First Mover Asia: Bitcoin Remains Calm Above $29.1 K but Is Higher Volatility in Its Future?

Good morning. Here’s what’s happening:

Prices: The recent monotony in bitcoin and altcoin prices may be a set-up for more volatile times ahead. Meanwhile, bitcoin remained in its recent tight range above $29.1K.

Insights: The supply of bitcoin active over a year ago drops. Is hodling starting to wane?

Is More Volatility in the Offing?

Is bitcoin’s current lull just a set-up for more dramatic movements to come?

A report by K33 report earlier this week suggested as much. The digital asset analytics group noted that while the largest cryptocurrency was recently trading in an increasingly narrow spread over the last six weeks, immune to macroeconomic and industry events that likely would have stimulated investors up or down in past years, it was headed for more volatile times based on historical precedent.

As TradFi markets in Asia opened Friday, BTC was changing hands just below 29,200, flat over the past 24 hours and firmly in the $500-dollar range it has occupied for the better part of two weeks. And bitcoin has failed to cross $31,000 since mid July.

“A deep crypto sleep tends to be followed by a violent wake-up,” K33 Senior Analyst Vetle Lunde wrote. “The market is clearly in an unprecedented stable stage, which has typically acted as a massive pressure valve for volatility once it finally reignites.”

“My short-term thesis,” he continued, “is that the market’s volatility pressure is about to climax and that an eruption is near.”

Ether, which has been similarly range-bound, was recently trading at $1,835, a 0.2% decline from Thursday, same time. Ripple’s XRP token and ADA, the native crypto of smart contracts platform Cardano, cut earlier losses but were still down about 2% in a market that retained a more than day-long reddish tint. The CoinDesk Market Index, a measure of cryptos’ performance, was recently down 0.35%.

At least cryptos found some companionship as equity markets, which have increasingly veered in their own direction from digital assets closed down with the S&P 500 off 0.3%.

According to K33 Research, bitcoin’s five-day volatility earlier this week had sunk below that of the S&P, gold and the Nasdaq 100. This only happened a few times in recent years, Lunde pointed out, and every occasion preceded periods of wild price swings.

The reported also noted that BTC’s 30-day volatility, which measures average price changes over the period, recently dropped to near a five-year low. At the same time, trading volumes also shrunk to multi-year lows, while derivatives activity has also declined sharply.

In her Crypto Is Macro Now newsletter on Friday, Noelle Acheson (CoinDesk’s former head of research) called crypto markets’ recent monotony even as significant events swirled “bewildering,” but quipped: “I’ve been covering this market long enough to be able to confirm that, anecdotally, whenever we start joking about BTC being a stablecoin, things turn fast.”

Is Hodling Starting to Wane?

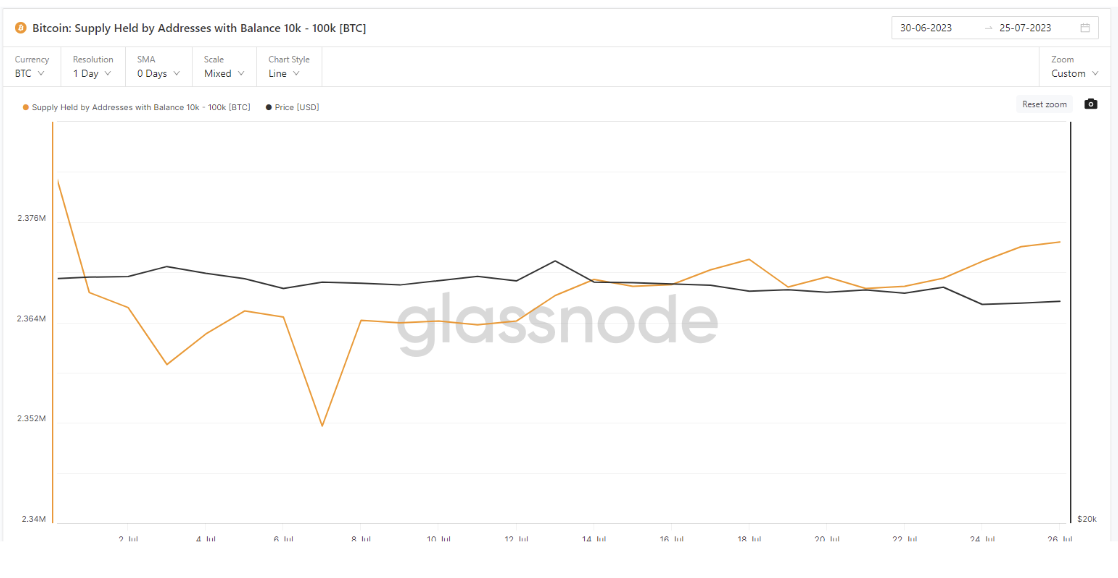

The total supply of bitcoin last active more than one year ago has declined recently according to on-chain analytics firm Glassnode. The decrease indicates that some longer term holders have decided to reduce their holdings.

An increased supply of an asset active in the past indicates that more investors have decided to “hodl” bitcoin as opposed to taking profits. A decrease in that amount indicates the opposite.

The primary age band where supply declined lies between 12 and 24 months. A slight decline in bitcoin supply is showing in the age band between 5 and 7 years as well, though its general direction has been higher.

Investors may want to monitor the behavior of long-term bitcoin holders, as a signal of potential shifts in sentiment.

This article was written and edited by CoinDesk journalists with the sole purpose of informing the reader with accurate information. If you click on a link from Glassnode, CoinDesk may earn a commission. For more, see our Ethics Policy.

In case you missed it, here is the most recent episode of “First Mover” on CoinDesk TV:

Semafor reported that Binance may face Department of Justice fraud charges, though prosecutors are weighing alternatives given the risk of an FTX-style bank run. Josh Sterling, Jones Day partner and former CFTC division director weighed in. Kaiko research analyst Riyad Carey and Sovryn core contributor Edan Yago discussed the future of DeFi following the Curve Finance exploit. And CoinDesk’s Emily Parker shared insights on Japan’s plans for a CBDC.

Coinbase Beats Analyst Estimates for Q2, but Transaction Revenue Falls: The crypto exchange beat on both the top and bottom lines, but transaction revenue and total trading volume fell.

Tether Is Going on a Bitcoin Buying Spree, but It Should Be Holding Cash: The USDT issuer Tether says it holds a lot of U.S. Treasuries and made a lot of money last quarter.

Curve Founder Still Owes $80M Despite Raising Nearly $30M in Past Two Days: Michael Egorov is under liquidation pressure following CRV’s recent price drop and Curve exploit.

Elon Musk’s X Seeks Data Partner to Build Trading Service on App: Semafor: Given the billionaire’s affinity for digital assets, the offering could include crypto trading.

Michael Saylor Says Bitcoin ETFs Will Be the ‘Super Tanker’ for His MicroStrategy ‘Sports Car’: The software company now owns around $4.5 billion worth of bitcoin and is planning to buy more in the third quarter of this year.

Edited by James Rubin.