First Mover Asia: Bitcoin Climbs Back to $29.4K; Crypto’s Correlation With Tech May Return

Good morning. Here’s what’s happening:

Prices: As the trading week begins in Asia, Bitcoin and Ether are experiencing minor declines.

Insights: An exploit of stablecoin exchange Curve could threaten more than $100 million in crypto. PLUS: Russia’s share of bitcoin mining rose when China banned the industry; now mining is booming in Russia.

Bitcoin Hovers Above 29K as Curve Exploit Works Its Way Through Market

As Asia opens its trading week, bitcoin is up 0.3% to $29,415, and ether is down 0.6% to $1,869.

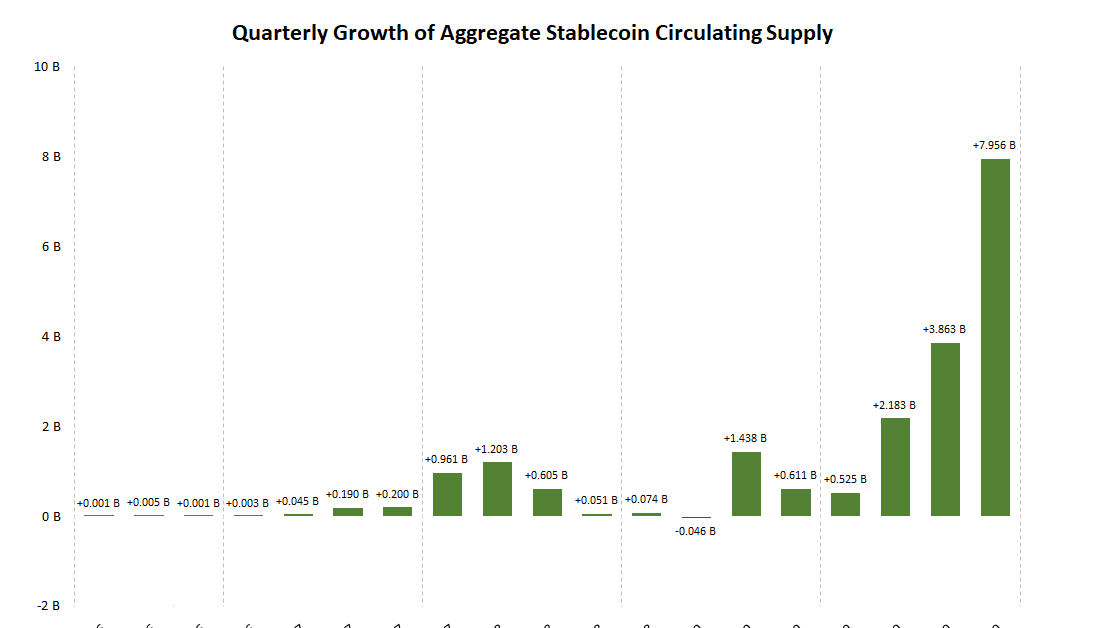

So far, the market seems to have digested an exploit in the Curve stablecoin exchange without further contagion. As CoinDesk previously reported, a “re-entrancy” bug in Vyper, the programming language used in parts of Curve, put over $100 million worth of cryptocurrency at risk. Blockchain auditing firm BlockSec preliminarily estimated the total losses to be above $42 million.

Elsewhere in the market, the Chia Network’s Gene Hoffman said in a recent interview with CoinDesk that despite a decoupling between stocks and tech stocks this year, Bitcoin and tech still have the potential for correlation due to ongoing mass adoption.

“The coin usually tends to trade as if it were a tech stock. The tech earnings around are mixed to positive,” he said. “There’s no real force to break things one side or the other.”

Hoffman also said he expects the market to move sideways in August due to the global vacation season but foresees a gentle move upward in all markets come September due to job support, an opening IPO market, and potential rate decreases after a final hike in the US.

Finally, last week, Markus Thielen, Matrixport’s head of research and strategy, said in an interview with CoinDesk that traders should switch from bitcoin to bullish call options due to low volatility, enabling them to lock in current gains while potentially benefiting from future upside rallies.

“This allows locking in the year-to-date gains for bitcoin, while the call option exposure allows participating in any upside rally,” Thielen said.

Biggest Gainers

Biggest Losers

Curve, a stablecoin exchange at the heart of decentralized finance (DeFi) on Ethereum, has been the victim of an exploit, according to a tweet from the project. Upwards of $100 million worth of cryptocurrency are at risk due to a “re-entrancy” bug in Vyper, a programming language used to power parts of the Curve system. Several stablecoin pools on the platform — used for pricing and liquidity on a number of different DeFi services — have been drained by hackers so far. Other projects that use the Vyper programming language could share the same vulnerability. As Asia opened its trading day, it was unclear how much had been drained from Curve as a result of the attack. BlockSec, a blockchain auditing firm, estimated the total losses above $42 million in a preliminary analysis posted to Twitter. Curve’s CRV token was recently trading at 62 cents, off more than 16% over the past 24 hours. It changed hands as low as 59 cents, a more than 19% decline late Sunday after the breach.

Russia’s Bitcoin Mining Boom

The bitcoin mining industry in Russia is booming, and hardware manufacturers Bitmain and MicroBT are positioning themselves to reap the benefits. More machines are flowing into Russia than anywhere else in the world, Ethan Vera, chief operating officer at global mining services firm Luxor Technologies, said at CoinDesk’s Consensus 2023 festival held last month in Austin, Texas. Russia has always been a powerhouse in Bitcoin hash rate – a measure of computational power being contributed to the blockchain – thanks to the availability of cheap energy and its cold climate. Russia’s share of world mining gained as China banned the industry in 2021, making it the second- or third-largest in the world, according to one of its biggest mining firms.

9 a.m. HKT/SGT(1 a.m. UTC): China Non-manufacturing PMI (June)

1 p.m. HKT/SGT(5 a.m. UTC): Japan construction orders (June/YoY)

1 p.m. HKT/SGT(5 a.m. UTC): Japan Consumer Confidence (July)

In case you missed it, here is the most recent episode of “First Mover” on CoinDesk TV:

Ripple VP of central bank engagements and CBDCs James Wallis explained why the country of Palau will be leveraging Ripple’s CBDC platform. Bitwise Asset Management president Teddy Fusaro shared his crypto markets analysis as the highly anticipated project co-founded by OpenAI’s Sam Altman launched its WLD token earlier this week. And, Eco App CEO Andy Bromberg discussed crypto wallet Beam going live.

Bitcoin Won’t Be Stuck Below $30K for Long, Crypto Options Traders Bet: BTC losing the significant price level after a month is likely just a short-term deviation based on derivatives trading data, SynFutures CEO said.

Sam Bankman-Fried Maybe Hasn’t Escaped Campaign Finance Charges: The Department of Justice pulled one charge, but it’s still pursuing seven for trial this October – and another trial on different charges next March.

Is the Worry Over Worldcoin Warranted?: No project since Facebook’s Libra has generated such hue and cry from within the crypto community. Is it right to be concerned by Sam Altman’s iris-scanning uber-ambitious UBI project?

Edited by James Rubin.