First Mover Asia: Nearly $275 Million in Ether Burnt This Month as It Continues Deflationary Trend

Good morning. Here’s what’s happening:

Prices: A new report from K33 highlights heightened volatility in Bitcoin and Ether in 2023, despite a slow start to the year.

Insights: Observers suggest that the market needs a new driver to lift prices higher. Could ether be that driver?

Volatility is Expected, But Was it Missed?

Bitcoin is opening the East Asia trading day at $27,686, down 0.2% while Ether is at $1,901, up 0.4%.

2023 has been an odd year for crypto. In December, during the depths of crypto winter, the price predictions for bitcoin were pretty grim. $10-12K by the first quarter of 2023, said VanEck.

But a lot has happened since then. Ordinals, bank failure, a liquidity crisis.

Between March and mid-May, the market was fairly stale, and bitcoin barely moved.

A new report from K33 Research says this is beginning to change.

Bitcoin’s trading range fluctuated between $25,800 and $28,000 over the last week amid increased volatility. The variation was fueled by a prospective debt ceiling agreement, prompting market rallies, increased Bitcoin dominance and trading volumes, and may lead to more market activity due to Asian regulatory changes and Recep Erdogan’s re-election as president of Turkey, K33 said in the report.

K33 said that this surge was partially amplified by over-leveraged shorts creating a decrease in open interest. At the same time, progress in U.S. debt ceiling negotiations spurred a rally in the crypto and U.S. equities markets.

All of this, they say, along with the transformation in the crypto market structure with stablecoins and ether gaining prominence, and bitcoin’s increased yet comparatively lower dominance, indicates a resemblance to the previous bear market with potentially insufficient de-risk rotation.

The cure for all of this is more liquidity, but that’s nowhere in sight.

Biggest Gainers

Biggest Losers

Could Ether Be the Next Market Driver?

Indeed, bitcoin is on track for its first monthly loss since December, as CoinDesk previously reported, primarily due to the increased likelihood that the U.S. central bank will maintain elevated interest rates, boosting the U.S. dollar and causing a decline in the crypto market.

Experts suggest that the market needs a new driver to lift prices higher.

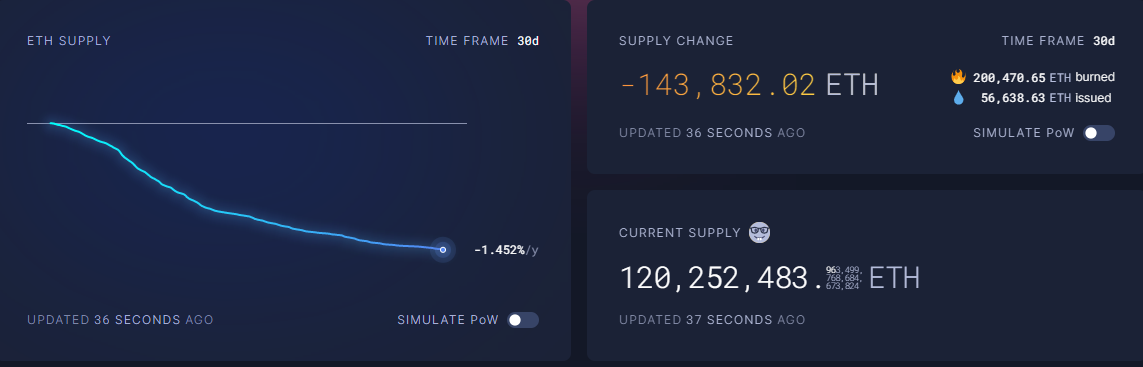

During the last month, over 143,830 ether worth $275 Million has been burnt, according to tracker ultrasound.money.

Ether is well into its deflationary stage, with a negative supply growth of 1.46% per year. The network is forecasted by the tracker to burn 2,441,000 ether this year, or approximately $4.5 billion worth.

In contrast, if Ethereum stayed on as a Proof of Work protocol, it would be on track for supply growth of 2%, the tracker shows.

Data shows that because of Ethereum’s deflationary stance, ether and bitcoin are breaking their correlation.

The positive correlation between the two digital assets has weakened this year, suggesting a long-lasting market shift where they operate more independently due to diverging supply-demand economics.

“What we are seeing could be the beginning of a long-term regime change. As Ethereum has shifted from PoW to PoS, the economics of supply and demand underlying the two tokens will continue to diverge,” Pulkit Goyal, Vice President of trading at OrBit Markets, previously told CoinDesk.

Over 13% of all ether in existence has been staked, according to CryptoQuant data, leading to ether balances on exchanges hitting all-time lows.

Ether is up 2.8% over the last week, while bitcoin has lagged behind, up only 2% during the same period.

In case you missed it, here is the most recent episode of “First Mover” on CoinDesk TV:

Bitcoin (BTC) still appeared on track for its first monthly loss since December. This comes as Berenberg noted that MicroStrategy (MSTR) represents an attractive alternative to Coinbase (COIN) for investors looking to gain exposure to the cryptocurrency sector. Berenberg equity research analyst Mark Palmer shared his analysis. Plus, DappRadar web3 analyst Sara Gherghelas joined “First Mover” to discuss a new report on NFT lending marketplace Blend. And, LabDAO co-founder Niklas Rindtorff weighed in on the future of open-source drug discovery.

BRC-721E Token Standard Converts Ethereum NFTs to Bitcoin NFTs: The new token standard allows traders to burn their ERC-721 NFTs and transfer them to inscriptions on the Bitcoin network.

The Plight of Hyped-Blockchain Canto Demonstrates Dreary DeFi Outlook: Canto’s slide is an example of fickle crypto investors’ lack of appetite in DeFi.

Stablecoin Issuer Tether Invests in Sustainable Bitcoin Mining in Uruguay: The company earlier this month announced plans to invest part of its profits in BTC purchases and infrastructure.

Optimism Token Prices Slide 7% Ahead of $580M OP Unlock, Doubling Token Supply: The initial vesting period for early investors and contributors ends today and will nearly double the circulating supply of the tokens.

Edited by James Rubin.