First Mover Americas: Market Doesn’t React Much to PayPal Stablecoin

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Bitcoin and ether remained little changed over the past 24 hours, another sign of just how tepid the market is, as even the entry of payment giant PayPal (PYPL) into the stablecoin market failed to move the needle. Both bitcoin and ether haven’t moved much in price on the day and have seen low trading volumes over the past few weeks. “The prevailing outlook suggests that in the absence of an ETF-triggered catalyst or substantial cryptocurrency-related drama, these price levels could persist for an extended period,” Matteo Bottacini, at Crypto Finance AG, wrote in a morning note.

PayPal USD (PYUSD) is the latest stablecoin to come to market. Stablecoins are digital tokens tied to a stable asset, typically the U.S. dollar. PayPal’s Ethereum-based token will soon be available to PayPal users in the U.S. This is the first time a major financial company is issuing its own stablecoin. Users can transfer PYUSD between PayPal and supported external digital wallets, use the tokens to pay for goods and services or convert any of PayPal’s supported cryptocurrencies to and from PYUSD.

Crypto exchange Bitstamp is raising capital to expand the number of markets it serves around the world, according to a report from Bloomberg. “Bitstamp is not for sale, and we are not actively looking to sell the company,” CEO Jean-Baptiste Graftieaux said in a statement to Bloomberg. “Our current and exclusive priority is to raise money through strategic investors to accelerate Bitstamp’s growth by providing new products and services to retail and institutional crypto customers.” Bitstamp will use the funds to launch a licensed derivatives trading operation in Europe and expand into more markets in Asia.

-

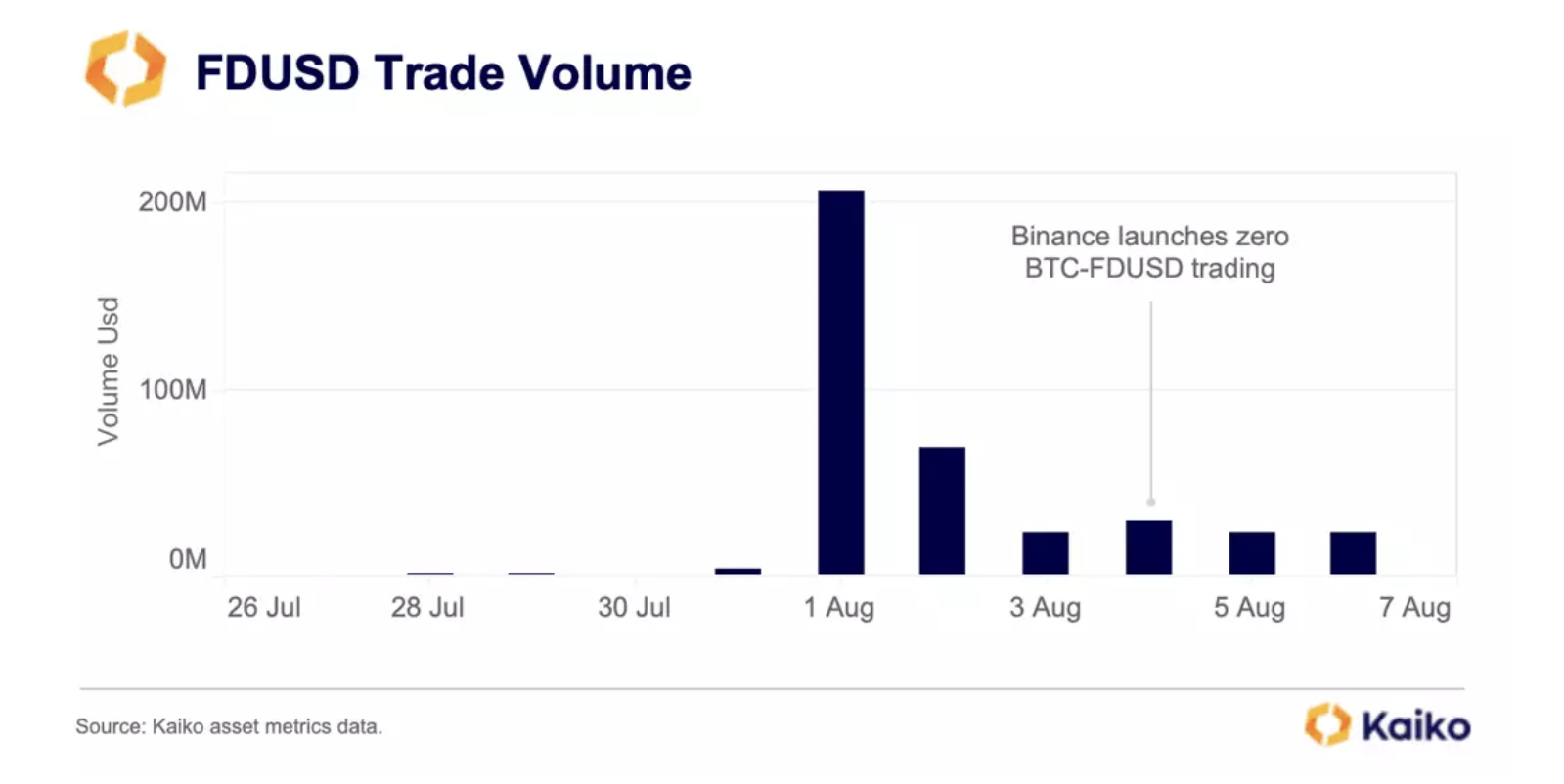

The chart shows the daily trading volume for First Digital’s FDUSD stablecoin, which went live on Binance on July 26.

-

The bitcoin-FDUSD (BTC/FDUSD) volume has averaged less than $100 million per day, barring the Aug. 1 spike.

-

“The lackluster market response to the zero-fee FDUSD pairs is surprising given that these types of promotions typically have a strong impact on overall trading activity. For example, TUSD volume skyrocketed after Binance heavily promoted the stablecoin’s zero-fee pairs. This suggests that traders are reluctant to engage with the stablecoin,” Kaiko said, referring to the trueUSD stablecoin.

Edited by Mark Nacinovich.