First Mover Asia: Individual Wallets Holding 1 Bitcoin Hit All-Time High as BTC Maintains $30K

Good morning. Here’s what’s happening:

Prices: Bitcoin continues to show healthy signs of decentralization, even as it has liquidity issues.

Insights: A lack of dollar liquidity means some weird things are happening on Binance.US.

Bitcoin’s Decentralization is Alive and Well as it Maintains $30K Mark

Bitcoin is opening the Tuesday trading day in Asia at $30,366, maintaining a strong presence above $30K.

While the trading volume and market movements have been fairly flat over the last few days, as the market continues its struggle with liquidity, bitcoin has recently passed a symbolic milestone.

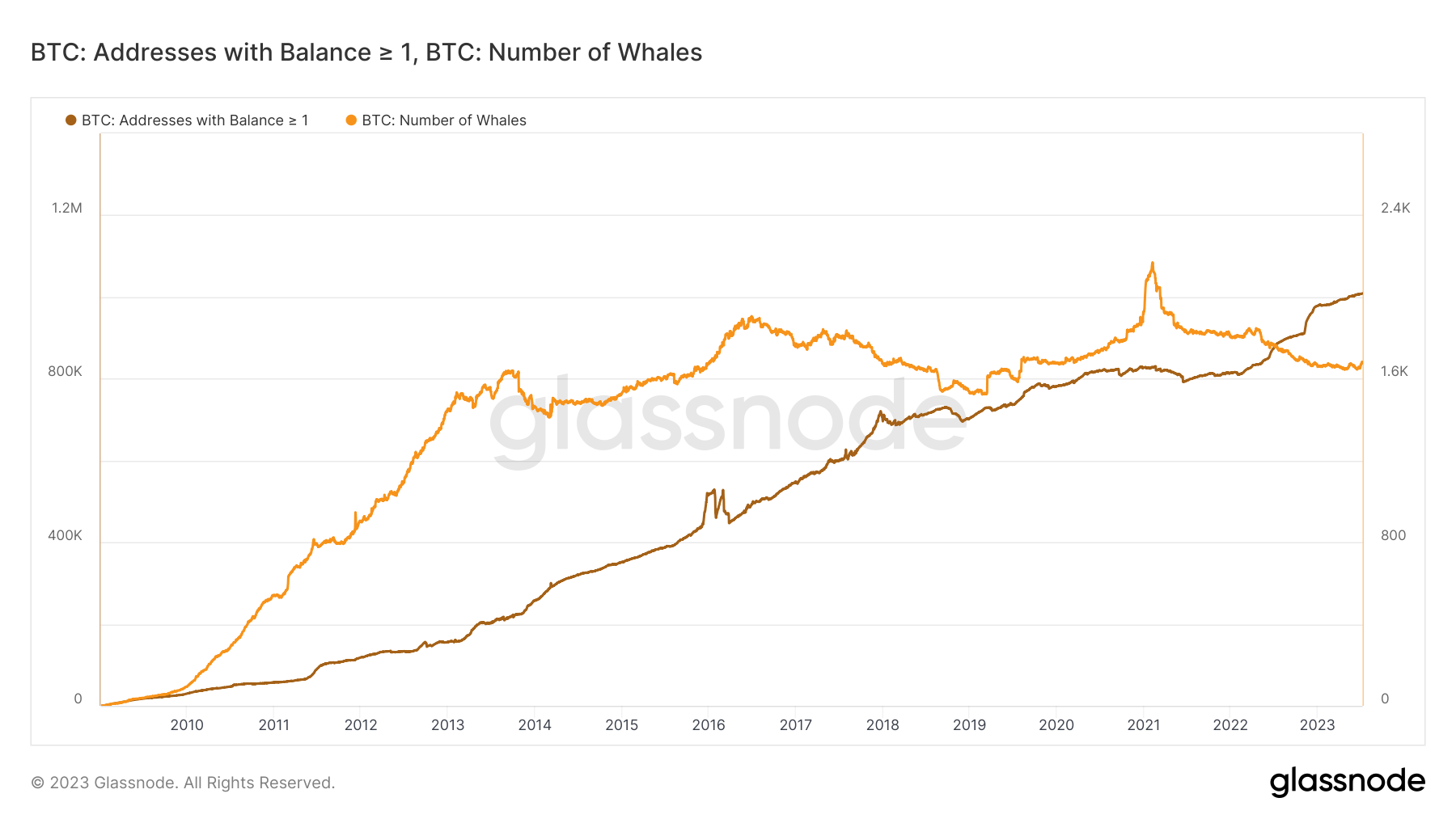

The number of wallets holding at least one bitcoin has reached an all-time high of 1,008,737 million, according to data from Glassnode.

This increased distribution of wallets with at least one bitcoin suggests increased decentralization of the network. Meanwhile, Glassnode’s data shows that the number of whales is also decreasing.

The number of wallets holding at least one bitcoin first crossed the million mark in May and has been rising since.

All this comes as the popularity of ordinals increases the load on the Bitcoin network.

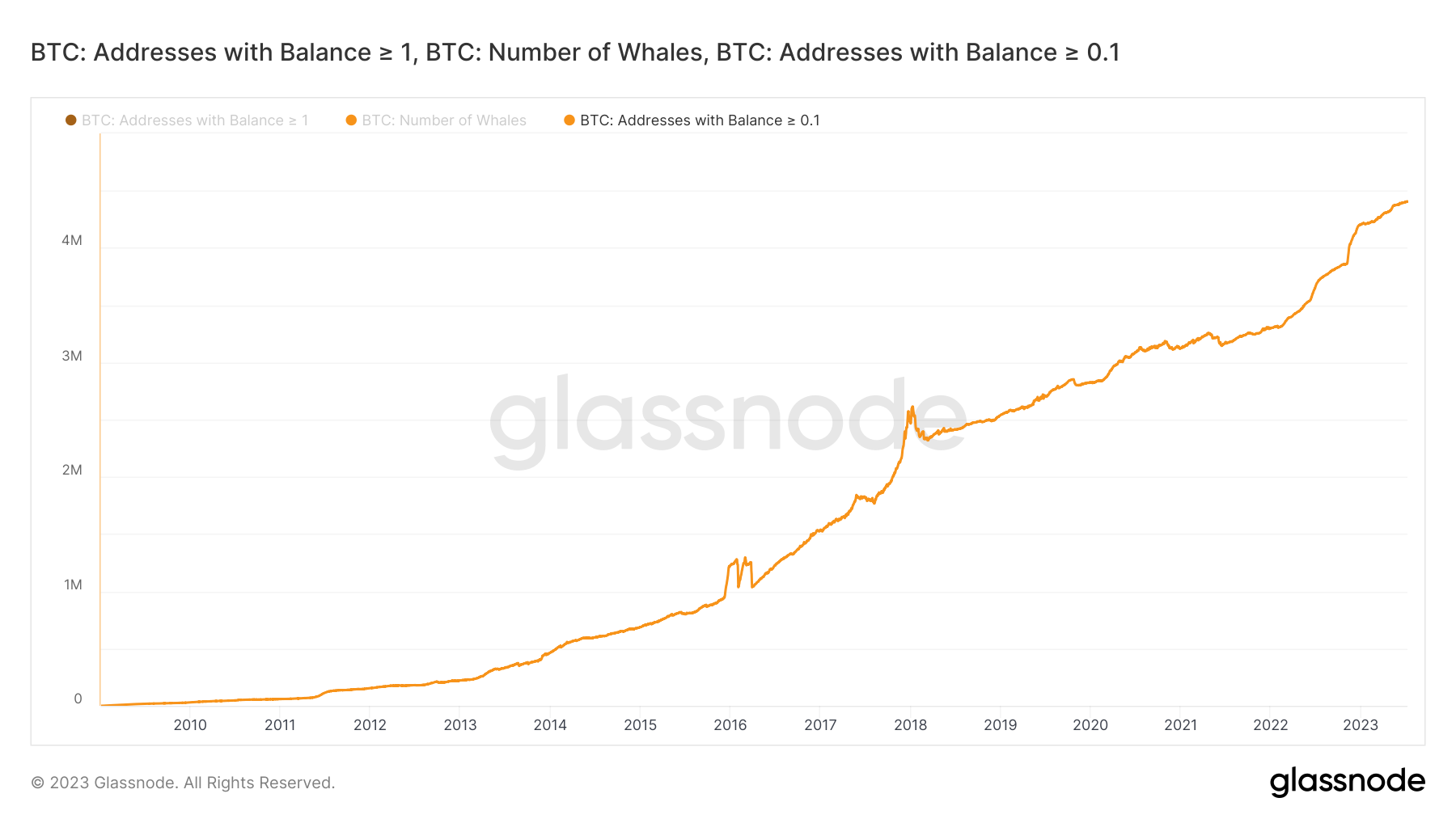

A number of metrics are showing increased activity, from an uptick in miners transferring coins to exchanges to the number of addresses with a balance greater than 0.1.

Bitcoin’s next big moves will likely come later this week as jobless claims and CPI data are released, both of which will indicate how successful the Fed’s moves at taming inflation are – data that traders zoom in on when making their next moves.

Biggest Gainers

Biggest Losers

Binance.US Has a Free Money Problem

Binance.US was always meant to be the fiat pipeline for U.S. nationals wanting to use Binance. But as of last month, it’s having trouble fulfilling that role as its fiat pipelines are suspended.

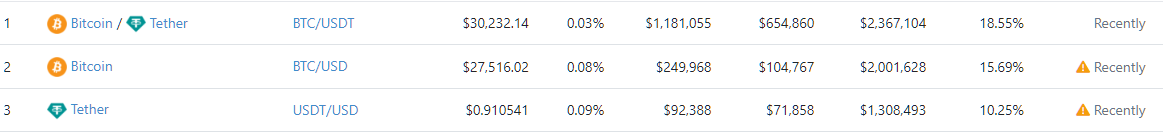

With no fiat liquidity, this has put the exchange in a weird place. Bitcoin is trading at a discount of 9%, as is Tether (USDT); the world’s biggest dollar-pegged stablecoin is trading at a nearly 9-cent discount from other exchanges.

The exchange’s market depth or traders’ ability to execute large orders at stable prices has also deteriorated significantly in recent months, aiding wild price action.

Data from research group Kaiko shows that market depth has collapsed on Binance.US, with an over 60% drop in liquidity available on the platform in June.

Adrian Wang, founder, and CEO at digital assets wealth management firm Metalpha, points to the looming withdrawal deadline of July 20 as a reason for the depegging.

“As the days approach this deadline, lesser liquidity and lesser banks to exchange fiat means that we may see this de-peg continue,” he told CoinDesk.

An easy trade right now is to buy USDT at a discount on Binance.US and move it elsewhere to trade with. But it just can’t involve fiat ramps – the bread and butter of most of Binance.US’ users.

“I think there might be some arbitrage opportunities for institutions or market makers, but retail traders wouldn’t likely have the risk tolerance or understanding,” Nick Ruck, COO of DeFi protocol ContentFi Labs said to CoinDesk in a note.

Certainly, many have been doing this to enjoy free money; in the last week the exchange has had a netflow of negative $16.2 million, according to Nansen.ai data.

But the question is, why hasn’t this resolved itself? Why hasn’t it either brought down Tether’s overall value, or pushed back up the value of USDT on Binance.US?

“Compared with the total circulation of USDT, the selling volume is not enough to affect the overall market price in the end,” Tony Ling, co-founder of data portal NFTGo, and a partner at Bizantine Capital, told CoinDesk. “There have been more serious price deviations before, and nothing happened in the end.”

For now, enjoy the free money.

This article was written and edited by CoinDesk journalists with the sole purpose of informing the reader with accurate information. If you click on a link from Glassnode, CoinDesk may earn a commission. For more, see our Ethics Policy.

In case you missed it, here is the most recent episode of “First Mover” on CoinDesk TV:

The SEC argued in a new filing last Friday that Coinbase acknowledged the possibility that federal securities laws would apply to its listings years ago. Hodder Law Firm Managing Partner Sasha Hodder weighed in on Gemini suing Digital Currency Group. DCG owns Genesis and CoinDesk. Opimas LLC CEO Octavio Marenzi shared his crypto markets analysis. And, Shardeum chief growth officer Kelsey McGuire discussed the Layer 1 blockchain’s latest funding round.

Apple May Not Like It, but ‘Zapple Pay’ Finds Workaround for Bitcoin Tipping on Damus: The new third-party payment service claims to be independent of the Damus iPhone app that Apple has tried to restrict, and lets users tip one another on any app that runs on the Nostr protocol.

Crypto Startup Arkham Has Apparently Been Doxxing Users for Months: The company had already angered the crypto community Monday with a service that unmasks anonymous crypto users. Then came allegations it used an easy-to-decipher method for hiding customers’ email addresses.

Grayscale Bitcoin Trust Discount Narrows to Lowest Since May 2022: Buying for the trust has picked up on hopes the SEC might soon approve a spot bitcoin ETF.

What Mastodon’s Critical Bug Fixes Say About Crypto’s Security Vulnerabilities: Crypto protocols are often multi-billion dollar bug bounties, for better or worse.

CoinDesk Market Index Q2 Review: Quiet Appreciation, Regulatory Uncertainty: On the positive side, the SEC started approving crypto ETF products, buoying markets for bitcoin and ether. On the other: major crypto exchanges were sued by regulators, increasing regulatory uncertainty around the sector.

Disclaimer: This article was written and edited by CoinDesk journalists with the sole purpose of informing the reader with accurate information. If you click on a link from Glassnode, CoinDesk may earn a commission. For more, see our Ethics Policy.

Edited by James Rubin.