First Mover: As Wall Street Goes Topsy-Turvy, Crypto Traders Are Bullish as Ever

Illustration from “The World Turned Upside Down.” (Alamy/Photomosh)

First Mover: As Wall Street Goes Topsy-Turvy, Crypto Traders Are Bullish as Ever

As the coronavirus takes its devastating toll on the U.S. economy, financial pros are increasingly confounded by the markets.

The economy is in its worst shape since the early 20th century, and stocks are soaring. The U.S. government’s borrowing is expected to triple to a record $4.5 trillionthis fiscal year, yet 10-year Treasury yields are close to historic lows.

You’re reading First Mover, CoinDesk’s daily markets newsletter. Assembled by the CoinDesk Markets Team, First Mover starts your day with the most up-to-date sentiment around crypto markets, which of course never close, putting in context every wild swing in bitcoin and more. We follow the money so you don’t have to. You can subscribe here.

A report Thursday showed that U.S. jobless claims fell to 963,000 last week, the first weekly figure below 1 million since March. But in the topsy-turvy logic of financial markets, the improvement was seen as neutral or even negative – since it might relieve pressure on authorities to speed up more trillion-dollar stimulus packages.

“The good news may be bad news now,” Chris Gaffney, president of world markets at TIAA Bank, told Bloomberg News.

Bank of America analyst Athanasios Vamvakidis acknowledged last week in a report that it was hard to tell if the dollar’s recent slide in foreign-exchange markets was due to ebullience over easy Federal Reserve monetary policies – or fears that the U.S. currency might be at risk of losing its status as the dominant world currency.

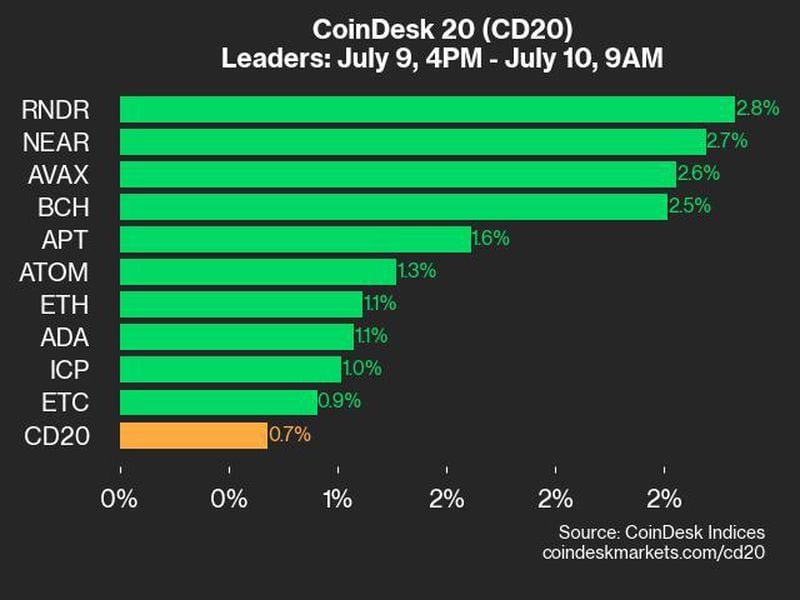

What’s striking is that, through it all, crypto traders have stayed almost unequivocally bullish.

Bitcoin is up 64% in 2020, more than double the gains for record-breaking gold. Prices for ether, the native token of the Ethereum blockchain, have tripled this year, thanks to the fast growth in decentralized finance, known as DeFi, and in digital “stablecoins” linked to U.S. dollars.

John Todaro, director of research at cryptocurrency analysis firm TradeBlock, noted in an email Thursday that the market value of 10 digital tokens associated with DeFi has quintupled this year to almost $10 billion.

Lennard Neo, head of research at Stack Funds, wrote Thursday in a report that bitcoin might do well in any of the currently plausible market scenarios: “Bitcoin could be a ‘risk-on hedging-type asset,’ where it performs relatively well in thriving markets, yet acting as a hedge to global uncertainties, displaying financial attributes that fall in between that of equity and gold.”

Mentions are becoming more common in mainstream financial publications. The Financial Times reported Thursday that crypto hedge-fund managers have returned more than 50% through July, compared with the low-single-digit gains that hedge funds generated across traditional asset classes.

Barstool Sports president Dave Portnoy, who has gained a following this year for live-streaming profanity-laced trading sessions to millions of retail day traders, reportedly owns $1 million of bitcoin after meeting with the Winklevoss twins, founders of the Gemini cryptocurrency exchange.

It’s all become so bizarre that some cryptocurrency analysts acknowledge even they can’t really make heads or tails of the markets these days.

“Ultimately, when it comes to investing in this environment, the risk factor is through the roof,” Mati Greenspan, founder of the cryptocurrency research firm Quantum Economics, told subscribers Thursday. “All risk metrics and meters have long been broken, so we really need to approach all investments with extreme caution right now.”

That’s probably the safest interpretation.

Bitcoin Watch

Bitcoin printed gains for the second straight day on Thursday, despite risk aversion in the stock markets. Even so, the immediate bias remains neutral, with the cryptocurrency still trapped in an ascending triangle (above left).

The current consolidation could end with a bullish breakout above $12,000, as ether, the second-largest cryptocurrency, has jumped to fresh multi-month highs, confirming a bull flag breakout, or a bullish continuation pattern on its daily chart. That could be taken as a positive signal for bitcoin, as ether has recently led the market higher with its DeFi-led price rally.

Supporting the case for the bullish breakout in bitcoin is the recent surge in institutional participation. Open interest in futures listed on the Chicago Mercantile Exchange (CME) rose to a record high of $841 million earlier this week and is up by over 100% over the last four weeks, according to data source Skew.

A triangle breakout, if confirmed, would shift the focus to resistance at $12,325 (August 2019 high). The short-term outlook would turn bearish if buyers fail to defend the lower end of the triangle, currently at $11,280. That could encourage selling and lead to a deeper decline toward the Aug. 2 low of $10,659.

Token Watch

XRP (XRP) – One of the largest cryptocurrency projects by market value is “still trying to find compelling uses” eight years after its launch, according to the Financial Times. Ripple CEO Brad Garlinghouse said it may take “years” to develop “a lot of utility through XRP.” Michael Arrington, a crypto hedge-fund manager, told the FT that Ripple’s efforts to work with banks is “like Uber trying to disrupt the taxi industry by working with the taxis.” The XRP token is underperforming this year, up 45% versus bitcoin’s gain of 59%.

Band Protocol (BAND) – The much-awaited “oracle” token started trading Thursday on the big U.S. cryptocurrency exchange Coinbase, according to CoinDesk’s Danny Nelson. The token’s price has surged more than 10-fold since the start of May, according to CoinGecko. Oracles provide price feeds for semi-automated DeFi lending and trading platforms. As previously reported by First Mover, the Band Protocol is being watched closely by cryptocurrency traders and analysts as a potential rival to Chainlink, whose LINK token has also jumped 10-fold in price this year, and is most valuable among digital assets with a market cap of at least $1 billion.

Yam (YAM) – The DeFi protocol was “a Frankenstein of other DeFi protocols,” according to the data firm Messari. It was a “blaze of social media-hosted meme-economy glory,” wrote Mati Greenspan of Quantum Economics. The Defiant, a newsletter, dubbed it the “YAMpocalypse.” Here’s what happened with Yam this week, according to CoinDesk’s Will Foxley and Paddy Baker: The project launched Tuesday, and the next day prices for the token shot up to $160. Early Thursday, a critical bug was discovered that effectively killed it, and the market value tumbled by $60 million in 35 minutes. “The longer it takes you to do due diligence in this cycle, the lower your alpha,” Amentum Capital co-founder Steven McKie told CoinDesk.

Tweet of the Day

What’s Hot

How DeFi ‘Degens’ Are Gaming Ethereum’s Money Legos (CoinDesk)

First there were Tendies and YFI. Then came (and went) YAM. And, as of yesterday, we have Based Money. Meet the new decentralized finance, in what amounts to a crossover between massive multiplayer online games and crypto pump-and-dump schemes.

The Federal Reserve Is Experimenting With a Digital Dollar (CoinDesk)

The U.S. Federal Reserve is actively investigating distributed ledger technologies in collaborating with researchers at MIT, pondering how they might be used for digitizing the dollar.

China to Launch Major Expansion of Digital Currency Trials (CoinDesk)

China is planning a major expansion of testing for the central bank-led digital yuan across a number of cities and regions including Hong Kong.

US Prosecutors Seize Bitcoin Allegedly Tied to Al Qaeda, ISIS, Hamas (CoinDesk)

The U.S. Department of Justice announced the “largest ever seizure of terrorist organizations’ cryptocurrency accounts” on Thursday, including millions of dollars and 300 crypto accounts.

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.