First Mover Americas: Is Bitcoin Heading Below $26K?

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

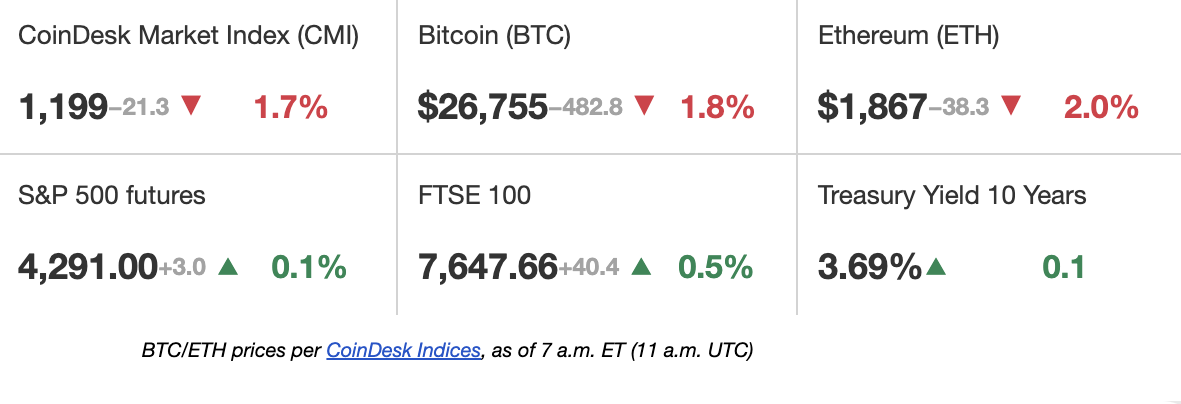

Bitcoin (BTC) is down almost 2% over the last 24 hours and back below $27,000 at $26,700 as investors continue to weigh the implications of the U.S. debt ceiling deal and last Friday’s strong employment report. U.S. stock index futures are little-changed Monday morning following last week’s strong rally in equities. Laurent Kssis, crypto advisor at CEC Capital, sees bitcoin dropping below $26,000 this week. “With summer getting closer, no obvious catalysts, dealers are not keeping inventories and any large selling order may trigger selling pressure,” he said, noting that long liquidations are currently triple those of short liquidations.

Retail demand for bitcoin is likely to remain strong over the coming year ahead of the next halving event for the world’s largest cryptocurrency, JPMorgan said in a research report Thursday. Recent increase in retail demand can be partly attributed to the advent of Bitcoin Ordinals and BRC-20 tokens, wrote the bank’s analysts led by Nikolaos Panigirtzoglo, but the more important boost in strengthening investor interest will be thanks to the approach of the April 2024 “halving.” Part of bitcoin’s original code, halvings occur every 210,000 blocks, or roughly every four years. At these events, bitcoin mining rewards are cut by 50%. This effectively doubles bitcoin production costs, according to the JPMorgan team, and creates “a positive psychological effect.”

The appointment of Richard Teng to oversee Binance’s regional markets outside the U.S. has positioned the one-time Abu Dhabi regulator as the most likely successor to Changpeng Zhao, who founded the world’s largest crypto exchange in 2017. The enhanced role follows a report last month that Zhao, commonly known as CZ, is looking to reduce his ownership of Binance.US, the firm’s American arm – a move that’s seen as something of an appeasement to U.S. regulators. Teng’s knowledge and experience as a regulator will come to bear in his new role overseeing Asia, Europe, the Middle East and North Africa as the exchange, often targeted by authorities, attempts to draw a line under mounting enforcement actions related to conduct during crypto’s early years. Prior to heading up the Financial Services Regulatory Authority at Abu Dhabi Global Market, Teng was chief regulatory officer of Singapore Exchange (SGX) and spent 13 years with the Monetary Authority of Singapore. In an interview with CoinDesk, Teng sidestepped the idea that he’s being groomed to take the reins from the 46-year-old CEO.

Edited by Stephen Alpher.