First Mover Americas: VC Giant Andreessen Horowitz Looks to U.K. For Expansion

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Venture capital giant Andreessen Horowitz (a16z) chose London as the site for its first office outside the U.S., saying the U.K. government is willing to create policies that encourage startups to pursue decentralization. Menlo Park, California-based a16z said it plans to use the office – which will open later this year and be led by Sriram Krishnan – to invest in the crypto and startup ecosystem in the U.K. and Europe. The firm cited a number of recent investments in U.K.-based companies, among them a new $43 million Series A funding round into blockchain-based computing resources for artificial intelligence platforms (AI) provider Gensyn.

Open interest tied to Binance’s BNB token continues to rise, according to data tracked by Coinglass. Total open interest – the number of unsettled and active futures contracts – rose to 1.57 million BNB ($360 million at current prices) on Monday, the highest since Jan. 1. The tally has increased by over 8% in the past 24 hours and nearly 27% in the days since the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Binance on June 5. Alongside, BNB’s going market rate has tumbled from about $300 to the current $234, its weakest level since mid-December, per CoinDesk data. The common thought among traders is that an increase in open interest alongside a price decline suggests an influx of short positions or bearish bets and thus possibly confirmation of a downtrend.

A key metric tracking crypto market liquidity tanked sharply over the weekend, leaving paper-thin order books that could amplify price swings. Crypto research firm Hyblock Capital’s global bid and ask indicator – which aggregates the dollar amount of resting bid and ask orders for more than 1,100 coins listed worldwide – fell by 20% across spot markets on Saturday. The sharp decline happened as alternative cryptocurrencies like SOL, MATIC, DOGE and others tumbled amid rumors of a fund liquidating its coin holdings. According to crypto hedge fund Assymetric’s CIO Joe McCann, some market makers likely pulled out from the market during the altcoin plunge, causing a sharp fall in the amount of resting bid and ask orders.

-

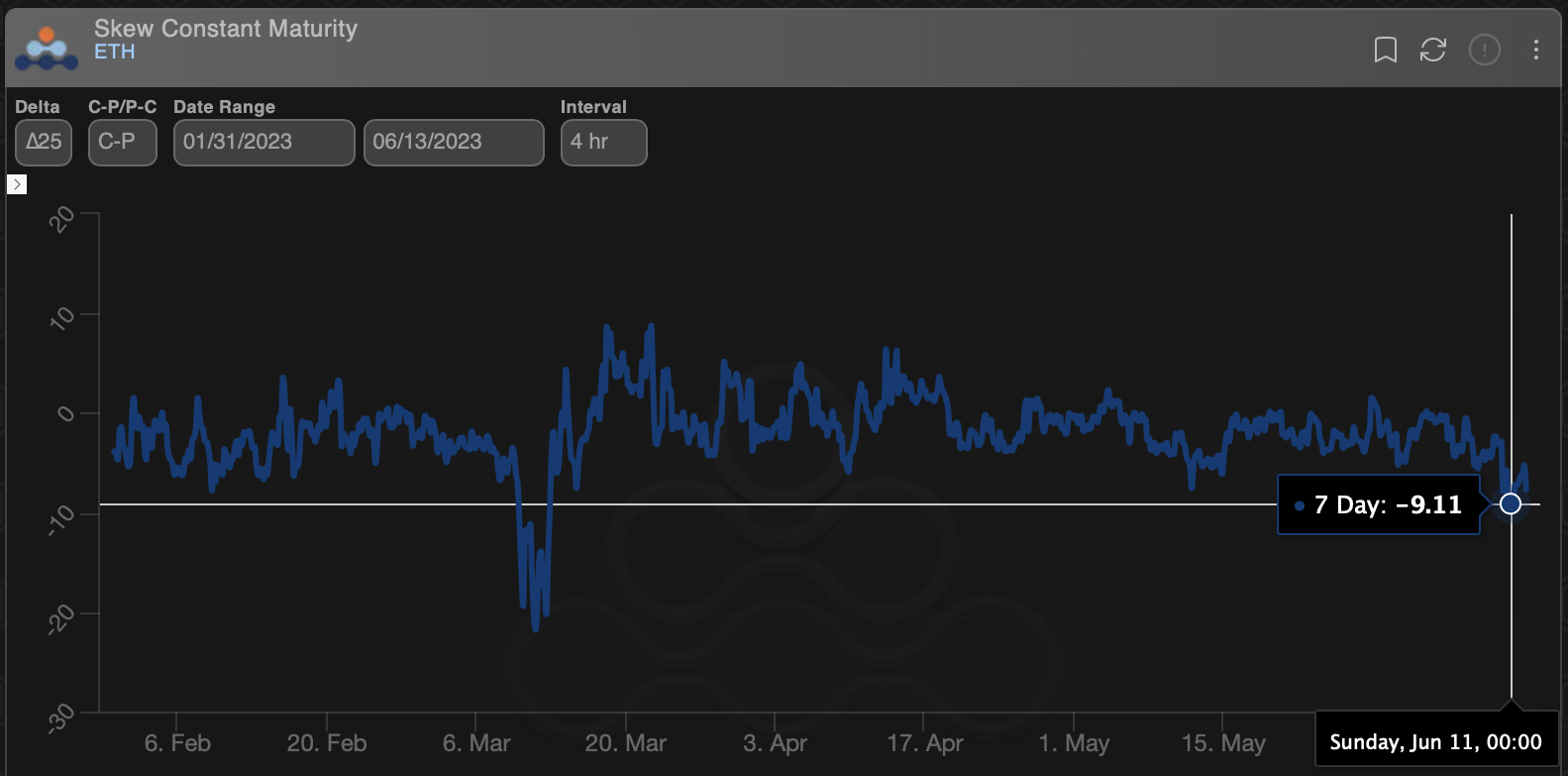

The chart shows seven-day ETH call-put skew, which measures the difference between prices for bullish call options and bearish put options tied to Ethereum’s native token.

-

The seven-day skew slipped to -9% over the weekend, signaling the strongest bias for puts since mid-March.

Edited by Stephen Alpher.