First Mover Asia: Crypto Flat as Markets Await Tech Earnings

Featured SpeakerAlex Thorn

Head of Firmwide ResearchGalaxy

Hear Alex Thorn share his take on “Bitcoin and Inflation: It’s Complicated” at Consensus 2023.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/7c0b0bd4-6cb4-4d93-8bc4-1db61149c9d1.png)

Featured SpeakerAlex Thorn

Head of Firmwide ResearchGalaxy

Hear Alex Thorn share his take on “Bitcoin and Inflation: It’s Complicated” at Consensus 2023.

Good morning. Here’s what’s happening:

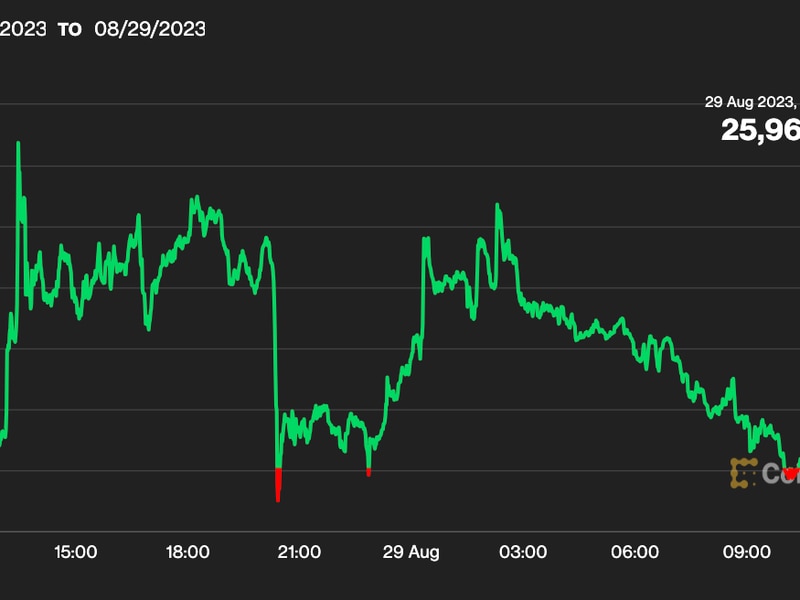

Prices: Crypto markets are playing the waiting game as tech’s expected mixed bag of earnings may push things down as the week progresses.

Insights: Do Kwon is in a Montenegro jail on charges he sold unregistered securities, but his attorneys raised a reasonable point about the SEC quest for unlimited jurisdiction over the asset class.

Markets in the region are opening flat, with both crypto and TradFi markets not doing much.

Bitcoin is currently at $27,514 down 1.2% while ether is down 2% to $1,845.

Ether’s relatively stagnant position comes as the protocol’s Shanghai upgrade brings record-breaking inflows into the ecosystem as stakers reinvest their rewards.

Data from Coinglass shows that while the market is still relatively flat, the majority of liquidations are coming from short positions, suggesting the market has legs.

Around Asia, the Nikkei 225 opened slightly in the green at 28,714 while Korea’s KOPSI is flat at 2,521.

In the U.S., Wall Street is awaiting earnings from Microsoft and Alphabet which are scheduled for April 25.

Crypto remains tightly correlated with the NASDAQ, as CoinDesk reported earlier this month, which reiterates the narrative that it’s another risk asset rather than a safe haven from economic malaise, thus making tech earnings as important as ever.

Biggest Gainers

Biggest Losers

Do Kwon is back in court in the U.S. – via his lawyers as he’s in jail in Montenegro – asking for the Security and Exchange Commission’s (SEC) case against him alleging he sold unregistered securities to be dismissed. UST is currency, not a security, is the argument being presented.

The SEC lacks a “clear congressional authorization” to regulate digital assets, the docket reads, pointing out that the CFTC chairman has changed his mind “about whether cryptocurrencies are securities, and currently asserts that stablecoins (like UST) are not.”

Kwon isn’t the only target here. The SEC is continuing its campaign of regulation by enforcement: attempting to get insider trading charges added to a case of a fired Coinbase product manager, thus vis-a-vis having a wide net to call everything a security; or sneaking in allegations that all exchange tokens are securities in a complaint against former Alameda COO Caroline Ellison which went uncontested as she submitted a plea deal to prosecutors.

In contrast, many jurisdictions in Asia are moving in the opposite direction: creating legal frameworks to properly define crypto – not apply frameworks from the mid-twentieth century – and regulate it as the unique asset class it is. The Monetary Authority of Singapore has this already set up, Hong Kong is working on its own framework, and even Taiwan is rolling out a rulebook.

Kwon is no saint, and is in a lot of trouble after being caught in Montenegro with a fake passport. But his counsel is putting forward a good argument about crypto regulation in the U.S, and the SEC’s quest for unlimited jurisdiction over the asset class.

Perhaps in his fall, he’ll create an important precedent for the future of crypto regulation in the U.S., and in the end, we’ll thank him for accelerating a push for regulatory clarity.

Consensus 2023 (April 26-28)

In case you missed it, here is the most recent episode of “First Mover” on CoinDesk TV:

Rep. Warren Davidson (R-Ohio) joined “First Mover” to discuss the future of U.S. crypto regulation and explained why he wants to restructure the Securities and Exchange Commission and called for the removal of SEC Chair Gary Gensler. This came as bitcoin (BTC) is falling for the third straight day and touched a 24-hour low of $27,844.46. PV01 CEO Max Boonen and Crypto is Macro Now economist Noelle Acheson also joined the conversation. Acheson is also the former head of research at CoinDesk and Genesis Trading.

What to Expect at Consensus 2023: From Solana phones to the future of U.S. crypto policy, here’s what to look out for at crypto’s Big Tent event – Consensus.

Zimbabwe to Introduce Gold-Backed Digital Currency, Report: The country’s central bank wants people to be able to exchange Zimbabwe dollars for the gold-backed token so that they can hedge against the currency’s volatility.

Wrapped Bitcoin Token Goes Live on Cardano Testnet: The anetaBTC project aims to attract bitcoin liquidity to the Cardano ecosystem.

Terra’s Do Kwon Wants SEC Charges Dismissed, Court Filings Show: The SEC cannot regulate digital assets involved in the case because the UST stablecoin is a currency, not a security, lawyers for Kwon have said.

Bitcoin Price May Hit $100K by Year End, Standard Chartered Bank Says: A report from the firm noted that the crypto winter is finally over and bitcoin halving is set to be a positive catalyst for the price.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/7c0b0bd4-6cb4-4d93-8bc4-1db61149c9d1.png)

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/7c0b0bd4-6cb4-4d93-8bc4-1db61149c9d1.png)