First Mover Asia: What Will Make Bitcoin Reach $30K?

Good morning. Here’s what’s happening:

Prices: Regulatory clarity is required for bitcoin to push past $30,000.

Insights: Crypto options traders are betting against price turbulence, and BTC is unlikely to get a bullish catalyst.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto industry leaders and analysis. And sign up for First Mover, our daily newsletter putting the latest moves in crypto markets in context.

What Will Make Bitcoin Reach $30K?

Cryptocurrency markets closed the Monday U.S. trading day fairly flat, with the CoinDesk Market Index (CMI) up 0.23%, bitcoin (BTC) up 0.57% to $29,165, and ether (ETH) flat at $1,826.

The question on everyone’s mind, is what will move bitcoin past the $30,000 mark?

Bullish traders are eyeing the upcoming U.S. July Consumer Price Index report for signs of continued inflation trends, with expectations set at a 0.2% monthly increase and a 3.3% year-over-year growth, amid a context of the Federal Reserve’s historical monetary tightening and subsequent market anticipation of rate cuts, which have historically been intertwined with Bitcoin’s recent price fluctuations.

But a big question is will this be a bullish catalyst for the world’s largest digital asset? CPI could also come in higher than expected, which would signal that rate hikes are not yet done.

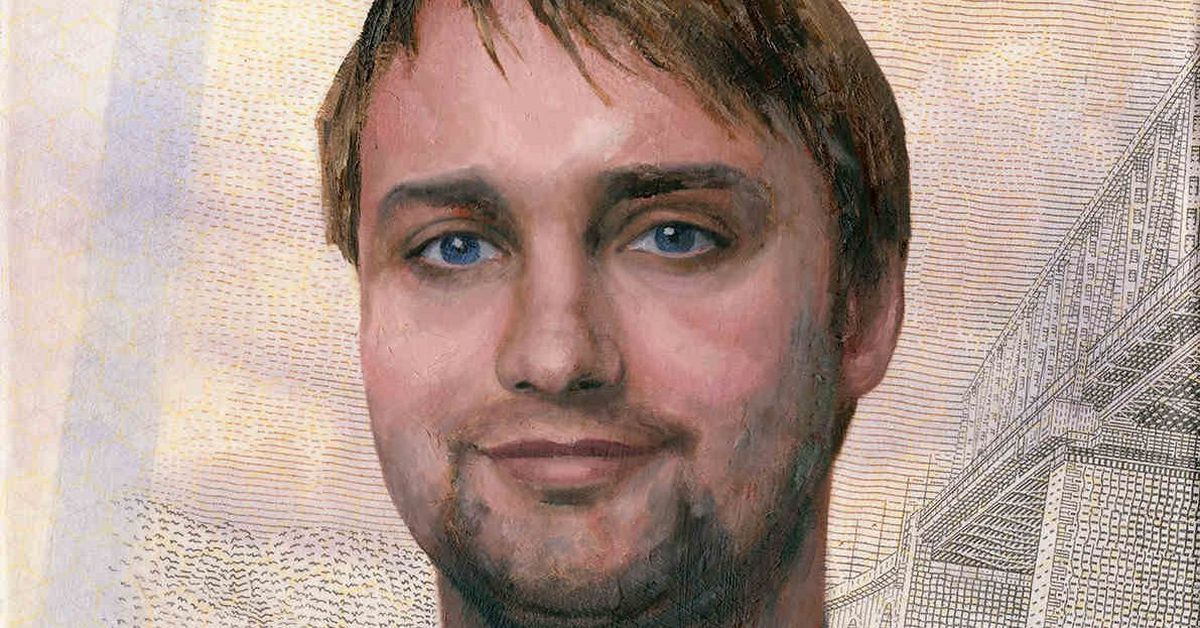

In a recent appearance on CoinDesk TV, “The Crypto Trader” author Glen Goodman said its concerning that bitcoin hasn’t moved all that much in the last few months and more regulatory clarity is required for the market to move.

“I’m not very impressed with Bitcoin. You’ll remember months ago there was the strong correlation between the S&P 500 and Bitcoin. We were following that for the best part of a year, and that correlation has pretty much broken down,” he said.

Goodman argues that a break below $25,000 would be the end of the 2023 bull market.

But to even get to that point, there needs to be a big change in the regulatory environment.

“The exchanges need to be reliable,” he said. “Nobody worries about if the New York Stock Exchange is going to exist next week.”

Biggest Gainers

Biggest Losers

Crypto Options Traders Bet Against Volatility: There is a lot of market chatter about an impending volatility explosion in bitcoin. Still, some crypto traders retain a bias for shorting volatility — that is setting up strategies that bet against price turbulence. Bitcoin, the leading cryptocurrency by market value, has primarily traded in the range of $29,000 to $30,000 since July 24. That’s below the $30,000-$32,000 range of the preceding four weeks. The cryptocurrency’s price hasn’t risen more than 4% in a single day since June 21. As such, key metrics gauging bitcoin’s backward-looking realized volatility and estimated or implied volatility have tanked to multiyear lows.

CPI Preview, Bitcoin Unlikely to Get Bullish Catalyst: Bitcoin (BTC) bulls are hoping for continued good news on the U.S. inflation front from Thursday morning’s July Consumer Price Index report from the Bureau of Labor Statistics. Economists expect a 0.2% increase on a monthly basis, the same increase as seen in June. Year-over-year growth is forecast at 3.3%, up from 3% in June. Headline inflation, which is not adjusted for seasonal factors and which includes often-volatile food and energy prices, peaked at 9.1% in June 2022 and was running at an 8.5% pace in July of last year.

In case you missed it, here is the most recent episode of “First Mover” on CoinDesk TV:

Bitcoin remained stagnant at $29K, teasing $30K. What will it take to push it past $30K? The Crypto Trader author Glen Goodman weighed in. Sandra Leow from Nansen discussed the latest developments with Curve Finance as white hat hackers and attackers return over 73% of all funds stolen from the exploit. And, Moses Singer partner Howard Fischer reacted to the latest legal update between Coinbase and the SEC.

PayPal to Issue Dollar-Pegged Crypto Stablecoin Based on Ethereum: The token will be available first on PayPal and then on Venmo, and can be exchanged for U.S. dollars at any time.

It’s ChatGPT, but for Bitcoin: New AI Tool Avoids ‘Hallucinations’: An experimental version of the Bitcoin-focused AI chatbot was released on Thursday by Chaincode Labs, which says its new “ChatBTC” is less likely to give incorrect answers about the original blockchain, or to “hallucinate” like the more popular (and generalist) ChatGPT.

Curve Recoups 73% of Hacked Funds, Bolstering CRV Sentiment: A public bounty is now open for finding the remaining funds with a $1.8 million reward.

Mantle Introduces New Governing Body for Treasury Management: The new layer 2 network passed a governance vote that establishes the Mantle Economics Committee as well as introduces more liquid staking into the ecosystem by authorizing liquid staking protocol Mantle LSD and the allocation of 40,000 ETH from its treasury to stETH.

Lido Attracted 10K Ether Stakers to Protocol in July: The largest staking service provider also crossed $15 billion in total value locked, a level not seen since May 2022.