First Mover Americas: PEPE Peaks After Binance Listing

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

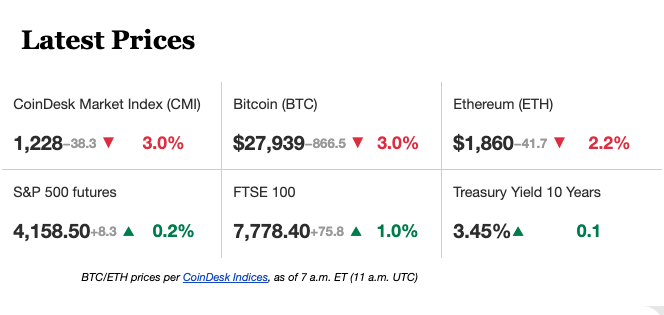

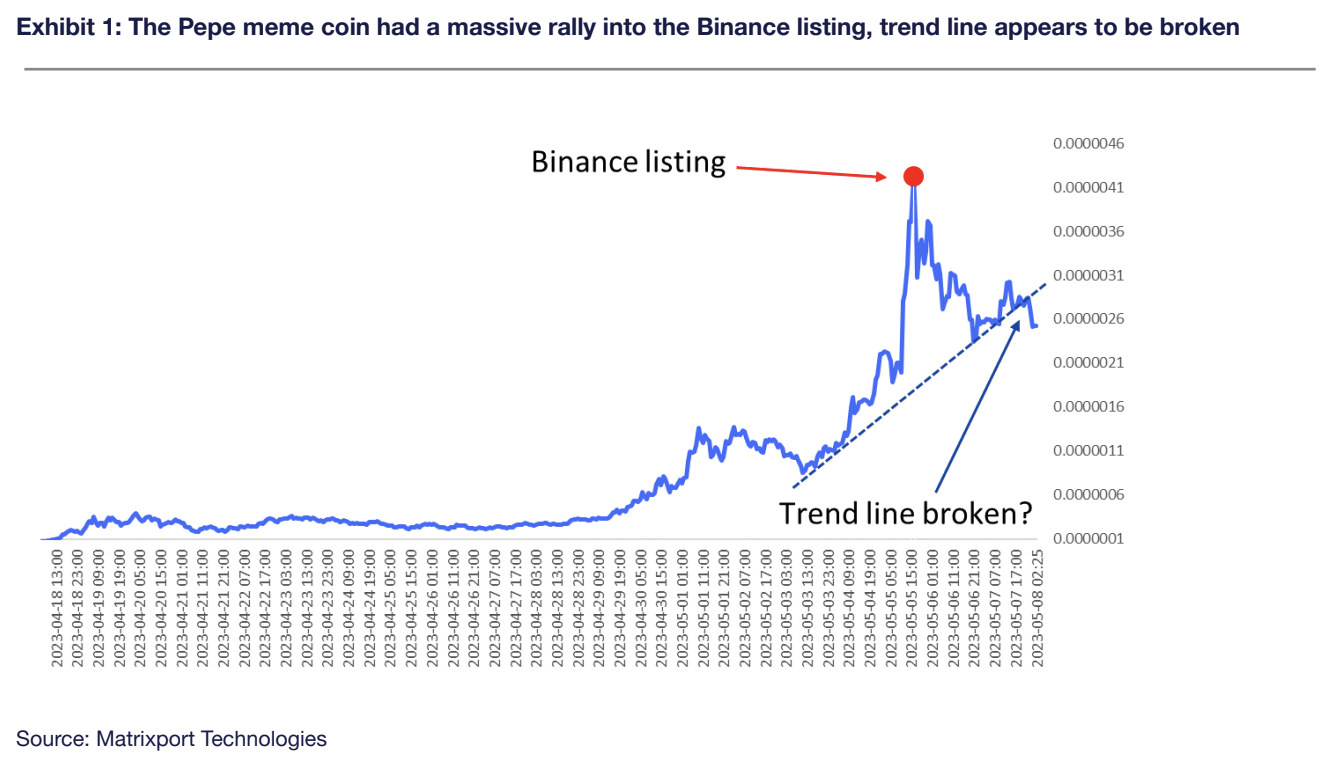

Pepecoin’s (PEPE) rally has run out of steam since Binance, the world’s leading cryptocurrency exchange by trading volume, listed the frog-themed cryptocurrency on Friday at 16:00 UTC. The token traded at around $0.0000022 at press time, having set a record high of $0.00000431 about 40 minutes after Binance listed the token, data from charting platform TradingView show. “The volume of news around Pepe peaked with the Binance listing and has since materially declined,” crypto services provider Matrixport’s Markus Thielen said in a note to clients. “The price of the PEPE appears to follow this news cycle and has broken the uptrend.” Per CoinDesk’s Shaurya Malwa, profit taking by early investors likely catalyzed the sharp pullback in PEPE.

Volatility expectations in market leaders bitcoin and ether continue to dwindle despite lingering macroeconomic uncertainty. Crypto exchange Deribit’s ether implied or expected volatility index (ETH DVOL) reached a lifetime low of 51 over the weekend, deepening six-month downtrend. According to crypto asset management firm Blofin’s volatility trader Griffin Ardern, consistent selling of options by structured products has contributed to the implied volatility slide. “Many sellers of these options are exchanges and third-party asset management institutions, and their customers are mainly groups that want to obtain fixed income, such as miners and whale groups,” Ardner told CoinDesk, explaining the unusually low volatility. Per some observers, now is the time to buy volatility, particularly in the ether market.

The Aave community has voted to deploy its version 3 (V3) on the Ethereum layer 2 ecosystem Metis Network. The deployment is likely to bring more liquidity on both platforms and provide liquidity mining incentives to Aave users. Metis will offer 100,000 native METIS tokens as a liquidity mining incentive to Aave users. These tokens will be distributed over a period of six months. AAVE and METIS were down 4.5% and 3.5% at press time.

-

Bitcoin’s price has dived out of its recent triangular consolidation to penetrate the widely-tracked 50-day simple moving average (SMA).

-

Per analysts, the breakdown of the SMA support might yield a deeper sell-off.

Edited by Stephen Alpher.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.