First Mover Americas: Litecoin Might Be Trading at a Discount

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

An onchain metric suggests that litecoin (LTC), the 12th largest cryptocurrency by market value, is trading at discounted prices. Litecoin’s market value to realized value (MVRV) Z-score was negative at press time. A sub-zero score indicates the cryptocurrency is undervalued relative to its fair value, according to analytics firm Glassnode. The market capitalization is calculated by multiplying the total number of coins in circulation by the crypto’s price. The realized value is a variation of the market cap that adds the market value of coins when they last moved on the blockchain. It excludes all coins lost from circulation (more than 15%) and is said to reflect the real or fair value of the network.

The stablecoin universe continues to shrink and a sustained recovery in crypto prices is unlikely until this stops, JPMorgan said in a research report Thursday. A stablecoin is a type of cryptocurrency that is pegged to another asset, such as the U.S. dollar. “Headwinds from the U.S. regulatory crackdown on crypto, the unsettling of banking networks for the crypto ecosystem and the reverberations from last year’s FTX collapse are weighing on the stablecoin universe which continues to shrink,” analysts led by Nikolaos Panigirtzoglou wrote.

Digital asset financial services firm HashKey Group is planning to raise funds at a $1 billion valuation, according to a Bloomberg report on Friday. The Asia-based HashKey is in preliminary talks to raise between $100 million to $200 million, according to the report, which cited people familiar with the matter. The firm is looking to capitalize on Hong Kong’s re-emergence in recent months as a potential crypto hub as the city has looked to formulate a clear regulatory structure for digital assets. Hong Kong is looking to attract crypto firms to its shores as a means of generating greater investment and capital, following a few years of restrictions related to COVID taking their toll on the economy.

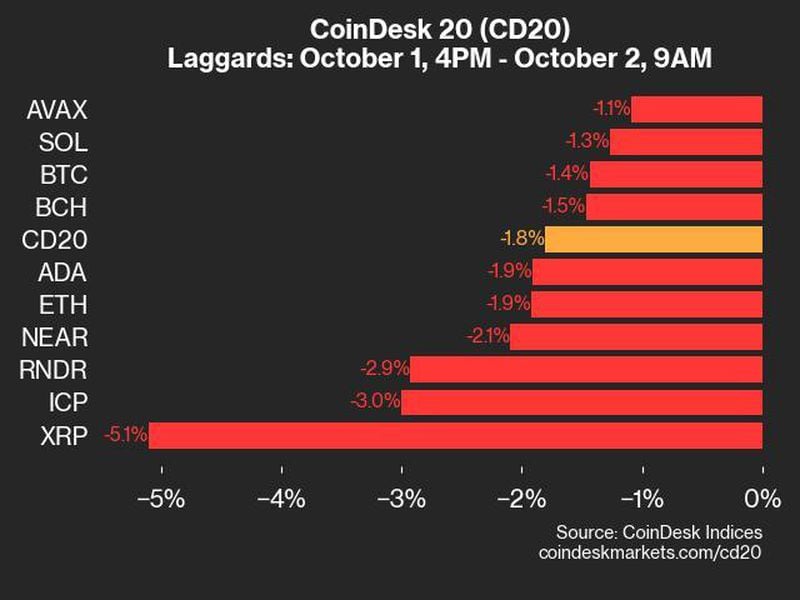

-

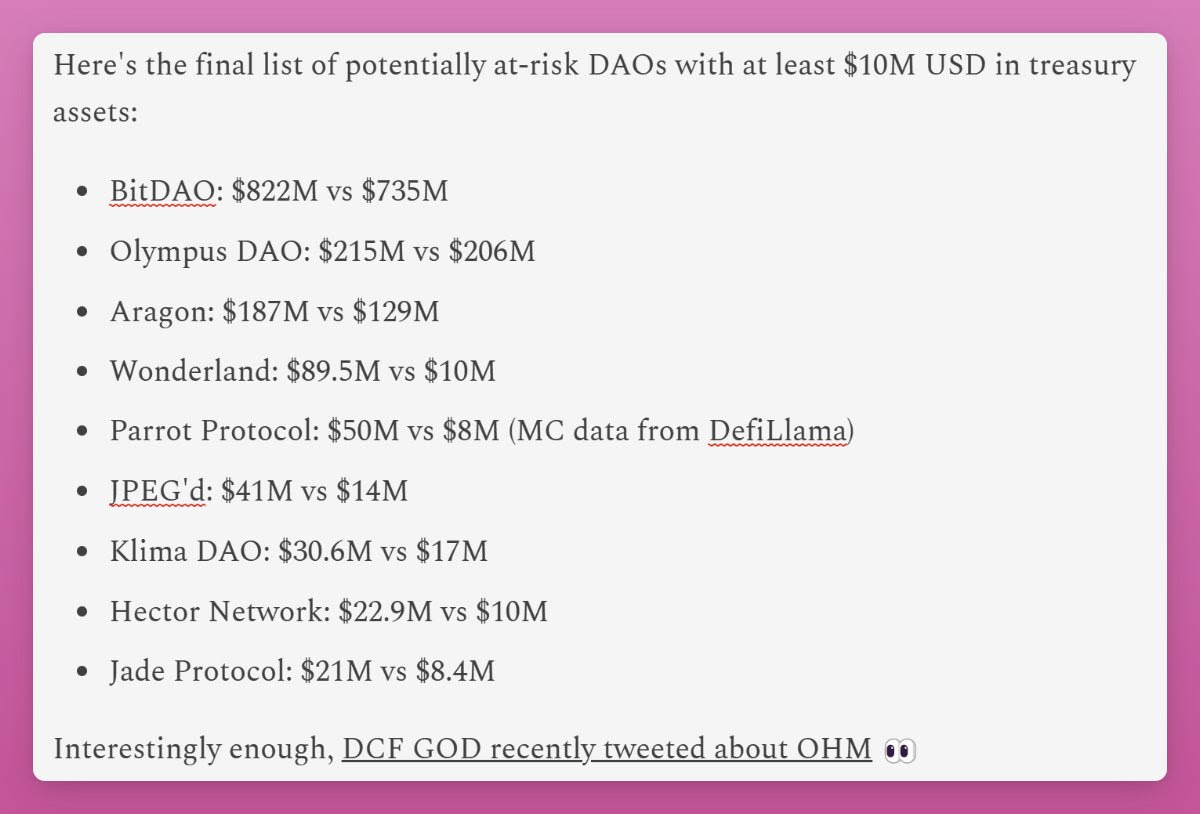

The chart by pseudonymous DeFi analyst Ignas shows that there currently are eight decentralized autonomous organizations (DAOs) with Treasury holdings less than the market capitalization of their respective tokens. (Treasury balances do include holdings of their own coins).

-

Per Ignas, these DAOs can be targeted by the so-called RFV raiders or supposed activist investors looking to take over the DAO to manipulate the price of tokens for financial gains.

Edited by Stephen Alpher.