First Mover: As US Stocks Defy Economic Gravity, Bitcoiners Shudder at March Memory

Defying gravity (lucas_moore/Shutterstock)

First Mover: As US Stocks Defy Economic Gravity, Bitcoiners Shudder at March Memory

Crypto traders are homing in on a pattern that’s becoming weirdly familiar: Stocks fall, bitcoin falls; the Federal Reserve makes a new stimulus announcement, stocks rise, bitcoin rises.

No one knows exactly how a second wave of coronavirus infections might affect traditional or digital-asset markets. Some analysts argue that better preparation and existing restrictions mean the effects could be more muted. In order to minimize disruption, governments might move quickly to isolate outbreaks, rather than resorting to further large-scale lockdowns.

You’re reading First Mover, CoinDesk’s daily markets newsletter. Assembled by the CoinDesk Markets Team, First Mover starts your day with the most up-to-date sentiment around crypto markets, which of course never close, putting in context every wild swing in bitcoin and more. We follow the money so you don’t have to. You can subscribe here.

But the action in markets last week might have provided glimpse of how things would play out in the event that the contagion came back – or even if doubts emerged about the prospects for an economic recovery.

Stocks and bitcoin tumbled last week amid concerns that cases were rising, and as the Federal Reserve warned that a full economic recovery wasn’t likely for at least three years.

Markets recovered quickly, partly due to an announcement of fresh stimulus from the Federal Reserve. But cryptocurrency analysts say the episode shows that bitcoin might tumble anew if traditional markets swoon again.

“Should a second wave hit this year, bitcoin will likely continue moving in correlation with the overall market,” Jonathan Leong, CEO of BTSE exchange, said in comments to First Mover.

Cases are rising around the globe as the coronavirus spreads through the herd of humanity.

After more than 50 days without a reported case, health authorities in Beijing reported 36 new cases on Saturday, believed to have been carried in on imported salmon sold at a local market. City officials shut down surrounding neighborhoods, and major supermarkets pulled salmon from shelves.

Daily records of new cases have also cropped up some U.S. states that have started reopening, including Florida, Texas and Arizona.

In France, where President Emmanuel Macron declared a “first victory” against the illness and reopened cafes and restaurants, he has warned that the pandemic could easily return.

The risk has spurred some cryptocurrency analysts to start asking how bitcoin might perform if conditions took a turn for the worse.

The memories are still fresh of the sell-off on March 12, now known as “Black Thursday,” when the Standard & Poor’s 500 Index of large U.S. stocks tumbled almost 10%, and bitcoin fell 39%.

Rapid pledges of trillions of dollars of liquidity injections by central banks helped to put a floor under markets. By mid-May, central banks and governments had injected roughly $15 trillion into the global economy. Both bitcoin and U.S. stocks recovered.

Over the past week, the pattern returned. From last Thursday through Monday, the S&P 500 fell by nearly 7%, and bitcoin tumbled too.

The markets rebounded after the Federal Reserve Monday announced it would start buying individual corporate bonds as part of an expanded program that might eventually reach $750 billion of total assets. The Bank of Japan (BoJ) also announced it was ready to pump an additional trillion dollars-worth of yen into local companies.

“The latest demonstration of seemingly unlimited central bank support drowned out the worrying news,” Michael Mackenzie wrote in his Market Forces newsletter for the Financial Times.

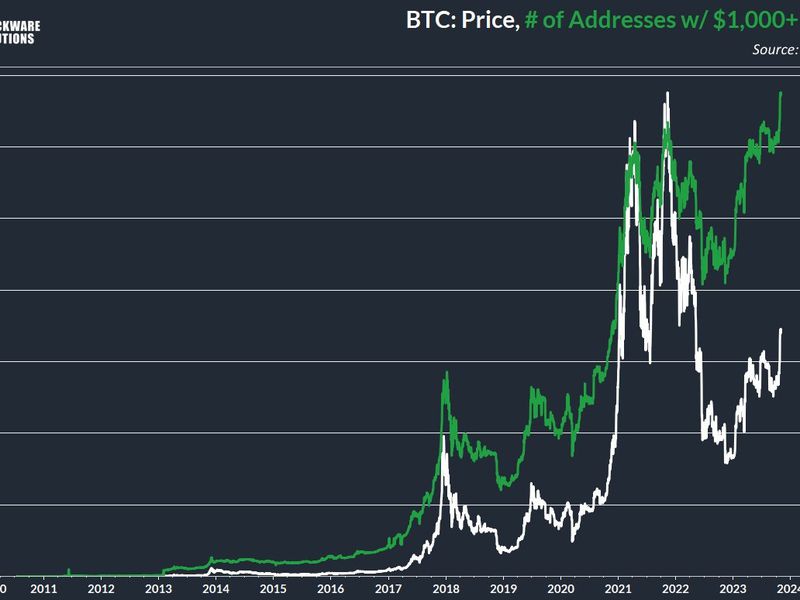

For the past several months, bitcoin and U.S. stocks have shown a weak but persistent correlation.

Mati Greenspan, founder of the foreign-exchange and cryptocurrency research firm Quantitative Economics, wrote Tuesday in an email to subscribers that the question of whether bitcoin will crash with stocks “keeps coming up lately.”

“The clearer it gets that we may be in for further pain in the stock markets, the more people want to know if bitcoin will again participate in a multi-asset sell-off,” he wrote.

Investors are likely to be “a lot more prepared” for a second crash, he said, and there’s a possibility that a “bout of extreme volatility could break the correlation” between bitcoin and stocks.

“Of course, it’s only a theory,” Greenspan said.

Tweet of the day

Bitcoin watch

BTC: Price: $9,434 (BPI) | 24-Hr High: $9,557 | 24-Hr Low: $9,240

Trend: Bitcoin continues to defend key support and may challenge the $10,000 market in the short-term.

The leading cryptocurrency by market value is currently trading near $9,440, having defended the ascending (bullish) 50-day moving average (MA) support at $9,375 early on Thursday.

Sellers have repeatedly failed to establish a strong foothold below the 50-day SMA in the last week. So far bitcoin has not been able to capitalize on the dip demand, or seller exhaustion, seen below the average support.

The range play, however, could soon end with a breakout on the higher side, according to bullish developments on the three-day chart.

To start with, the 50- and 100-candle MAs have produced a bull cross for the first time June 2016. Back then, the confirmation of the bullish crossover had accelerated the preceding uptrend. Similarly, bitcoin broke into a bull market in the October 2015 following a bull cross of the same two averages.

In addition, the cryptocurrency created a classic long-tailed bullish hammer candle in the three-days to June 17, marking a strong dip demand near support at $8,876. That level marks the 23.6% Fibonacci retracement of the rally from $3,867 to $10,429.

With the three-day chart reporting bullish patterns, technical traders may enter the market, lifting prices higher. The immediate resistance is seen at $9,566, followed by $10,000. On the downside, the Fibonacci support at $8,876 is the level to beat for the sellers.

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.