First Mover Asia: Crypto’s Rotating Profits

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/7c0b0bd4-6cb4-4d93-8bc4-1db61149c9d1.png)

Good morning. Here’s what’s happening:

Prices: Amid Bitcoin role debates and halving concerns, bitcoin and ether start flat in East Asia; Cobo’s data points to market confidence recovery and Bybit links memecoin surge to reinvestment, warning of mining impacts if Bitcoin doesn’t stabilize above $30,000 post-halving.

Insights: Bitcoin’s reduced congestion impacted altcoin rallies and BRC-20 tokens’ demand led to high fees and boosted miner revenue without new users, possibly changing bitcoin’s relationship with ether and its market dynamics.

Bitcoin and ether are both starting the East Asia trading day off flat, with the world’s largest digital asset down 0.6% to $27,037, and ether up 0.4% to $1,824.

According to the Asset Under Custody (AUC) data from Cobo, an institutional custodian, the confidence in the cryptocurrency market hit its lowest point in February 2022, followed by a quick recovery from March onwards. Cobo’s AUC has already bounced back to the level in November 2022, indicating that funds are returning to the market, the firm shared with CoinDesk in a note.

“The recent surge in memecoins that occurred alongside a decline in general interest in crypto (as measured by Twitter and YouTube analytics), suggests these capital inflows are likely the result of investors rotating profits made from crypto’s strong performance year-to-date,” said Charmyn Ho, head of crypto insights at Bybit, in a note to CoinDesk.

Ho wrote that there might still be some space for further depreciation and that these ranges represent attractive accumulation zones for long-term HODLers.

Meanwhile, macroeconomics continues to be the defining part of the bitcoin story. But there’s debate around whether bitcoin is a store of value, or a hedge against risk, which won’t be solved any time soon.

Then there’s the halving. Expected sometime in early 2024, this is thought to be the next chapter in the pricing narrative. But Cobo CEO Mao Shixing disagrees.

“From an economic point of view, bitcoin halving currently does not play a significant role, but it is a good narrative logic,” he told CoinDesk in a note.

One thing to look at, he noted, is the impact it might have on miners.

The S19 mining machine remains the mainstream choice for miners. However, he told CoinDesk, if the price of the coin doesn’t stabilize above $30,000 following the next halving event scheduled for next year, these mining machines will inevitably have to cease operation.

Biggest Gainers

Biggest Losers

Bitcoin is Clearing the Unconfirmed Transaction Pile, But It’s Still at Record Highs

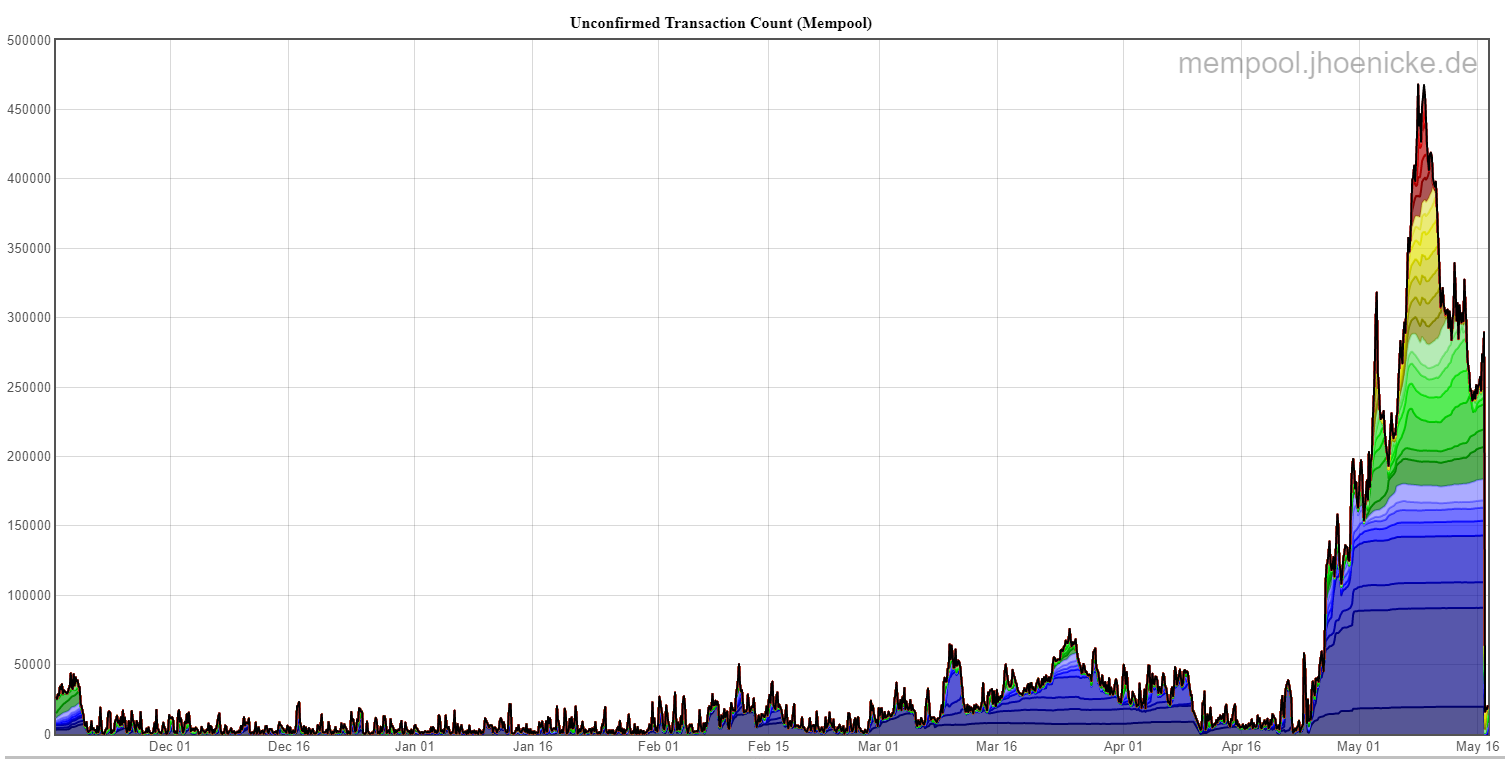

The congestion on the Bitcoin blockchain, which caused Binance to temporarily disable withdrawals twice last week, has eased, with the number of unconfirmed transactions falling to 260,000 from a record high of just over 450,000 reached last week.

This easing has taken the wind out of the rally in bitcoin knock-offs, bitcoin cash (BCH), and bitcoin SV (SBV). Both rallied last week as congestion on Bitcoin saw investors pour money into alternatives. Bitcoin continues to uphold its 1 MB block size. In contrast, Bitcoin Cash and Bitcoin SV have expanded their block sizes to 32 MB and a whopping 128 MB, respectively. Consequently, these two protocols offer notably lower transaction costs than the Bitcoin protocol.

As the episode is over, we can look back at the final tally of the fees paid out during Bitcoin’s Ordinals rally, as noted by Glassnode, which are enormous.

The surge in demand for block space due to BRC-20 tokens has led to notably high fees, with the average fee per block exceeding the block subsidy for only the fifth time in Bitcoin’s history. This has brought total daily fees near an all-time high at $17.8 million per day and resulted in an additional $100M revenue for miners, raising fee-based miner revenue to 11.5%, Glassnode wrote.

Meanwhile, this has resulted in record-breaking transaction counts, achieving a new all-time high of 682,000, representing an increase of 39% from the peak in 2017.

But is this bringing in new users? Not really. Despite the surge in transaction activity, the number of active addresses decreased, indicating a trend of BRC-20 users reusing Bitcoin addresses.

One question on the minds of many is will the introduction of BRC-20-powered tokens and NFTs onto Bitcoin move the relationship between bitcoin and ether into something different.

As CoinDesk previously reported, the 30-day rolling correlation between bitcoin and ether prices has dropped to 77%, the lowest since 2021, indicating a possible long-term decoupling of the two largest cryptocurrencies.

This weakening correlation could boost trading activity in bitcoin-ether pairs on major exchanges, creating new opportunities for traders to capture the relative value between the two without involving the dollar.

Or, for Bitcoin’s narrative, is this just an annoyance or actually a material change?

In case you missed it, here is the most recent episode of “First Mover” on CoinDesk TV:

Landmark new crypto rules were signed off on Tuesday by finance ministers of the European Union (EU). Clifford Chance LLP senior associate Laura Douglas joined “First Mover” to discuss the significance. Separately, crypto markets remained fairly quiet, as prices for both bitcoin (BTC) and ether (ETH) were trading below their 20-day moving average. 3IQ CEO Fred Pye shared his crypto markets outlook. And, LandVault CEO Samuel Huber discussed how partnerships are shaping up in the metaverse amid crypto winter.

Bitcoin’s Realized Price on Cusp of Flashing Major Bullish Signal: The crypto’s realized price looks set to cross above the average on-chain acquisition price of long-term holders, indicating a prolonged bullish period ahead.

Bitcoin-Ether Correlation Weakest Since 2021, Hints at Regime Change in Crypto Market: As Ethereum has shifted from PoW to PoS, the economics of supply and demand underlying the two cryptocurrencies will continue to diverge, one observer said.

One Million Individual Wallets Now Hold a Whole Bitcoin: A major bump in such wallets came after the implosion of crypto exchange FTX between November and January.

Peter Thiel Backs Bitcoin Startup River in $35M Round: The Series B funding for the Bitcoin financial services provider was led by Kingsway Capital.

Optimism, Scaling Solution for Ethereum, Sets June Date for Biggest Ever Upgrade, ‘Bedrock’: The upgrade, a hard fork proposed earlier this year and approved by the Optimism community in April, is supposed to bring a “new level of modularity, simplicity and Ethereum equivalence.”

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/7c0b0bd4-6cb4-4d93-8bc4-1db61149c9d1.png)

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/7c0b0bd4-6cb4-4d93-8bc4-1db61149c9d1.png)