Good morning. Here’s what’s happening:

Prices: BitBull Capital’s Joe DiPasquale says that a rate hike pause has helped the market, but rate cuts are what’s needed to stop it from struggling in the future.

Insights: Indonesia updates its list of digital assets approved for trading in the country. Is its motivation to increase tax revenues?

Is a Rate Hike Pause Enough for a Rally?

Bitcoin is beginning the trading week in Asia down 0.5% to $26,366, while ether is down 0.2% to $1,724.

The trading week was fairly flat for the two largest digital assets, as during the past seven days, bitcoin was up 1.6% while ether was down 1.7%. The CoinDesk Market Index, a measure of crypto markets performance, was slightly in the red.

“With Fed having left interest rates unchanged, the environment appears supportive for crypto assets to start rallying again,” Joe DiPasquale, the CEO of crypto fund manager BitBull Capital, said in a note to CoinDesk. “However, the Fed went ahead to add that rate cuts were not on the horizon in the near-term, which saw the market struggling.”

Bitcoin and majors have held relatively well, says DiPasquale, arguing that this is a favorable accumulation opportunity for the mid to long-term.

“For now, however, all eyes are going to be on Bitcoin, especially as its dominance has been on the rise due to selling pressure in altcoins,” he said. “As long as the market leader maintains the range between $20k – $22k, bulls shouldn’t be overly concerned.”

Biggest Gainers

Biggest Losers

Indonesia’s Approved List of Crypto Tokens Has Plenty of Junk – and Possible Securities

One of the stories that was missed during the last week was an updated list from the Indonesian Commodities Bureau (BAPPEBTI) that shows which digital assets are approved for trading in the country.

This isn’t the first time the regulator has done this. Last September, the regulator published its initial list, and now it’s much more expansive.

But it’s interesting now because of the timing.

So many of the tokens on the list would be considered securities in the U.S. Tokens named by the Securities and Exchange Commission (SEC) as securities, like Solana (SOL), Cardano (ADA), and Decentraland (MANA) are on there. Tokens that wouldn’t pass Hong Kong’s quality test of high liquidity and a 12-month track record are on there.

Perhaps the message the regulator wanted to telegraph is that Indonesia is open to a wide variety of crypto trading – it just wants the capital gains tax from it.

It gets that sought-after tax by taking a light touch on the quality of trading by allowing quantity. Lots of Hong Kongers were burned on the collapse of FTX, which is why the regulator there has an eye on quality control. Indonesia is more set on capturing tax revenue as its middle class grows, something it has had trouble doing with its large informal economy.

The concerns are just different in Indonesia. There are also plenty of tokens on the list that wouldn’t cut it in Thailand, like PEPE and Floki – where the regulator has banned meme tokens. There’s not a demand for a flight to quality with regulated crypto in this country.

But isn’t that a core tenant of a free-market economy? Why is the government in the best position to pick your crypto?

6:00 p.m. HKT/SGT(10:00 UTC) German Buba Monthly Report

In case you missed it, here is the most recent episode of “First Mover” on CoinDesk TV:

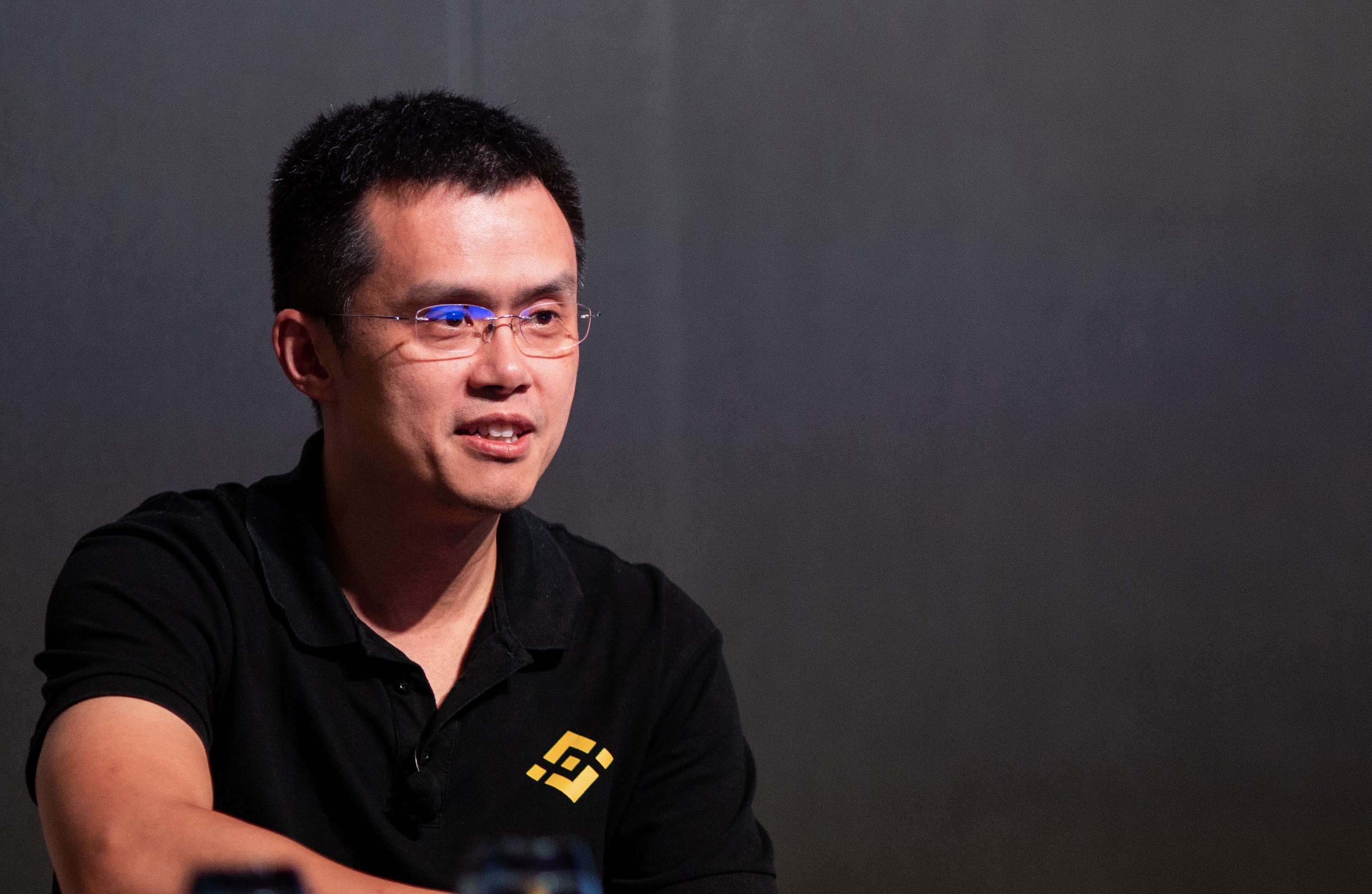

Binance’s French unit is under investigation for the “illegal” provision of digital asset services and “acts of aggravated money laundering.” BlackRock (BLK) iShares had filed paperwork with the U.S. Securities and Exchange Commission (SEC) for the formation of a spot bitcoin (BTC) ETF. Anthony Georgiades, Innovating Capital General Partner, weighed in on market reaction. Plus, Cboe Digital President John Palmer joined to discuss gaining CFTC approval to launch margin futures on bitcoin and ether. Generative artist Dmitri Cherniak’s Ringers #879 non-fungible token (NFT) sold at auction for a full price of $6.2 million. Sotheby’s Head of Digital Art and NFTs Michael Bouhanna joined the conversation.

Tether’s Banking Relationships, Commercial Paper Exposure Detailed in Newly Released Legal Documents: Obtained by CoinDesk under a Freedom of Information Law request, the documents offer a rare but limited window into the reserves behind USDT, the crypto market’s largest stablecoin.

Binance to Quit Netherlands After Failing to Acquire License: The crypto exchange’s attempt to secure a virtual asset service provider (VASP) license from the Dutch regulator was unsuccessful.

Central Banks Successfully Test Over 30 CBDC Use Cases, Including Offline Payments: An API layer could facilitate a wide range of central bank digital currency payment scenarios, a Bank for International Settlements and Bank of England experiment has shown.

Professional Investors Still Have an Appetite for Digital Assets, Survey: A survey by Nomura’s digital asset subsidiary shows that investors overwhelmingly say digital assets represent an important diversification opportunity.

BlackRock’s Bitcoin ETF Would Be a Big Deal: And it doesn’t really matter if it’s technically a trust.

Edited by James Rubin.