First Mover Americas: Trading Giants Like Jane Street Might Support Blackrock’s BTC ETF

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/J57GNFZ7MZB3TC3W3GC5VEZAZU.png)

Top Stories

Some of the world’s largest market-making firms are in the mix to potentially provide liquidity for BlackRock’s eagerly awaited bitcoin ETF if regulators approve the product, according to a person with knowledge of the matter. Trading giants Jane Street, Virtu Financial, Jump Trading and Hudson River Trading have held talks with BlackRock about a market-making role, according to a BlackRock slide deck reviewed by the person. BlackRock, Jane Street, Virtu and Jump declined to comment. Hudson River Trading, also known as HRT, didn’t respond to a request for comment.

The Commodity Futures Trading Commission (CFTC), which regulates derivatives markets in the U.S., has paid out $16 million to whistleblowers this year, and most of the 1,530 tips involved crypto, Commissioner Christy Goldsmith Romero said on Tuesday. “The majority of the tips received this year involved crypto – an area that continues to have pervasive fraud and other illegality,” Romero said in a statement published on the CFTC website. “With the rise of crypto, more retail customers have come under the CFTC’s jurisdiction, making even more critical the efforts of the CFTC’s Whistleblower Program and the Office of Customer Education and Outreach.”

Etherfuse, a platform attempting to improve decentralized blockchain infrastructure, unveiled “Stablebond” at Solana’s breakpoint conference in Amsterdam, a tokenized bond offering, to retail investors in Mexico. The firm is targeting Mexico because it is the second-largest bond market in Latin America, after Brazil, according to the company’s research. The market is also one of the most liquid in Latin America, with $623 billion in outstanding debt and an average daily trading volume of $200 million, the research added. The majority of trading volume in Mexico comes from institutions, governments and foreign investors, according to a press release from Etherfuse, meaning there’s a lack of retail investors or individuals investing in bonds.

Chart of the Day

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/7WJZJPF3PVCL5L6ZCJYVAE7TRA.png)

-

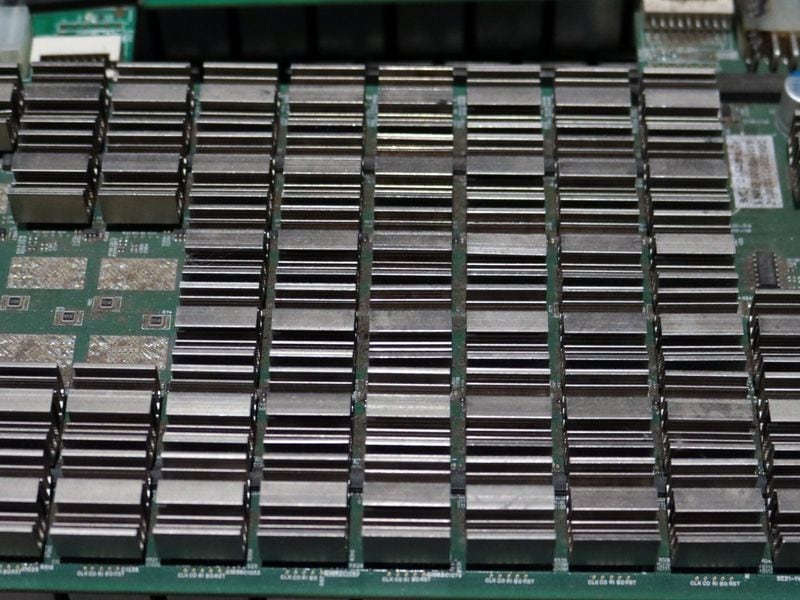

The Bitcoin blockchain settled more than 40 million transactions in the July quarter, the highest on record.

-

Increased network usage may bode well for bitcoin’s price ahead, according to Hashdex.

-

Source: Hashdex Research

Trending Posts

Edited by Sheldon Reback.