First Mover Asia: Bitcoin at $28.6K Remains Unstirred by Binance Temporary Withdrawal Pause

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/7c0b0bd4-6cb4-4d93-8bc4-1db61149c9d1.png)

Good morning. Here’s what’s happening:

Prices: Bitcoin and ether fell slightly on Sunday, although there’s potential for a market-wide rally and significant price movement, an analyst says. Meme coin mania has been fueling dramatic shifts in market sentiment.

Insights: Challenges from network congestion due to the Ordinals surge are offset by increased mining incentives, network security and available Layer-2 and sidechain solutions.

Bitcoin Has a Boring Weekend, Despite Binance’s Temporary Withdrawal Pause

Good morning Asia. As the East begins its trading week, bitcoin and ether were both recently down a few fractions of a percentage point. Bitcoin was off 0.34% to $28,787, while Ether fell 0.4% to $1,913.

BitBull Capital CEO Joe DiPasquale points to meme coins as a reason for a pump in market sentiment but fairly flat activity for the crypto majors.

“The market hasn’t moved strongly this week, but the market sentiment has been on a rollercoaster with meme coin mania at peak,” DiPasquale wrote to CoinDesk in a note. “With PEPE and other meme coins posting high five-figure percentage gains, we wouldn’t be surprised if a market-wide rally materializes in the near term.”

DiPasquale notes that bitcoin still hasn’t tested support levels on the downside, and that Bollinger Bands continue to tighten. This means that the gap between the upper and lower bands is narrowing, indicating a decrease in market volatility. This typically suggests that a significant price movement might be on the horizon, as periods of low volatility often precede larger market trends.

“Moving forward, we’d expect a strong bounce off $25K to continue another leg above $30K,” DiPasquale concluded.

Biggest Gainers

Biggest Losers

Bitcoin Maximalists Find Ordinals Annoying, but They Are a Much-Needed Revenue Source for Miners

The Bitcoin community is at a crossroads right now.

On the one hand, some of the largest miners are either working through bankruptcy proceedings, getting bailouts, or are restructuring debt – all of this a hangover from a brutal, bearish 2022. At the same time, many in the bitcoin community are decrying the congested, expensive state of the bitcoin network caused by the surge in the popularity of the NFT-like Ordinal inscriptions. Binance’s temporary pause of bitcoin withdrawals on Sunday was proof that there’s a problem brewing.

For the uninitiated, Ordinal Inscriptions, akin to NFTs, are digital assets inscribed on satoshis (the smallest currency unit of bitcoin) enabled by the Taproot upgrade, allowing for smart contracts and the minting of NFTs directly onto the Bitcoin blockchain.

The scale of ordinals’ growth has been immense (though many of them are just text). Earlier this month, the number of ordinals surpassed three million, and now that number is just over four million.

In the long run, however, cash-strapped miners are going to be a big beneficiary of this newfound interest in the bitcoin blockchain.

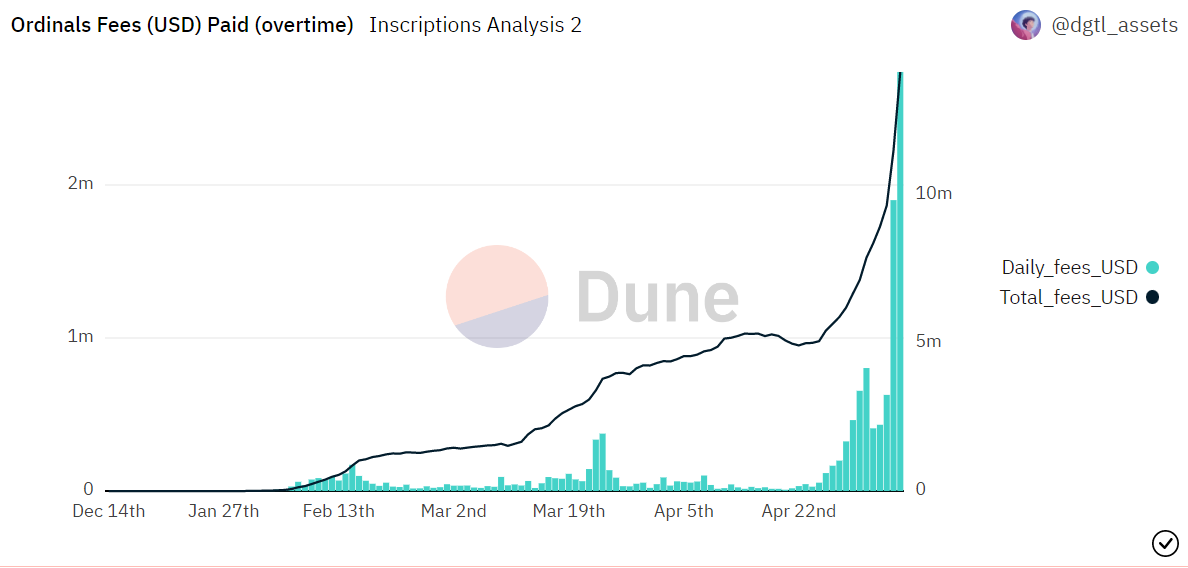

According to data compiled by the user dgtl_assets on Dune, ordinal inscriptions are now producing daily fees just north of $2.7 million, with the total fees coming in at around $14 million.

In an April note, Grayscale argued that the surge in fees from ordinals is useful for incentivizing mining and thus, securing the network.

“While some are critical of ordinals, cautioning against bloating the blockchain or harming fungibility, we believe that ordinals represent one of the larger opportunities for Bitcoin adoption, especially as the Bitcoin network has historically been viewed as a rigid blockchain ecosystem,” Grayscale wrote. “The advent of ordinals has led to an increase in total fees paid to miners, could potentially establish a sustainable baseline level of transaction fees to incentivize miners.”

Grayscale and CoinDesk share the same parent company in Digital Currency Group.

When balancing network security versus a new channel of mining incentives versus the annoyance of congestion, which one wins? Probably the new incentives channel.

Realistically, this could do a lot to help plug holes in miners’ balance sheets. Sure, bailouts could also be a solution, but that would centralize mining around stakeholders like Binance and Galaxy Digital.

And for those complaining, there are plenty of solutions readily available, like Layer-2s or sidechains such as the Lightning Network or Liquid.

Bitcoiners should celebrate ordinals and be glad that the market is signaling they are here to stay.

7:00 a.m. HKT/SGT(23:00 UTC) China Trade Balance

In case you missed it, here is the most recent episode of “First Mover” on CoinDesk TV:

The U.S. added 253,000 jobs in April, up from a downwardly revised 165,000 in March and ahead of economist forecasts for 180,000, according to a Bureau of Labor Statistics report. Separately, CoinDesk’s executive director of global content, Emily Parker, explained why central bank digital currencies could become a topic in the U.S. presidential election. Mysten Labs CEO Evan Cheng and Chase White from Compass Point Research also joined the conversation.

Pepecoin’s Bewildering Rise Turned a Pittance Into an Almost 5,000,000% Meme Coin Profit: A pseudonymous crypto trader bought trillions of the meme coin three weeks ago on UniSwap for $263, and still holds about $9 million of PEPE after selling several million dollars worth, according to data from blockchain platform Arkham.

Pump the BRCs: The Promise and Peril of Bitcoin-backed Tokens: A new way of issuing tokens on Bitcoin is growing fast. So why did their creator warn that they “will be worthless?”

Alibaba Says ‘Open Sesame’ to Web3: The Chinese tech giant is releasing a metaverse launchpad. Plus, Sports Illustrated announces an NFT ticketing platform.

Coinbase Jumps 17% Post-Earnings; Analysts Praise Results but Worry About Regulatory Uncertainty: The crypto exchange’s first quarter revenue of $773 million was up 23% from the previous three months and blew past estimates for just $655 million.

NFT Lending Platform Blend Sparks Concerns Over Ecosystem Liquidity: Blend, the name of NFT marketplace Blur’s new lending platform, allows traders to lease NFTs to bolster liquidity. However, concerns have been raised about its impact on broader NFT markets.

Edited by James Rubin.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/7c0b0bd4-6cb4-4d93-8bc4-1db61149c9d1.png)

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/7c0b0bd4-6cb4-4d93-8bc4-1db61149c9d1.png)