Crypto Is Too Big for Partisan Politics

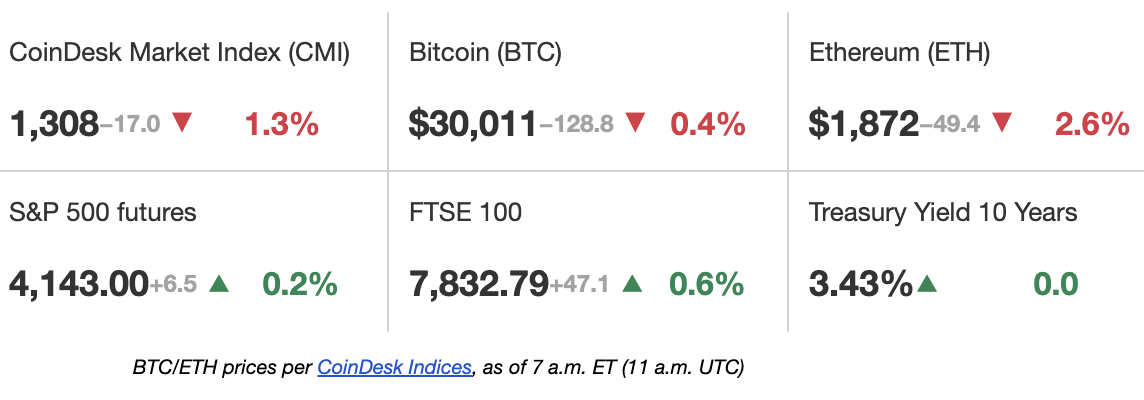

Every major American issue seems to get sucked into the “red vs. blue” political dichotomy these days, and now it is cryptocurrency’s turn in the barrel. Following somewhat tense recent testimony between U.S. Securities and Exchange Commission Chairman Gary Gensler and the Senate Banking Committee, Politico confidently declared “Crypto becomes partisan.”While Capitol Hill fireworks might…

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)