First Mover Asia: Major Cryptos Remain Unstirred by Inflation Data, Ethereum Shanghai Fork

Featured SpeakerAlex Thorn

Head of Firmwide ResearchGalaxy

Hear Alex Thorn share his take on “Bitcoin and Inflation: It’s Complicated” at Consensus 2023.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/0ce39235-9db0-4b82-a938-ae1d0516b491.png)

James Rubin is CoinDesk’s U.S. news editor based on the West Coast.

:format(jpg)/www.coindesk.com/resizer/KnsJr2e_U9xZpD2ZQMUcfS-ZspM=/arc-photo-coindesk/arc2-prod/public/ZEPFGG2W5BBFRJUO5WS4CTRCPA.jpeg)

Jocelyn Yang is a markets reporter at CoinDesk. She is a recent graduate of Emerson College’s journalism program.

:format(jpg)/www.coindesk.com/resizer/CabGUKozR1NyiBkjN56PYzuQ3RQ=/arc-photo-coindesk/arc2-prod/public/R5JVYM4XOFBPRLGHVGCYQXUAQM.png)

Glenn C Williams Jr, CMT is a Crypto Markets Analyst with an initial background in traditional finance. His experience includes research and analysis of individual cryptocurrencies, defi protocols, and crypto-based funds.

He owns BTC, ETH, UNI, DOT, MATIC, and AVAX

Featured SpeakerAlex Thorn

Head of Firmwide ResearchGalaxy

Hear Alex Thorn share his take on “Bitcoin and Inflation: It’s Complicated” at Consensus 2023.

Good morning. Here’s what’s happening:

Prices: Bitcoin and ether were trading flat after a mildly encouraging inflation report and the unveiling of the Ethereum Shanghai upgrade.

Insights: Go whale watching for a sense of where bitcoin’s price might be headed, writes CoinDesk analyst Glenn Williams writes

Bitcoin, Ether Remain Largely Unmoved by Major Events

Neither hotly anticipated inflation data nor an eagerly awaited Ethereum Shanghai upgrade could move bitcoin or ether much from their most recent perches.

Bitcoin, the largest cryptocurrency by market capitalization, was recently trading at about $29,900, down the better part of a percentage point over the past 24 hours. Ether, the second largest crypto in market value, was hovering around $1,905, up almost a percentage point. Many investors had been looking for both cryptos to react more strongly to Wednesday’s events, particularly the Ethereum “hard fork,” a continuation of the platform’s transformation from a proof-of-work to a faster, more efficient proof-of-stake protocol.

“We should be looking ahead at what’s in store for the Ethereum roadmap,” Jake Boyle, director of retail crypto brokerage Caleb & Brown, wrote. “A lot of progress has been made, and a lot is going to be made. This paints a wildly optimistic picture going forward.”

Boyle added: “We are heading into a recession, or at least it seems that way, and retail investors would be the profile of investors that would sell in the situation we find ourselves in. But this doesn’t seem to be the case, and this suggests to me that the profile of investors in the Ethereum ecosystem right now tends to be larger-scale. They appear to be more institutional-grade, and I don’t think that kind of investor would be quick to sell at this moment in time. They’re long-term focused.”

Most other major cryptos were recently trading flat. The CoinDesk Market Index, a measure of crypto markets overall performance, was recently down about a half percentage point. Equity indexes fell slightly with the tech-focused Nasdaq and S&P 500 off 0.8% and 0.4%, respectively. Gold continued to hold strongly over $2,039, near its all-time high as investors look toward assets that hold their value.

Meanwhile, in an email to CoinDesk, Konstantin Boyko-Romanovsky, CEO at non-custodial platform Allnodes, struck an upbeat note about Ethereum’s future.

“With previously locked ETH becoming available again, it could lead to “a rise in the staking ratio, increased liquidity, and potentially higher prices,” Boyko-Romanovsky wrote. “As the staking ratio rises, it will boost network security, a crucial indicator of blockchain health, and decrease the amount of circulating ETH.”

He added: “Early stakers will be able to reinvest their staking rewards. At the same time, removing uncertainty related to undetermined ETH lock-up periods will likely generate more interest in staking among retail and institutional participants.”

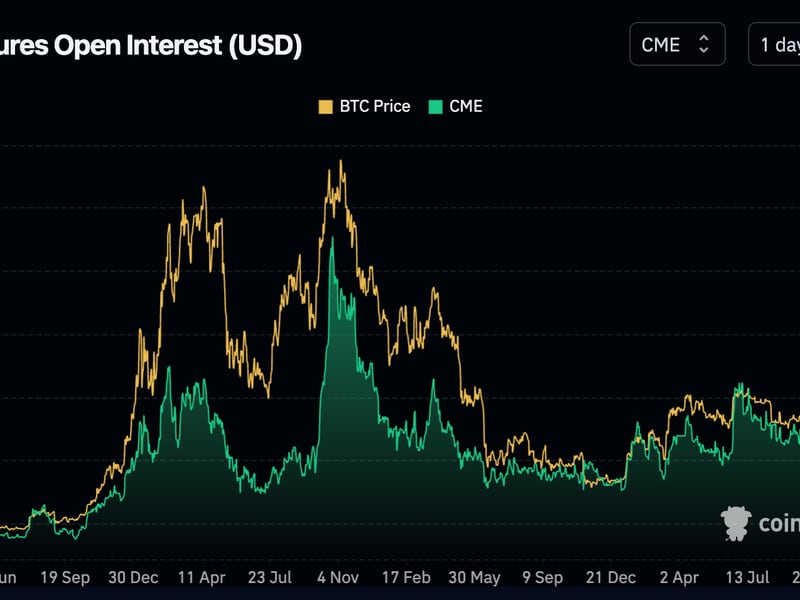

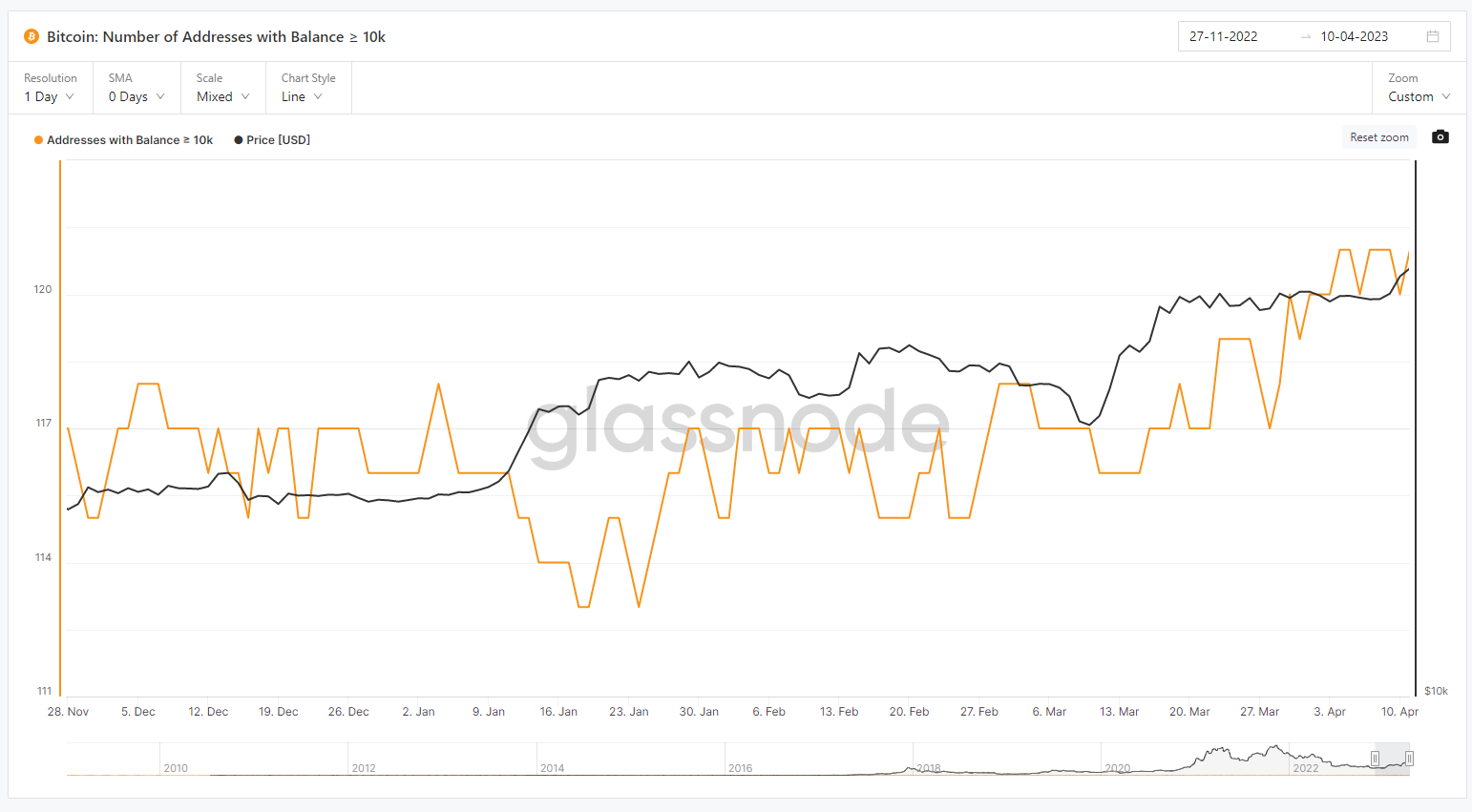

Bitcoin Whales May Forecast BTC’s Price Path

As bitcoin establishes new support at around $30,000, investors might want to track larger unique wallet addresses. Among wallets holding significant amounts of crypto to determine BTC’s price path:

-

The number of wallets holding between one and 99 BTC and those with more than 10,000 BTC has been growing since January.

-

Over the same period, the number of wallets holding between 100 and 9,999 BTC has also been growing.

-

Whales holding at least 10,000 bitcoins have been willing to pivot quickly. While the bias is upwards, these larger traders have been willing to enter and exit positions, taking profits at short-term peaks, and retreating as the price retraces.

Investors on the precipice of 10,000 BTC may be optimistic, locked into the asset and increasing their exposure – ready to move into a higher tier.

Their positions may represent a base of support for BTC prices because investors who went long on the digital asset in January are up 80% year to date.

1:00 a.m. HKT/SGT(17:00 UTC) United States IMF Meeting

In case you missed it, here is the most recent episode of “First Mover” on CoinDesk TV:

The Shanghai upgrade on the Ethereum blockchain, also referred to as “Shapella,” took place on Wednesday at 22:27 UTC (6:27 p.m. EST). “First Mover” was tracking the activation and market impacts of the upgrade that, among other things, will enable staked ETH withdrawals. BTCS Inc. CEO Charles Allen and RockX Co-Founder and CEO Zhuling Chen joined the conversation. Also, Andre Portilho, head of digital assets at BTG Pactual, provided his crypto markets analysis. And Casa CEO Nick Neuman discussed self-custody of digital assets.

Ethereum’s Shanghai Upgrade Is Complete, Starting New Era of Staking Withdrawals: The upgrade on the blockchain, also known as “Shapella” was triggered at 22:27 UTC, and the network is now processing withdrawal requests.

Adidas Releases Chapter 1 of Its ALTS Dynamic NFT Collection: Holders of Adidas’ Into The Metaverse NFTs can burn their tokens to join the new dynamic NFT ecosystem.

LIVE BLOG, Ethereum’s Shanghai Upgrade: CoinDesk reporters and editors chronicle the first-ever activation of withdrawals from the Ethereum staking mechanism, set for Wednesday at 6:27 p.m. ET (22:27 UTC). We’ve got the play-by-play on Shanghai – also known as “Shapella” – from what we’re seeing on the blockchain and at the watch parties.

Ethereum Trades Flat After Ethereum Shanghai Upgrade: Analysts had been divided on how prices might react.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/0ce39235-9db0-4b82-a938-ae1d0516b491.png)

James Rubin is CoinDesk’s U.S. news editor based on the West Coast.

:format(jpg)/www.coindesk.com/resizer/KnsJr2e_U9xZpD2ZQMUcfS-ZspM=/arc-photo-coindesk/arc2-prod/public/ZEPFGG2W5BBFRJUO5WS4CTRCPA.jpeg)

Jocelyn Yang is a markets reporter at CoinDesk. She is a recent graduate of Emerson College’s journalism program.

:format(jpg)/www.coindesk.com/resizer/CabGUKozR1NyiBkjN56PYzuQ3RQ=/arc-photo-coindesk/arc2-prod/public/R5JVYM4XOFBPRLGHVGCYQXUAQM.png)

Glenn C Williams Jr, CMT is a Crypto Markets Analyst with an initial background in traditional finance. His experience includes research and analysis of individual cryptocurrencies, defi protocols, and crypto-based funds.

He owns BTC, ETH, UNI, DOT, MATIC, and AVAX

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/0ce39235-9db0-4b82-a938-ae1d0516b491.png)

James Rubin is CoinDesk’s U.S. news editor based on the West Coast.

:format(jpg)/www.coindesk.com/resizer/KnsJr2e_U9xZpD2ZQMUcfS-ZspM=/arc-photo-coindesk/arc2-prod/public/ZEPFGG2W5BBFRJUO5WS4CTRCPA.jpeg)

Jocelyn Yang is a markets reporter at CoinDesk. She is a recent graduate of Emerson College’s journalism program.

:format(jpg)/www.coindesk.com/resizer/CabGUKozR1NyiBkjN56PYzuQ3RQ=/arc-photo-coindesk/arc2-prod/public/R5JVYM4XOFBPRLGHVGCYQXUAQM.png)

Glenn C Williams Jr, CMT is a Crypto Markets Analyst with an initial background in traditional finance. His experience includes research and analysis of individual cryptocurrencies, defi protocols, and crypto-based funds.

He owns BTC, ETH, UNI, DOT, MATIC, and AVAX