First Mover Americas: Ether Steals the Show, Alts Follow Suit

Featured SpeakerJenny Johnson

President and CEOFranklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

Featured SpeakerJenny Johnson

President and CEOFranklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

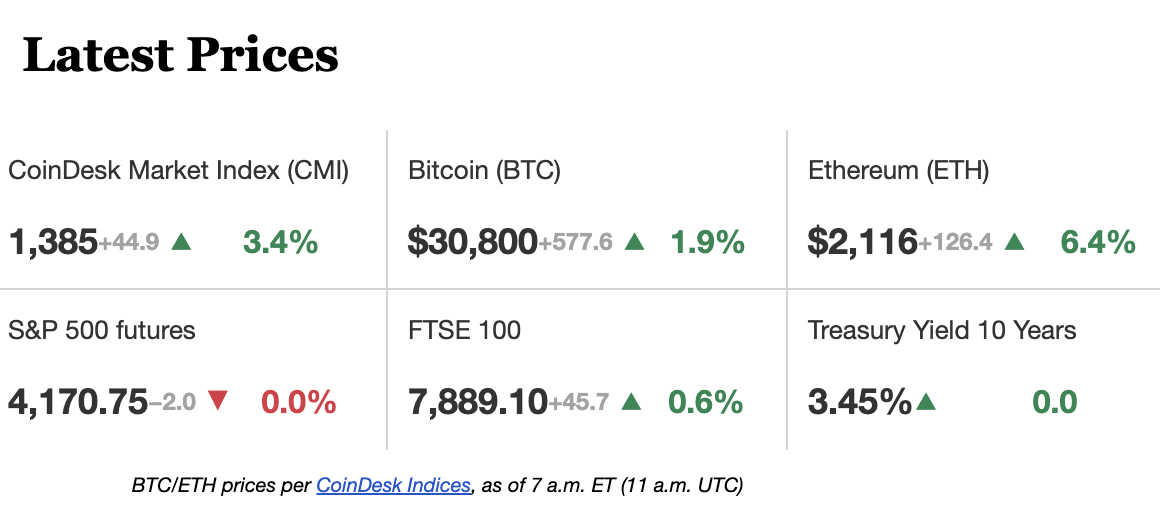

Ether (ETH) continues to outperform bitcoin (BTC) following the Ethereum network’s Shanghai upgrade, which has proven to be bullish for much of the cryptocurrency market, with many altcoins following suit. Ether is up 6% on the day vs. bitcoin which gained 1%. Bitcoin did briefly cross $31,000 on Friday for the first time since June 2022, marking a 10% gain over the last 7 days. Ether rose 13% over the same time frame. Arbitrum (ARB) an Ethereum scaling solution, led gains this week, rising almost 30%. According to Sheraz Ahmed, STORM’s managing partner, ARB is bouncing back from the overselling caused by its airdrop in March, which saw the Ethereum layer 2 distribute its long-awaited governance token to community members. The airdrop, however, was plagued with bugs and phishing scams. “The crypto markets are heavily emotionally driven, and we often see overbought/sold tokens based on over-reactions,” said Ahmed.

Top 10 protocols with a market capitalization > $1B. (Messari)

The tokenization of real-world assets gathers pace, Bank of America (BAC) said in a research report Thursday, which noted that the tokenized gold market surpassed $1 billion in value last month. Tokenization is the process of putting ownership of tangible assets – precious metals being one example – on the blockchain, and thus offering the convenience of buying and selling these assets around the clock as the involvement of traditional brokers is not necessary. Bank of America sees this tokenization – which could also include commodities, currencies and equities –as a “key driver of digital asset adoption.”

Solana Labs’ crypto-forward smartphone Saga will go on public sale May 8, the company behind the Solana blockchain said Thursday. Pre-ordered devices are shipping now. The Android smartphone is a gamble on mobile being imperative to the future of crypto, employees at Solana-focused companies told CoinDesk. It was nearly 10 months ago that Solana first teased the radical potential of a cellphone that doubled as a dedicated crypto hardware wallet, and the possibilities such a product could hold for its entire ecosystem. The new device from Solana Mobile costs $1,000 and is built on hardware from Bay Area smartphone company OSOM. Phonemaker names both big and small – HTC and Sirin Labs among them – have previously failed in their efforts to create a crypto-forward smartphone, setting an ominous precedent for Solana, a device built for and marketed to a single crypto ecosystem.

Source: Refinitiv, The Market Ear newsletter

-

The chart shows bitcoin continuing to rally despite recent sideways action in Wall Street’s tech-heavy index Nasdaq.

-

The 90-day correlation coefficient between the two rose to 0.9 early this month, signaling a strong positive relationship.

-

“Follow the hot money,” analysts at The Market Ear newsletter said in a note to subscribers early Friday. “Imagine the pain should Nasdaq decide to catch up to the BTC break up move.”

Edited by Stephen Alpher.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.