First Mover Americas: Worldcoin, The Graph and Filecoin Finish the Week on Top

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/33C5HVRVBFFZVKYJNZRHK44CFE.png)

Top Stories

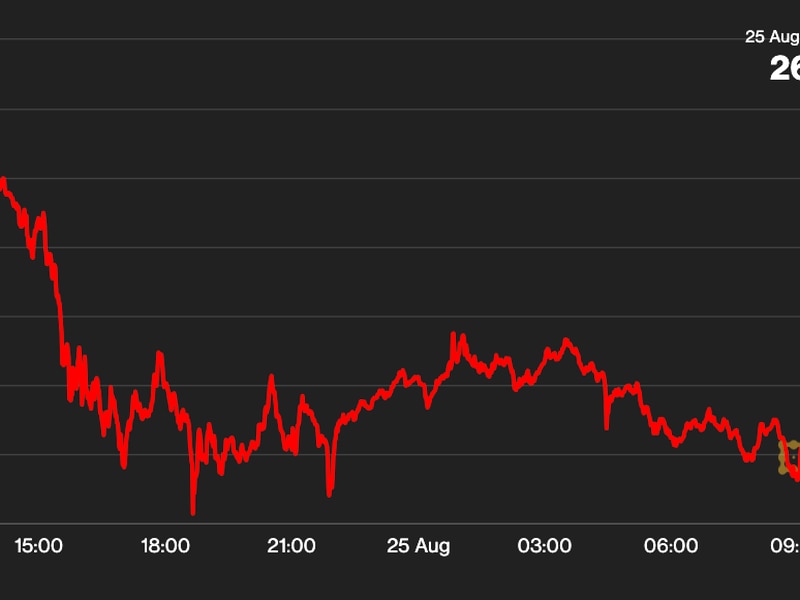

Artificial Intelligence (AI)-related altcoins finished the week on top: SingularityNET (AGIX) surged 97% and Worldcoin’s WLD gained 93% to a record of $9.03. Filecoin’s FIL token and the Graph’s GRT also performed well, rallying more than 40% over the past seven days. The gains lifted the CoinDesk Computing Index 11% while the broader market gauge CD20 dropped some 2%. AI cryptocurrencies initially jumped in price Wednesday after chipmaker Nvidia (NVDA) beat fourth-quarter earnings and first-quarter guidance expectations, and the move has gained strength since. Bitcoin (BTC), the world’s biggest cryptocurrency by market value, has been trading between $50,500 and $52,500 and is down 2% on the week.

Reddit said it invested part of its excess cash in bitcoin (BTC) and ether (ETH), making the firm one of the few companies that directly purchased digital assets, alongside the likes of Michael Saylor’s MicroStrategy and Elon Musk’s Tesla. The social-media platform disclosed the investments in the two largest cryptocurrencies when it filed with the U.S. Securities and Exchange Commission (SEC) to go public on the New York Stock Exchange under the ticker symbol “RDDT.” It also said that it acquired ether and Polygon (MATIC) “as a form of payment for sales of certain virtual goods.” Reddit said it may continue this strategy in the future.

Fintech company Block posted a remeasurement gain of $207 million on its bitcoin (BTC) holdings in its fourth-quarter earnings report released Thursday. As of Dec. 31, 2023, Block held approximately 8,038 BTC for investment purposes with a fair value of $340 million. The Jack Dorsey-led company made $66 million in gross profit on bitcoin sales last quarter through Cash App, a banking services platform, a 90% increase year over year. “The total sale amount of bitcoin sold to customers—which we recognize as bitcoin revenue—was $2.52 billion, up 37% year over year,” the report said.

Chart of the Day

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/TFMWXYPWABESRMYUXUI64U7X7Y.png)

-

The ether-bitcoin (ETH/BTC) ratio is rising and looks set to break out of a 17-month-long downtrend.

-

A potential breakout would mean ether outperformance ahead.

-

Source: TradingView.

Trending Posts

Edited by Sheldon Reback.