First Mover: Bitcoin Difficulty Adjustment Feels Like Post-Halving Easing Party

Credit: Shutterstock/Roman Samborskyi

First Mover: Bitcoin Difficulty Adjustment Feels Like Post-Halving Easing Party

At its core, the Bitcoin blockchain is a sprawling global machine – a human-created network of human-operated computers.

And for bitcoin traders, it’s bullish that key events on the blockchain network over the past couple weeks have gone smoothly, showing that the machine is working well. Or, at least – exactly as it was designed.

You’re reading First Mover, CoinDesk’s daily markets newsletter. Assembled by the CoinDesk Markets Team, First Mover starts your day with the most up-to-date sentiment around crypto markets, which of course never close, putting in context every wild swing in bitcoin and more. We follow the money so you don’t have to. You can subscribe here.

On May 11, the Bitcoin blockchain underwent the third “halving” in its history, a once-every-four-years occurrence when the pace of new issuance of bitcoin gets automatically cut in half. The much-hyped event passed so unobtrusively that it got panned as anticlimactic, even dull.

Now bitcoiners are counting down to the next milestone on the blockchain: the latest “difficulty adjustment,” expected Tuesday. Occurring roughly every two weeks, it’s another automatic mechanism built into the network to keep things operating smoothly. And like the halving, it’s expected to be uneventful.

“It’s validating that bitcoin is just like a perfect little clock, and it just keeps ticking, and we can rely on it,” Tuur Demeester, founder of Adamant Capital, said in a video interview published Monday by data provider Messari.

Demeester drew a contrast with another human-designed construct, the traditional monetary system, where central banks led by the Federal Reserve this year have unilaterally injected trillions of dollars of coronavirus-related stimulus into the global financial system. The central banks say that the moves aim to keep the economy and markets from collapsing, but the officials are effectively just making up monetary policy on the fly.

“It’s just such a contrast with this craziness in the central-banking world where all bets are off,” Demeester said. “Who knows what’s next?”

Bitcoin prices rose Monday to about $9,700, and are up 36% to date this year. That contrasts with an 8.6% gain in 2020 for the Standard & Poor’s 500 Index of large U.S. stocks, even after a rally Monday fueled by optimism that a coronavirus vaccine might be showing signs of promise.

Just like the bitcoin halving had several “countdown clocks” erected by cryptocurrency data providers, the difficulty adjustment has its own countdown clock – the Bitcoin Difficulty Estimator.

According to the tool, the difficulty adjustment is supposed to take place Tuesday around 5 p.m. New York time. And it’s supposed to make the difficulty of finding new bitcoin about 5 percent easier.

The difficulty adjustment will be the network’s first since last week’s halving, and its significance this time can’t really be understood outside of that milestone.

The new bitcoin produced by the blockchain every day are the rewards for computer operators known as “miners” who agree to help maintain the network and keep it secure. So when the rewards were cut by half last week, the miners suffered an immediate reduction in their daily revenue.

True to the incentives built into the bitcoin blockchain, less-efficient and high-cost miners – primarily those with older-generation computers or in regions where electricity is more expensive – dropped off the network, to avoid losing money.

The defections were evidenced by a reduction in the “hash rate,” which is the number of new computations sent to the network each second.

Average times to confirm new data blocks increased to about 18 minutes after the halving, well above the 10-minute average targeted in bitcoin’s original programming, according to Delphi Digital, a cryptocurrency research firm.

The slowdown caused transactions in the network to back up. That’s apparent from a chart of the “mempool,” which is the aggregate size in bytes of transactions waiting to be confirmed on the blockchain:

Since transactions got backed up, any senders wishing for faster confirmation times had to increase their fees to get priority. So average transaction fees rose to $4.91 from $2.38, the highest in 11 months, according to Delphi.

This is where Tuesday’s difficulty adjustment comes in. By making it easier for miners to find new blocks, the network should automatically bring block times back down to around 10 minutes and “should result in more mining power coming back on line,” according to Delphi.

The “difficulty adjustment should help to clear the log and return the fees to normal,” Mati Greenspan, founder of the foreign exchange and cryptocurrency analysis firm Quantum Economics, wrote Monday in a note to clients.

Just like clockwork. And refreshingly dull.

Tweet of the day

Bitcoin watch

BTC: Price: $9,770 (BPI) | 24-Hr High: $9,817 | 24-Hr Low: $9,473

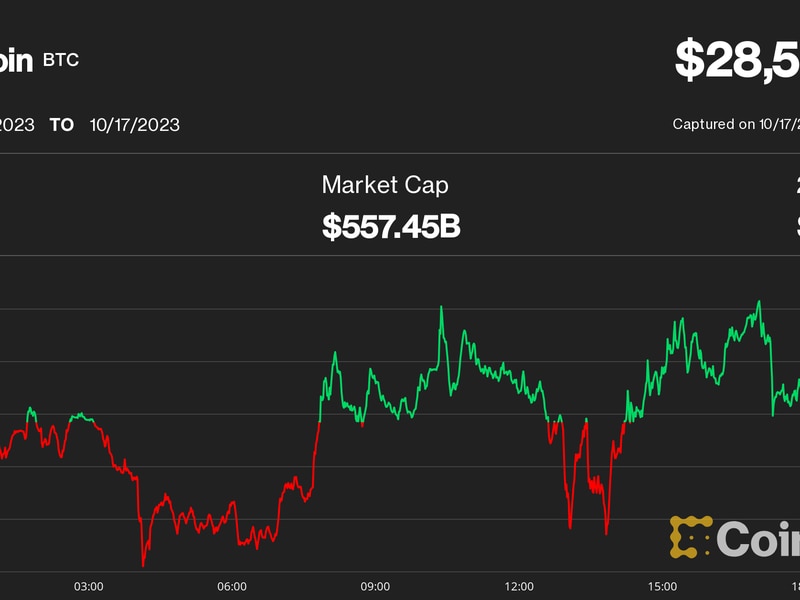

Trend: While bitcoin has recovered from lows below $9,500 seen earlier on Tuesday, the immediate bias remains neutral with prices are still trading within Monday’s price range.

The top cryptocurrency witnessed two-way business on Monday, printing a high and low of $9,966 and $9,451, respectively, before ending the day (midnight, UTC) on a flat note at $9,720.

Essentially, the cryptocurrency created a “doji” candle, comprising of long upper and lower wicks and a small body. The candle is widely considered a sign of indecision in the market place. In such cases, traders usually wait for strong directional bias to emerge in the form of a move outside of the doji’s high or low.

So, Monday’s doji candle has made Tuesday’s UTC close pivotal. A close above the doji candle’s high of $9,966 would mean the period of indecision has ended in a bull victory. That could cause more buyers to join the market, leading to a stronger rise toward $10,500.

Alternatively, acceptance under doji’s low of $9,451 would confirm a bearish reversal and shift risk in favor of a drop to the 200-day average located at $8,050.

The longer duration indicators like the weekly chart MACD histogram and the 14-week relative strength index are reporting bullish conditions. Additionally, the previous weekly candle violated a long-term descending trendline in favor of continued upward move. As a result, a bullish daily close looks likely.

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.