First Mover Americas: Landmark Crypto Laws Pass in Europe

Featured SpeakerJenny Johnson

President and CEOFranklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

Featured SpeakerJenny Johnson

President and CEOFranklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Lawmakers in the European Union on Thursday voted 517-38 in favor of a new crypto licensing regime, Markets in Crypto Assets, which is popularly known as MiCA, with 18 abstentions, making the EU the first major jurisdiction in the world to introduce a comprehensive crypto law. The European Parliament also voted 529-29 in favor of a separate law known as the Transfer of Funds regulation, which requires crypto operators to identify their customers in a bid to halt money laundering, with 14 abstentions. The votes follow a Wednesday debate in which lawmakers largely supported plans to make crypto wallet providers and exchanges seek a license to operate across the bloc of 27 nations and require stablecoin issuers to maintain sufficient reserves.

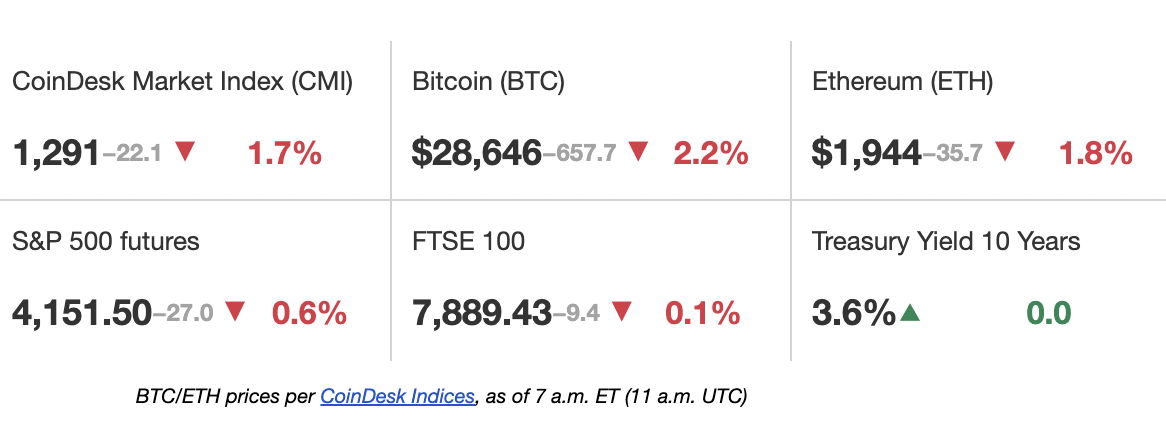

Bitcoin fell for a second straight day on Thursday, dropping to $28,500, a 10-day low. The world’s largest cryptocurrency declined 2% over the past 24 hours as traders across the globe moved away from risky assets. Bitcoin closed below its 20-day moving average on Wednesday, according to data from TradingView, a sign of weakness. The cryptocurrency has rallied this year, but Craig Erlam, an analyst at foreign-exchange trading firm Oanda, said in a morning note that the recovery may be running on fumes. Popular meme token, dogecoin (DOGE), was one of the few coins trading in the green Thursday, up 5% over the past 24 hours. Some supporters refer to April 20 as “DogeDay.”

The substantive parts of the Voyager Digital-Binance.US sale deal could be allowed to proceed even before a legal appeal is worked through, court filings made Wednesday suggest, as concerns rise that the buyer could pull out. The document says the U.S. government has now agreed that the bulk of Binance.US’ $1 billion deal to purchase assets of the bankrupt crypto lender can proceed, despite concerns that the fine print of the contract would pardon breaches of tax or securities law. The filing proposes that, until an appeal is settled, those contentious “exculpation provisions” should remain on hold, but not the remaining elements of the deal.

-

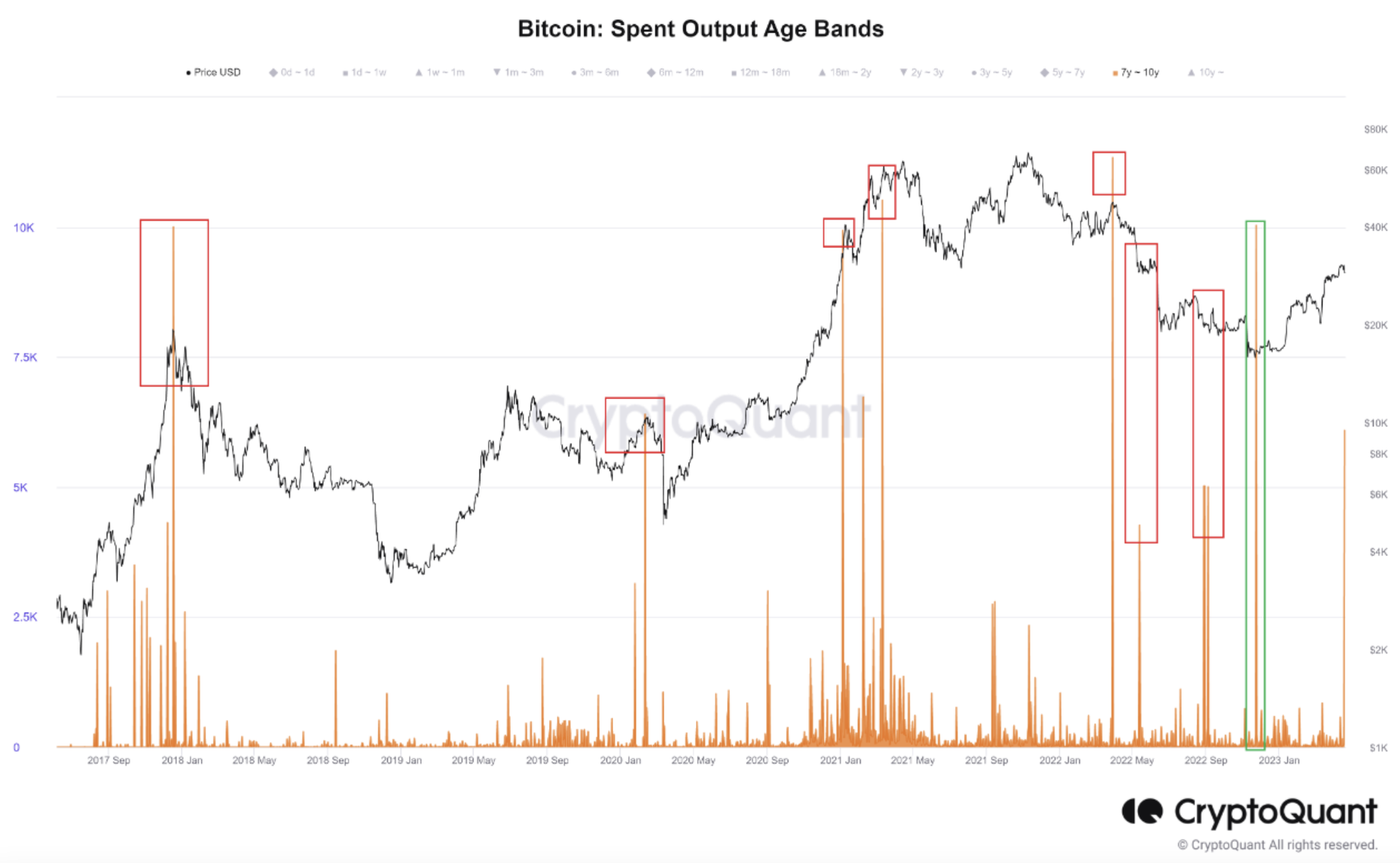

The chart shows the on-chain movement of bitcoin that’s been sitting dormant for between seven and 10 years.

-

More than 5,000 bitcoins, worth $144 million, were moved early Thursday.

-

Whenever such old coins move, bitcoin tends to see increased price turbulence.

Edited by Mark Nacinovich.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.