First Mover Asia: Bitcoin, Ether Prices Stuck in ‘Wind Tunnel’

:format(jpg)/www.coindesk.com/resizer/CabGUKozR1NyiBkjN56PYzuQ3RQ=/arc-photo-coindesk/arc2-prod/public/R5JVYM4XOFBPRLGHVGCYQXUAQM.png)

Glenn C Williams Jr, CMT is a Crypto Markets Analyst with an initial background in traditional finance. His experience includes research and analysis of individual cryptocurrencies, defi protocols, and crypto-based funds.

He owns BTC, ETH, UNI, DOT, MATIC, and AVAX

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/f22b7b33-3453-471b-9db5-9f17af90a499.png)

Bradley Keoun is the managing editor of CoinDesk’s Tech & Protocols team. He owns less than $1,000 each of several cryptocurrencies.

Good morning. Here’s what’s happening:

Prices: Bitcoin was stable around $27,300.

Insights: Funding rates on bitcoin and ether perpetual futures, often an indication of sentiment, remain positive.

Quiet market translates to less bullish energy

Crypto markets were quiet, and prices for both bitcoin (BTC) and ether (ETH) were trading below their 20-day moving average.

As CoinDesk markets analyst Glenn Williams Jr. wrote, trading volumes will be key to watch, since they could amplify or mute the sentiment behind any directional move.

According to Jeff Dorman, chief investment officer at the digital-asset manager Arca, so-called bid/ask spreads – the difference between the price a buyer is willing to pay and what a seller will accept – is wide, especially after some market makers quit crypto.

“The prices of most digital assets are stuck in a wind tunnel,” Dorman in a newsletter.

In traditional finance, stock-market action was muted as traders try to handicap the odds of whether U.S. lawmakers can agree on a plan to avoid a default by the federal government, with the Treasury’s borrowings moving closer to the official limit.

Biggest Gainers

Biggest Losers

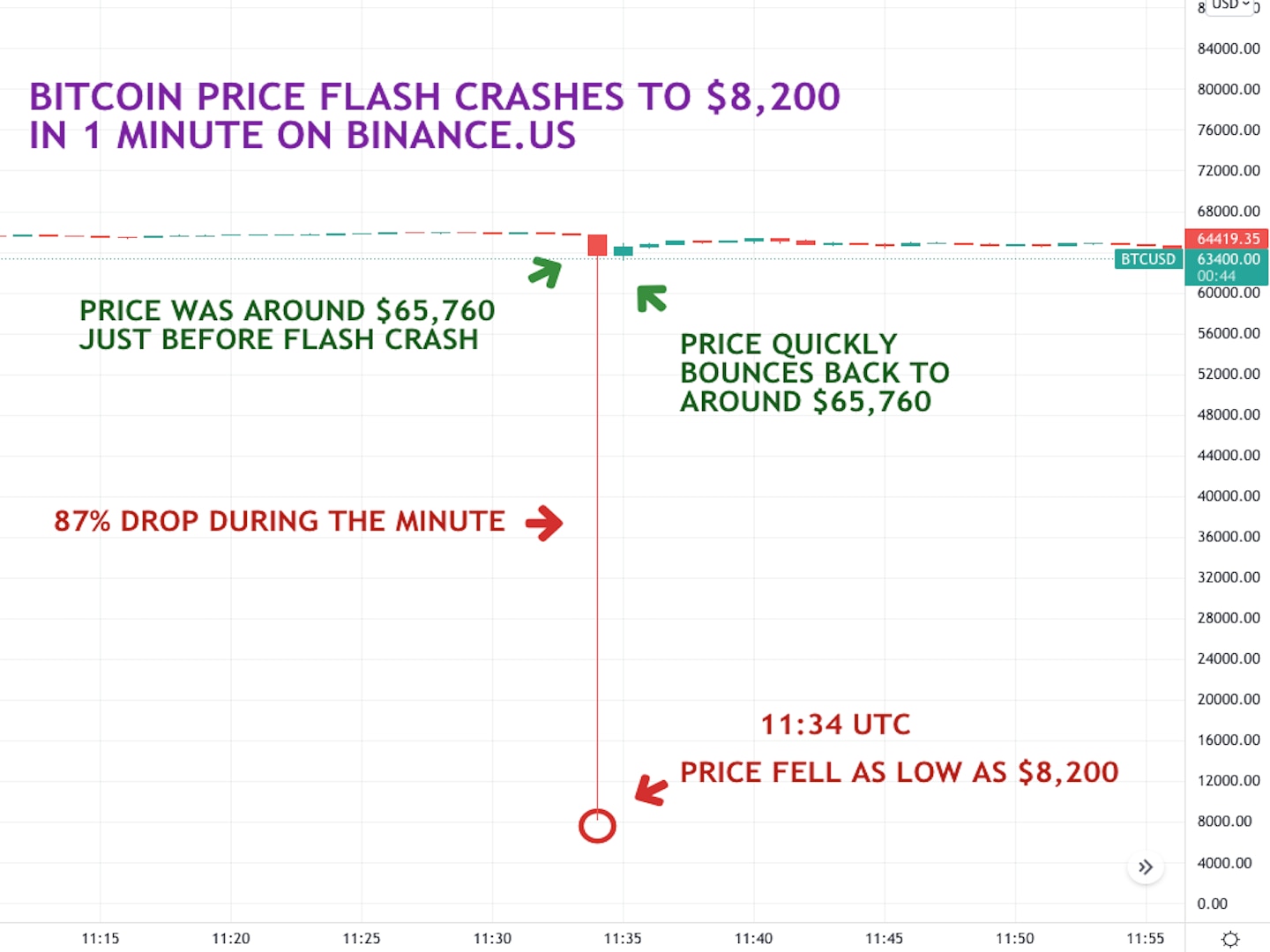

Funding rates remain positive in crypto markets

Perpetual futures funding rates remain positive for both bitcoin and ether, a sign that sentiment in the market remains positive for the moment.

Funding rates on bitcoin perpetual futures. (Glassnode)

Perpetual funding rates represent payments within the futures markets between participants who are long or short the asset. When funding rates are positive, holders of long positions pay a fee to holders of short positions. When funding rates are negative, the opposite is the case.

The interpretation is that funding rates can often indicate bullish or bearish sentiment, with the former represented by positive rates, and the latter represented by negative ones.

For bitcoin funding rates have been positive in 8 of the most recent 10 trading days. Ether by comparison has shown positive funding rates in 7 of the most recent days, declining to zero 3 times, but not falling below zero since April 6.

In case you missed it, here is the most recent episode of “First Mover” on CoinDesk TV:

Bitcoin (BTC) was trading over $27,000, recovering some lost ground after its plunge last week. This came as crypto exchange Binance announced that it would cease operations in Canada, citing the challenging regulatory environment. Dunleavy Investment Research crypto strategist Tom Dunleavy shared his markets analysis. Separately, EY Global blockchain leader Paul Brody discussed the professional services giant starting an Ethereum-based platform for enterprises to track their carbon emissions and carbon credit traceability. Christoph Jentzsch, corpus.ventures CEO and Slock.it founder, also joined the conversation.

Weekly DEX Volume on BNB Chain Hits Highest in a Year: Lower fees and Binance’s popularity are among the reasons noted by market analysts.

Polygon Co-Founder Launches Web3 Fellowship Program: Sandeep Nailwal will invest $500,000 of his personal capital on a new cohort each year.

South Korea Probes Crypto Exchanges Upbit, Bithumb on Ex-Lawmaker’s Transfers: Lawmaker Kim Nam-kuk resigned from the main opposition party after his crypto transfers incited controversy.

Bankrupt Crypto Lender Celsius Transfers $75M of Ether to Staking Service Figment: The maneuver represents one of the largest transfers of funds for Celsius Network since it filed for bankruptcy protection in July.

Edited by Bradley Keoun.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/CabGUKozR1NyiBkjN56PYzuQ3RQ=/arc-photo-coindesk/arc2-prod/public/R5JVYM4XOFBPRLGHVGCYQXUAQM.png)

Glenn C Williams Jr, CMT is a Crypto Markets Analyst with an initial background in traditional finance. His experience includes research and analysis of individual cryptocurrencies, defi protocols, and crypto-based funds.

He owns BTC, ETH, UNI, DOT, MATIC, and AVAX

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/f22b7b33-3453-471b-9db5-9f17af90a499.png)

Bradley Keoun is the managing editor of CoinDesk’s Tech & Protocols team. He owns less than $1,000 each of several cryptocurrencies.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/CabGUKozR1NyiBkjN56PYzuQ3RQ=/arc-photo-coindesk/arc2-prod/public/R5JVYM4XOFBPRLGHVGCYQXUAQM.png)

Glenn C Williams Jr, CMT is a Crypto Markets Analyst with an initial background in traditional finance. His experience includes research and analysis of individual cryptocurrencies, defi protocols, and crypto-based funds.

He owns BTC, ETH, UNI, DOT, MATIC, and AVAX

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/f22b7b33-3453-471b-9db5-9f17af90a499.png)

Bradley Keoun is the managing editor of CoinDesk’s Tech & Protocols team. He owns less than $1,000 each of several cryptocurrencies.