First Mover Asia: Large Bitcoin Holders Content to Hold Long Positions Amid Regulatory Turmoil

Good morning. Here’s what’s happening:

Prices: Bitcoin and other cryptos stabilize after Wednesday afternoon dip. BTC regains $25K.

Insights: Increasing U.S. regulatory scrutiny leaves large bitcoin holders unmoved.

Bitcoin Regains $25K After Dip

Bitcoin regained $25,000 after a late Wednesday dip, fueled by fears about a renewal of central bank hawkishness later this year, sent the price below the threshold.

BTC was recently trading at about $25,171, off 3.1% over the past four hours, part of a wider crypto selloff. The largest cryptocurrency in market value had been traveling comfortably just below $26,000 for much of the past five days as markets awaited the latest interest rate decision by the U.S. central bank and continued to chew over last week’s U.S. Securities and Exchange lawsuits against crypto exchanges Binance and Coinbase.

The Federal Reserve elected to suspend rate hikes, but comments by bank Chair Jerome Powell following the announcement appeared to spook markets. Powell reiterated the Fed’s commitment to sink annual inflation to a target 2.5%. It currently stands at 4%. But critics of bank policy say that the focus on prices risks sending the economy into a recession.

Just as equity markets were closing a lackluster day, digital assets plunged. Ether, the second largest crypto by market cap, fell to $1,630 before regaining ground to hover near $1,654, off 5.1% from Tuesday, same time.

Among other major cryptos, XRP retreated was recently down 6.4% to trade at just over 48 cents over the past 24 hours. It sank as low as 46 cents earlier in the day, its lowest level in June, according to CoinDesk Indices data. The CoinDesk Market Index, a measure of crypto markets performance, was recently down 3.8%.

In an email to CoinDesk, Ruslan Lienkha, chief of markets at Web3 crypto and fiat service provider YouHodler, wrote that bitcoin’s late plunge did not necessarily foreshadow a larger downturn. “We have to remember that the crypto market is a relatively small market, and a few hundred million dollars can move the market for a few percent,” Lienkha wrote. “So let’s see the following days if it is really a downward trend or just a single whale sell off.”

And in a follow-up comment to an earlier note to CoinDesk, Markus Levin, co-founder of blockchain geospatial network XYO Network, wrote that despite the Fed’s hawkish, post-announcement comments, he believed that has “bottomed already for” its current “four-year cycle.”

“But nothing is certain in this market, especially when it comes to crypto,” he added. For example, if we do enter recession territory, then we should be prepared for even more unpredictable movements with Bitcoin and other assets that are further along the risk curve.”

Biggest Gainers

Biggest Losers

Large Bitcoin Holders Hold Their Ground

Despite the recent regulatory turmoil hitting crypto markets, larger holders of bitcoin have not been reducing their bitcoin holdings.

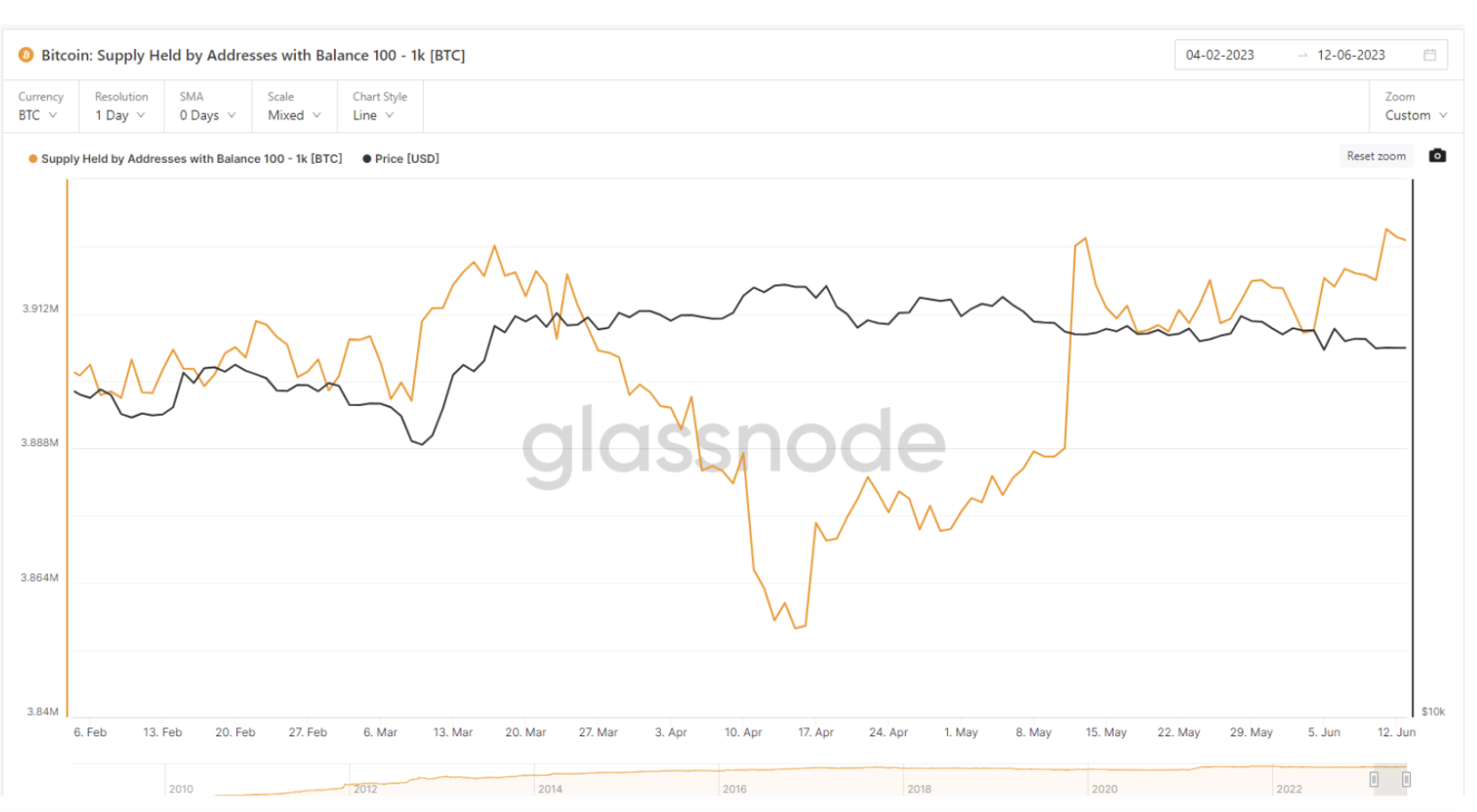

Data from on-chain analytics firm Glassnode, shows that unique addresses holding between 100-1,000 BTC have increased their BTC holdings since the U.S. Securities and Exchange Commission’s (SEC) announced lawsuits versus Binance and Coinbase.

Addresses holding between 10 and 100 BTC performed similarly. The risk appetite was not as robust however for wallets holding more than 1,000 BTC.

Addresses holding between 1,000 and 100,000 BTC stayed relatively flat, although a slight decline occurred with the segment of addresses holding between 1,000 and 10,000.

The data coincides with funding rates that remain positive for BTC as well as a decrease in BTC on centralized exchanges. While not necessarily a bullish signal, the data implies that large bitcoin investors are content to sit on their positions at the moment.

This article was written and edited by CoinDesk journalists with the sole purpose of informing the reader with accurate information. If you click on a link from Glassnode, CoinDesk may earn a commission. For more, see our Ethics Policy.

10:00 a.m. HKT/SGT(2:00 UTC) China Retail Sales (YoY/May)

In case you missed it, here is the most recent episode of “First Mover” on CoinDesk TV:

Bitcoin traders were taking a defensive stance ahead of the Fed’s monetary policy meeting later today. Bitwise Asset Management Chief Investment Officer Matt Hougan joined “First Mover” to discuss. Separately, the federal judge overseeing the U.S. Securities and Exchange Commission (SEC)’s case against Binance and Binance.US declined to order a temporary restraining order freezing the U.S. trading platform’s assets. CoinDesk Global Policy and Regulation Managing Editor Nikhilesh De broke down the decision. Plus, Prometheum co-CEO and founder Aaron Kaplan joined the show after speaking on Capitol Hill Tuesday about crypto legislation.

DeFi Platform EigenLayer Rolls Out Restaking Protocol on Ethereum Mainnet: EigenLayer’s developers raised $64.5 million in a series of investment rounds.

The Graph Starts Migrating its Settlement Layer to Arbitrum from Ethereum: The transition is aimed at reducing barriers of entry for The Graph’s users by decreasing gas costs and speeding up transactions.

‘Distributed Validator Technology’ Marks Last Key Milestone in Ethereum’s Current Era: The technology known as DVT involves splitting a validator’s private key across several node operators. The goal is to increase the network’s resilience – while also protect the individual validators – by reducing single points of failure.

Bitcoin Supply on Exchanges Slides to Three-Year Low: Supply is likely dropping as traders and investors increasingly choose to self custody bitcoin holdings amid regulatory and exchange risks.

Blockchain Developer Platform Alchemy Releases AI-Powered Tools for Web3 Builders: AlchemyAI will launch as two new products – an in-app chatbot and a ChatGPT plugin – to help web3 developers access data faster and speed up product development.

Edited by James Rubin.