First Mover Asia: Bitcoin Has Its Eyes on $30K Amid Steadfast Institutional Interest

Good morning. Here’s what’s happening:

Prices: Crypto majors are beginning the trading day in the green as a short squeeze pushes up the price of bitcoin.

Insights: Total value locked in smart contracts lending platform Aave’s v3 platform has risen 15% in June, continuing its 2023 momentum.

Crypto Rises as Asia Opens

Bitcoin and ether are beginning the Asia trading day significantly in the green, with the world’s largest digital asset up 5.8% to $28,359, while ether is up 3.4% to $1,793.

The CoinDesk Market Index is up 4.1% to 1,166.

“Bitcoin’s move above USD $28,000 also comes with the coin’s share in the aggregate crypto market cap topping 50% for the first time in two years. Unlike most other digital assets, bitcoin has not been implicated in any of the regulatory complexity, we’ve seen coming out of the U.S.,” Strahinja Savic, head of data and analytics at Toronto-based crypto platform FRNT Financial told CoinDesk in a note.

Savic says that BlackRock’s bitcoin ETF filing has really underscored that institutional interest in bitcoin remains steadfast, despite the sell-off and bankruptcies we’ve seen earlier this year and in late 2022.

Joe DiPasquale, CEO of crypto fund manager BitBull Capital, points to the bitcoin ETF filings as well as the launch of a new institutionally backed crypto exchange called EDX, as a bull case for crypto.

“It wouldn’t be surprising if Bitcoin continues to lead the market for now,” he said. “On the top side, $30k is the obvious resistance.”

Biggest Gainers

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| XRP | XRP | −0.3% | Currency |

Aave’s v3 TVL Rises in June

Smart contracts crypto lending platform Aave has continued its year-to-date momentum in June.

The version 3 (v3) blockchain’s total value locked (TVL) has surged 15% since the start of the month to $1.76 billion, data from blockchain analytics firm DefiLlama shows. Aave’s TVL has skyrocketed 300% since Jan. 1, widely outpacing other major cryptos over this period. Bitcoin and ether, the two largest digital assets by market capitalization, have risen about 70% and 50%, respectively, in 2023.

Aave’s gains offer the latest evidence of rising interest in DeFi protocols that eliminate the need for third-party institutions to help execute transactions. A banking crisis that led to the collapse of three major regional banks in March has meanwhile undermined confidence in traditional, financial services organizations that have been central to lending markets.

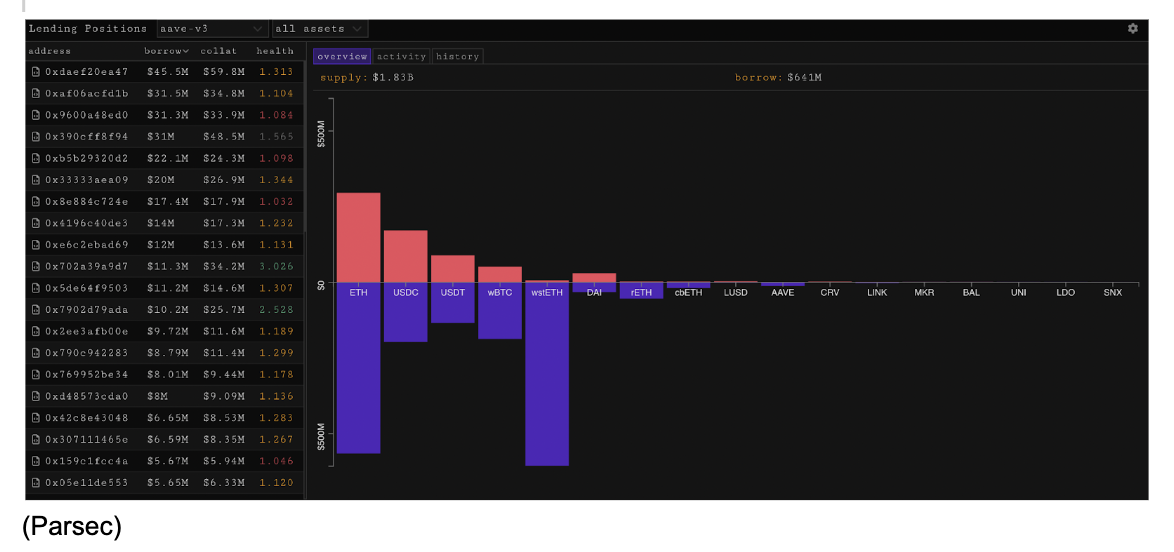

At presstime, Aave users have supplied $1.83 billion worth of assets and borrowed $641 million on Aave’s version three (v3), per on-chain markets terminal Parsec, highlighting the level of financial activity occurring within the protocol.

The five largest borrowers accounted for more than $227.2 million in assets loaned and roughly $181.4 million in loans, about 28% of total loans on Aave v3. Ether, stablecoins, wrapped bitcoin and liquid staking tokens compose the majority of crypto assets transacted on Aave, reflecting their popularity in the DeFi ecosystem.

6:45 a.m. HKT/SGT(22:45 UTC) Trade Balance NZD (YoY/May)

In case you missed it, here is the most recent episode of “First Mover” on CoinDesk TV:

Bitcoin (BTC) traded little changed on Tuesday as China’s first cut in benchmark lending rates in 10 months failed to lift the mood in traditional markets. Bannockburn Global Forex managing director and Chief Market Strategist Marc Chandler joined to discuss his crypto markets analysis. Plus, Ron Hammond from the Blockchain Association joined “First Mover” to discuss why the trade group had filed a Freedom of Information Act request with the SEC seeking records relevant to Prometheum, a crypto broker. And, Alchemy developer experience lead Elan Halpern shared how the blockchain developer platform aims to help Web3 developers access data faster and speed up product development.

Bitcoin’s Rally to $28K Causes the Largest Short Squeeze This Month: The price surge liquidated some $36.6 million of short positions in the past 24 hours, the most this month, CoinGlass data shows.

Polygon Proposes POS Chain To Become ZK Compatible: In a pre-proposal discussion post, Polygon co-founder Mihailo Bjelic argues why the mainchain should go through a major upgrade.

GBTC Share Price Soars, Discount Narrows to Multi-Month Low on BlackRock ETF Filing Optimism: Investors turned optimistic about Grayscale allowing redemptions in the future after BlackRock’s filing for spot bitcoin ETF last week, one analyst said.

Tokenization Could Be a $5T Opportunity Led by Stablecoins and CBDCs, Bernstein: About 2% of global money supply, via stablecoins and CBDCs, could be tokenized over the next five years, which is about $3 trillion, the report said.

Edited by James Rubin.