First Mover Americas: Investors Dig Risk Again

Jenny Johnson

President and CEO

Franklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

Jenny Johnson

President and CEO

Franklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/www.coindesk.com/resizer/jX7WPvpd1pYeRAy6SoZTU_N_Zl0=/arc-photo-coindesk/arc2-prod/public/ISMDW3SATBA25J4ZU65XNCUANE.jpg)

Omkar Godbole was a senior reporter on CoinDesk’s Markets team.

Jenny Johnson

President and CEO

Franklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

Jenny Johnson

President and CEO

Franklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

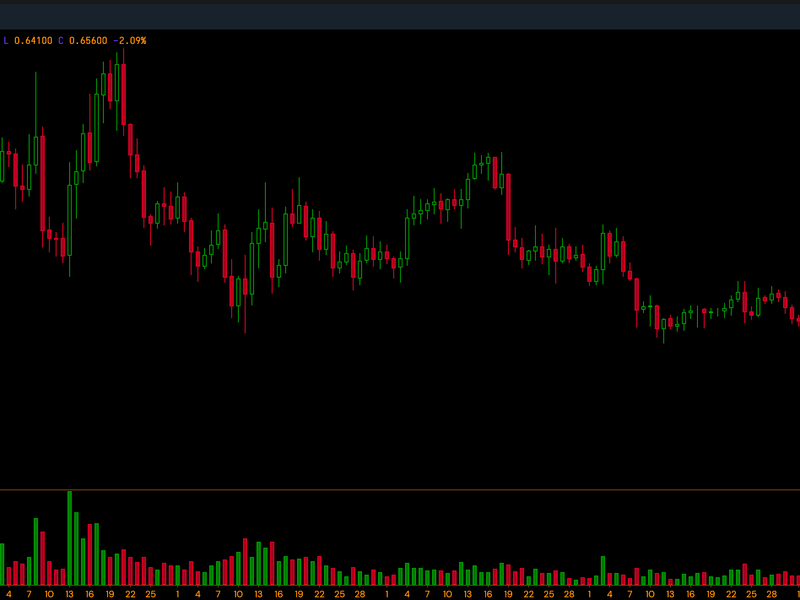

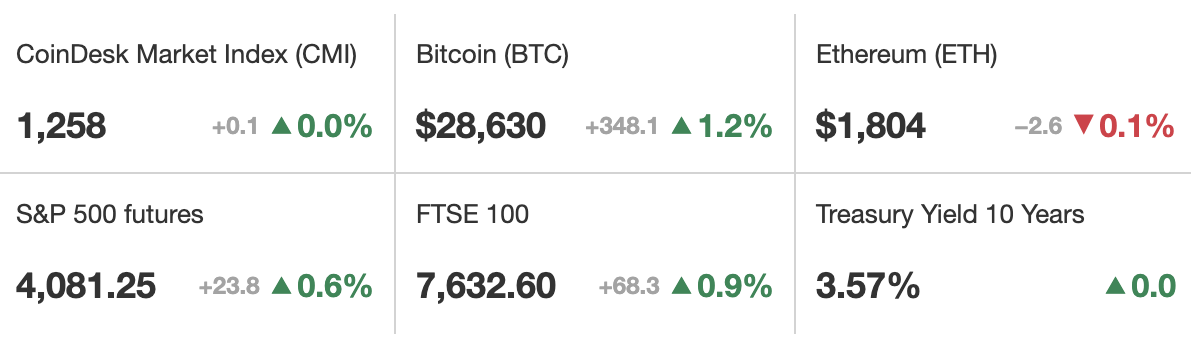

Bitcoin rose slightly on Thursday while the U.S. dollar slipped as investors showed an increased appetite for risk. Bitcoin was up 1% over the past 24 hours to about $28,500. It reached an intraday high of $29,100 but has since retreated a bit. Contracts on the tech-heavy Nasdaq 100 advanced 0.4% after a rally on Wednesday to enter into a bull market for the first time in nearly three years. Meanwhile, data from IntoTheBlock shows that bitcoin now has the highest “Sortino ratio” compared with traditional markets and ether. The metric measures the risk-adjusted performance of assets. A higher Sortino ratio suggests better risk-adjusted returns.

Crypto investors are fleeing Circle Internet Financial’s USD coin (USDC) stablecoin, with many of them switching to tether, another stablecoin, which has reached a 22-month high in market share. Net outflows from USDC have surpassed $10 billion since March 10 That’s when regulators shuttered Silicon Valley Bank, a firm Circle banked with. Circle, a payments firm, has weathered SVB’s collapse as USDC has re-established the U.S, dollar price peg it lost in the immediate aftermath of SVB’s failure, but the token has still dropped 23% from its one-time $43 billion market capitalization, according to crypto price tracker CoinGecko. USDC’s plunge comes as the stablecoin sector has been severely tested by problems in the banking industry and regulatory scrutiny. Crypto exchange Binance’s BUSD token has also plummeted, among other stablecoins.

OKX says it has identified $157 million in digital assets belonging to FTX and Alameda Research, and is turning them over to the bankruptcy estate for the two firms that both filed for bankruptcy in November. The exchange didn’t specify what digital assets it had identified. OKX said in a release it conducted investigations to identify any FTX-related transactions on its exchange, and upon discovering assets and accounts linked to FTX and Alameda Research, a trading firm that is affiliated with FTX, it moved to secure the assets and freeze the connected accounts. Shortly after the collapse of FTX, a hacker siphoned $600 million from the exchange’s wallets, leading to fears that FTX accounts on other exchanges were compromised.

(Amberdata)

-

The bitcoin options market skew remains positive across time frames even as the cryptocurrency failed to keep gains above $29,000 early Thursday.

-

The positive skew reflects a bullish bias.

-

The skew measures the richness of bullish call options relative to the bearish put options. It shows what traders are willing to pay to acquire an asymmetric payout from an uptrend or downtrend.

Edited by Mark Nacinovich.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/www.coindesk.com/resizer/jX7WPvpd1pYeRAy6SoZTU_N_Zl0=/arc-photo-coindesk/arc2-prod/public/ISMDW3SATBA25J4ZU65XNCUANE.jpg)

Omkar Godbole was a senior reporter on CoinDesk’s Markets team.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/www.coindesk.com/resizer/jX7WPvpd1pYeRAy6SoZTU_N_Zl0=/arc-photo-coindesk/arc2-prod/public/ISMDW3SATBA25J4ZU65XNCUANE.jpg)

Omkar Godbole was a senior reporter on CoinDesk’s Markets team.