First Mover Asia: Will Bitcoin Soon Begin a Retest of 30K?

Good morning. Here’s what’s happening:

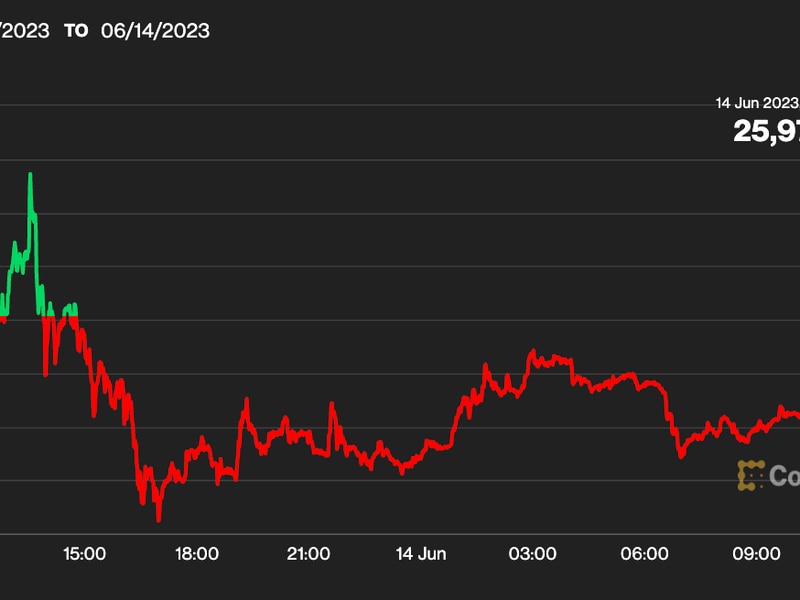

Prices: Bitcoin is in consolidation mode before an eventual retest of $30,000, says BitBull Capital.

Insights: The crypto industry is spending less than other industries on lobbying. That may need to change.

Bitcoin and ether are continuing their downward drift. Bitcoin is opening the Asia trading week down 1.3% to $26,779, while ether is down 0.8% to $1,806.

During the last month, bitcoin has primarily been in consolidation mode. Drifting downward ever so slowly, but still maintaining its value, down just 2% over the last 30 days – a much-needed break for investors from the roller-coaster of last year.

“Bitcoin has corrected to levels between $27k and $25k. This is where we’d like to see some consolidation before a retest of $30k in the coming days,” Joe DiPasquale, CEO of BitBull Capital, said to CoinDesk in a note. “While the market may not rally in the near term, the price action is following expectations as we witness consolidation during bearish sentiment.”

Meanwhile, Tornado Cash’s TORN token has begun to recover after the protocol’s DAO was the victim of vote fraud over the weekend. This attack – which was not an exploit or hack – involved an attacker putting forward a proposal that looked benign on the surface but allowed the attacker access to all governance votes via some hidden malicious code.

In the aftermath, the protocol’s TORN token dropped 40% to $3.59 from $5.76, but is now recovering and up to $4.66.

The Tornado Cash community is proposing solutions to revert the unauthorized code changes and considering creating a new contract with airdropped tokens for existing holders.

The Crypto Industry’s Lobbying Deficit

A recent report from Washington, D.C.-based political watchdog Open Secrets shows that first-quarter federal lobbying has topped $1 billion for the second consecutive year.

Some expected industries lead the rankings in lobbying spend: healthcare, finance, real estate and energy.

Overall in 2022, industries and activist groups of all shapes and sizes spent $4.1 billion on federal lobbying efforts.

As for crypto? Despite increasing regulatory hostility from D.C, crypto’s actual lobbying spend came in at $21.6 million for the year, according to Open Secrets data. Certainly, this is an increase from years prior, but as an industry with a market cap of just over $1 trillion, it wouldn’t even crack the top-20 list for lobbying spend.

In comparison, big pharma spent $375.2 million in 2022. The automotive industry spent $82 million, and commercial banks paid $64.6 million to lobbyists that year.

The industry’s political contributions to election campaigns grew tenfold from 2020 to 2022, totaling $2.3 million in the latter, Open Secrets recently reported. Major contributors included Coinbase, which alone spent $3.4 million on lobbying.

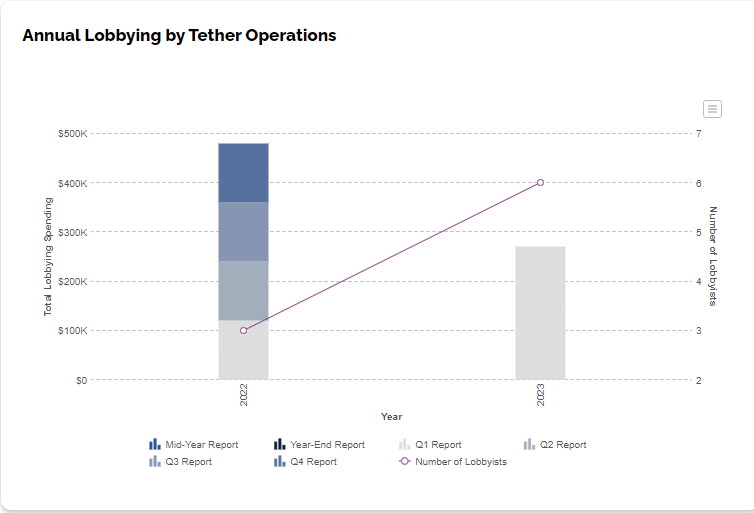

Open Secrets’ data shows that lobbying by crypto majors is up during the first quarter of the year.

Tether has spent $270,000 lobbying in the first quarter of 2023, which doesn’t sound like much, but is a huge jump over its first quarter 2022 spend of $100,000.

The Blockchain Association is up as well, to $490,000 spent this quarter compared to $460,000 for the same time last year. Stablecoin issuer Paxos also saw a huge jump, with its lobbying spend rising from $50,000 in Q1 2022 to $80,000 this past quarter.

Of course, this is all dwarfed by TradFi lobbying spending. The American Bankers Association spent $2 million during this past quarter, while Citigroup spent $1.4 million.

Sadly, successful businesses need to lobby to become more successful. That’s just the nature of modern politics. And it looks like crypto must do more of it.

In case you missed it, here is the most recent episode of “First Mover” on CoinDesk TV:

Ripple is starting a central bank digital currency (CBDC) platform which allows central banks, governments, and financial institutions to issue their own digital currency. Ripple Vice President of Central Bank Engagements and CBDCs James Wallis joined “First Mover” to discuss. Plus, Sky Mavis, which is behind NFT project Axie Infinity, is launching its Axie Infinity: Origins card game on the Apple App Store in key markets where the game is most popular. Sky Mavis co-founder Jeffrey ‘Jihoz’ Zirlin shared his insights. Bitwise Asset Management President Teddy Fusaro and Southern Methodist University Dedman School of Law assistant professor Carla Reyes also joined the conversation.

Bitcoin Payments App Strike Expands to More Than 65 Countries From Three: Strike, led by Jack Mallers, currently operates in the U.S. and El Salvador. Now it’s pushing into new markets in Africa, Latin America, Eastern Europe, Asia and the Caribbean – from Antigua and Barbuda to Vanuatu and Zambia.

Sotheby’s Auctions Part of 3AC’s Rare NFT Collection, Bringing In $2.4 Million: The highest-priced NFTs from Part 1 of the Grails collection are Fidenza #725 and Autoglyph #187.

Demand for Tokenized Treasury Bonds Soars as Crypto Investors Chase TradFi Yield: The combined market capitalization of tokenized money market funds is nearing $500 million as high yields in traditional markets attract crypto capital.

U.S. Sanctions Watchdog Alleges Russia-Linked Crypto Wallet Processed $5M: An Irish national helped wealthy Russians evade sanctions and hide money in UAE, OFAC said Friday.

Ledger’s Hard Lesson: Being Right Isn’t Good Enough: Public communication doesn’t work like computer code. The French hardware wallet maker learned that the hard way.

Edited by James Rubin.