First Mover Americas: Upbit Moves Up to No. 2 in Spot Trading Volume

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

South Korea’s Upbit surpassed centralized exchanges Coinbase (COIN) and OKX in spot trading volume for the first time in July, according to a report from CCData, making it the world’s second-largest crypto exchange after Binance. Coinbase’s volume dropped by 11.6% to $28.6 billion in July, and OKX’s fell 5.8% to $29 billion. Upbit bucked the general market trend, with a 42.3% increase to $29.8 billion. The Korean market is being driven by demand for cryptocurrencies from retail investors.

Coinbase, the biggest publicly traded U.S. crypto exchange, announced that Base, its layer-2 blockchain built with Optimism’s OP Stack, will open to the public next Wednesday. Base went live for developers in July so that they could test applications on the network. Users are now able to transfer their ether to Base, Coinbase wrote in a blog post. The Base announcement came ahead of Coinbase releasing its second-quarter results. Its revenue topped analysts’ expectations, and its loss was narrower than expected.

ProShares and Bitwise have filed applications with the U.S. Securities and Exchange Commission for an exchange-traded fund focused on bitcoin and ether. According to ProShares’ filing, the Bitcoin and Ether Equal Weight ETF will measure “the performance of holding long positions in the nearest maturing monthly bitcoin and ether futures contracts.” Bitwise, meanwhile, filed for a Bitcoin and Ether Market Weight ETF. In recent months, excitement has mounted over the possibility that a spot bitcoin ETF could soon be approved.

-

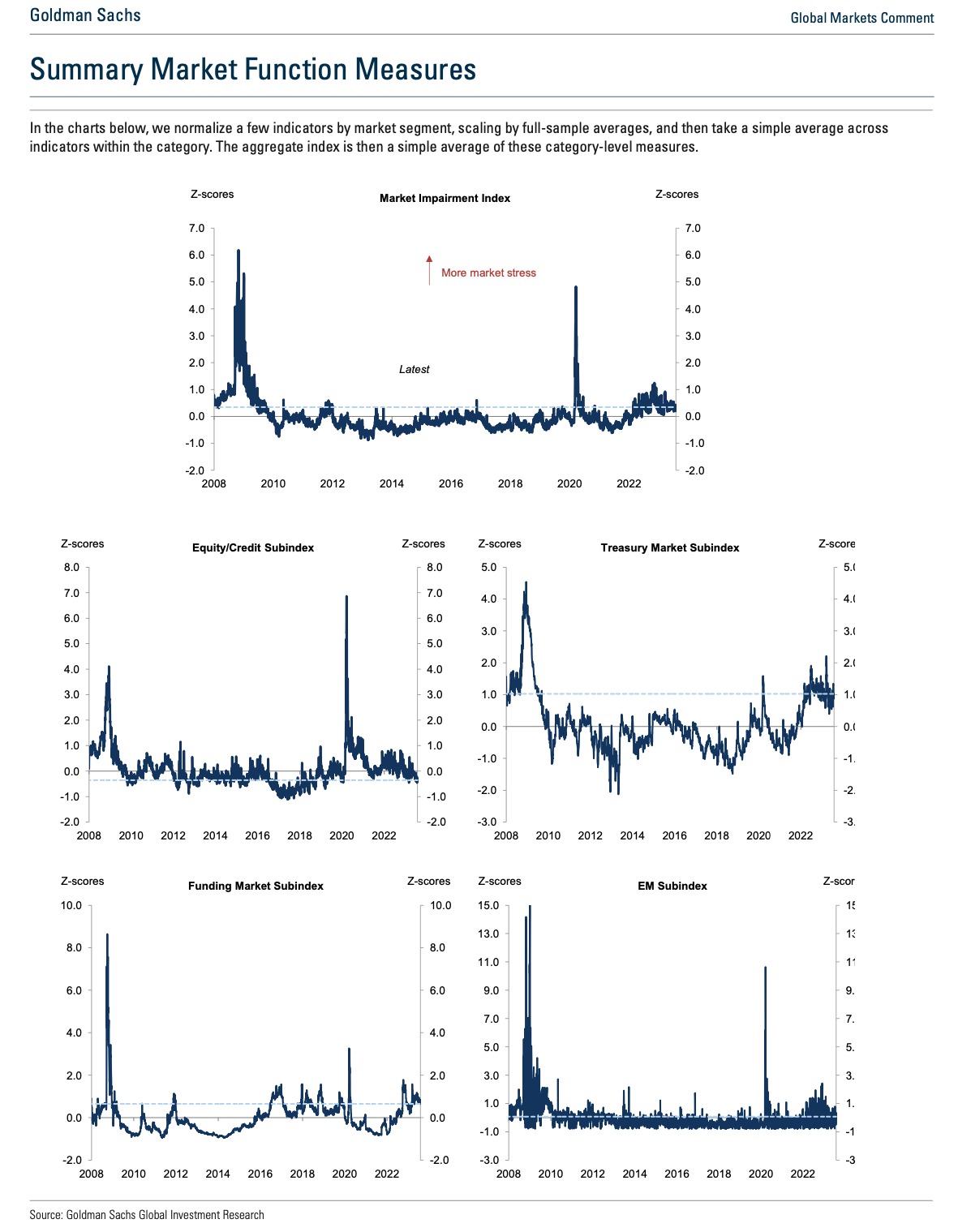

Goldman Sachs’ indicators that measure stress across traditional markets suggest no signs of panic even as Treasury yields surge.

-

“Market functioning in both equity and credit markets has been well-behaved, as has been the case for emerging markets,” Goldman’s economic research team said in a note to clients on Wednesday.

-

Stable market stress indicators mean a low probability of panic sell-off in risky assets, including cryptocurrencies.

Edited by Mark Nacinovich.