitcoin has witnessed big moves in either direction following a decline in the metric to or below 0.10.

For instance, Bollinger bandwidth dropped to 0.06 a week before BTC broke into a bull market with a high-volume move to $5,000 in April 2019. Similarly, bandwidth declined to 0.09 in early January, following which bitcoin rose from $7,500 to $9,000 in just two weeks.

If history is guide, bitcoin could soon chart a notable upward or downward move, marking an end of the price consolidation.

Further, price action seen in the first two trading days of the week is signaling scope for a bullish move. Bitcoin rose by 1% on Tuesday, validating the strong dip demand, or seller exhaustion, signaled by a long lower wick attached to Monday’s chart candle and confirming a bullish revival.

Put simply, the big move implied by the volatility squeeze could happen to the higher side. Key resistance levels are located at $10,000 (psychological hurdle) and $10,500 (February high).

Meanwhile, support is located at $8,900. A breach there would confirm a short-term bearish reversal and open the doors to the 200-day average at $8,219.

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.