First Mover Americas: Race for Ether ETFs Kicks Off With 6 Asset Managers Filing

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

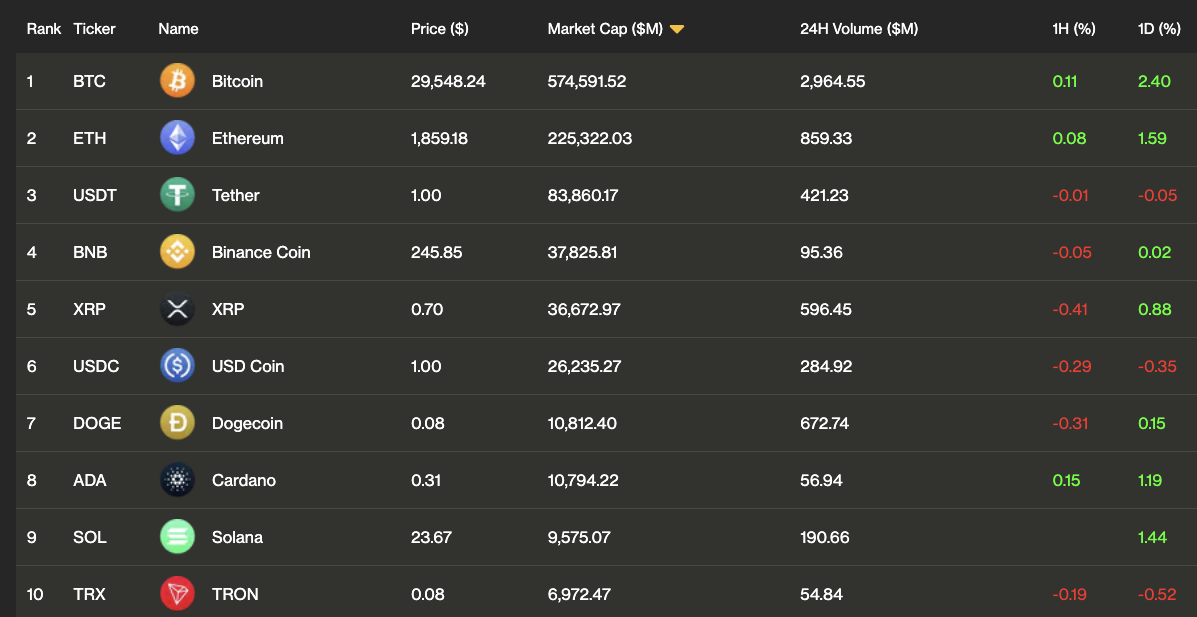

As many as six asset managers have filed applications with the U.S. Securities and Exchange (SEC) for ether (ETH) futures-based exchange-traded funds (ETFs). First off the block on July 28 was the Volatility Shares Ether Strategy ETF. That filing was quickly followed by five other applications: the Bitwise Ethereum Strategy ETF, VanEck Ethereum Strategy ETF, Roundhill Ether Strategy ETF, ProShares Short Ether Strategy ETF, and Grayscale Ethereum Futures ETF all were submitted to the SEC by August 1. Grayscale currently operates the Grayscale Ethereum Trust (ETHE) with just more than $3 billion in assets under management. It’s suffered from a long period of trading at a substantial discount to net asset value – 41.5% as of yesterday.

MicroStrategy (MSTR), the software developer that’s amassed a giant bitcoin stash in recent years, filed to raise up to $750 million in share sales, with plans to use the proceeds to in part buy more bitcoin. The news came just after the company announced its second quarter results late Tuesday afternoon. Including some small bitcoin purchases made last month, MicroStrategy’s holdings as of July 31 amounted to 152,800 tokens worth about $4.5 billion at current prices. The news seemingly gave a lift to bitcoin, which quickly rose about 3% and briefly breached $30,000. The price has since pulled back to the current $29,500.

Binance counts China as its largest market, followed by South Korea, Turkey, Vietnam, and the British Virgin Islands, according to documents reviewed by the Wall Street Journal. The Journal reports that despite the ban on crypto within China, teams from Binance regularly collaborate with Chinese law enforcement to detect potential criminal activity. It also has 900,000 active users in-country, according to the report. A spokesperson for the exchange did not immediately respond to CoinDesk’s request for comment. Data from the Journal shows that China is a $80.6 billion futures market and a $9.4 billion spot market for Binance. Second place South Korea provides $56.9 billion in futures volume and $1.39 billion in spot volume, and fifth place British Virgin Islands is responsible for $12.82 billion in spot volume and $5 billion in futures volume.

-

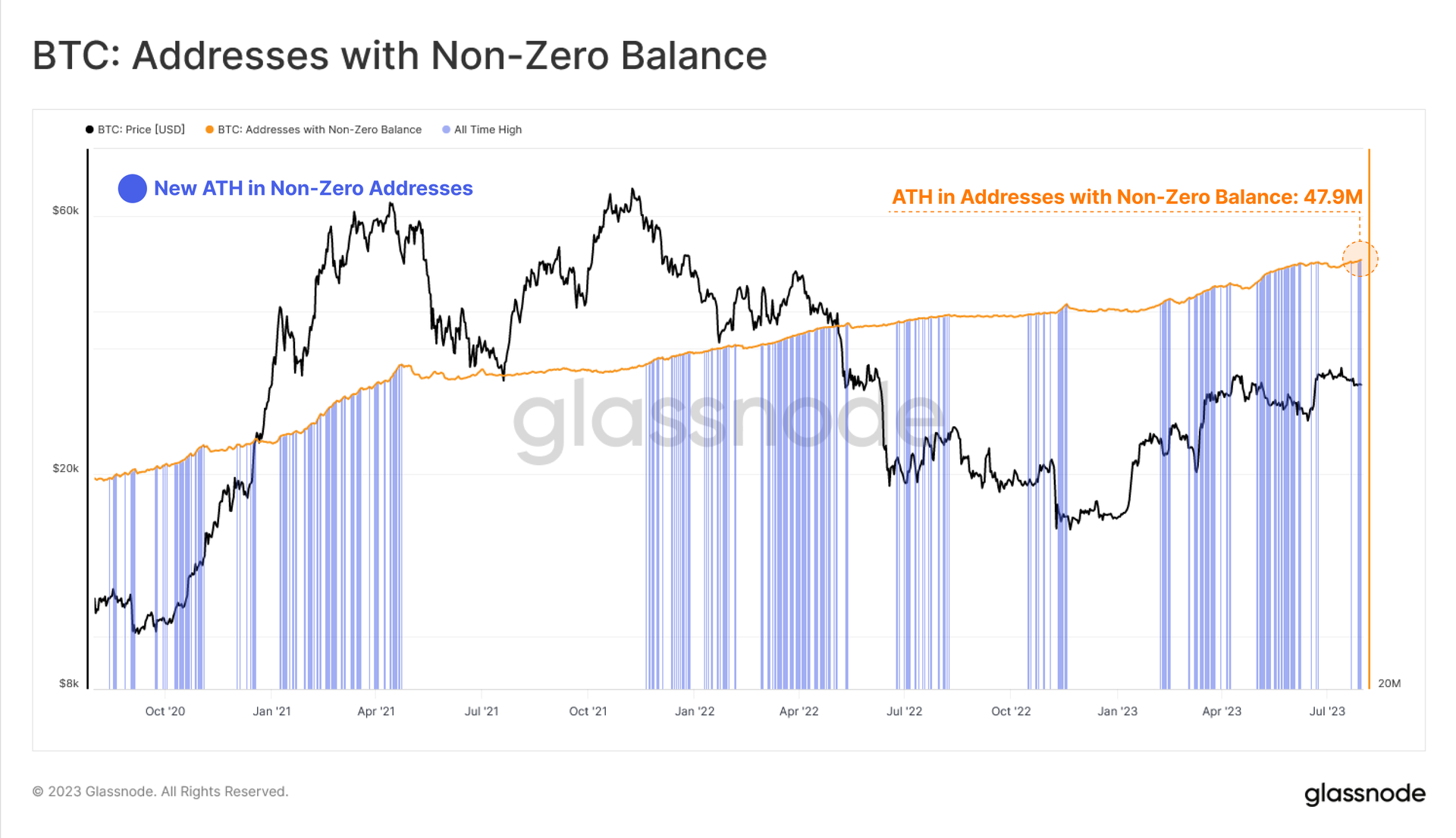

The chart shows the number of addresses with a non-zero bitcoin balance has increased to a new record high of 47.9 million.

-

Per Glassnode, it’s a sign of continued bitcoin adoption.

Disclaimer: This article was written and edited by CoinDesk journalists with the sole purpose of informing the reader with accurate information. If you click on a link from Glassnode, CoinDesk may earn a commission. For more, see our Ethics Policy.

Edited by Stephen Alpher.