First Mover Americas: Ether Options Tilting Bearish

Featured SpeakerJenny Johnson

President and CEOFranklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

:format(jpg)/www.coindesk.com/resizer/jX7WPvpd1pYeRAy6SoZTU_N_Zl0=/arc-photo-coindesk/arc2-prod/public/ISMDW3SATBA25J4ZU65XNCUANE.jpg)

Omkar Godbole was a senior reporter on CoinDesk’s Markets team.

Featured SpeakerJenny Johnson

President and CEOFranklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

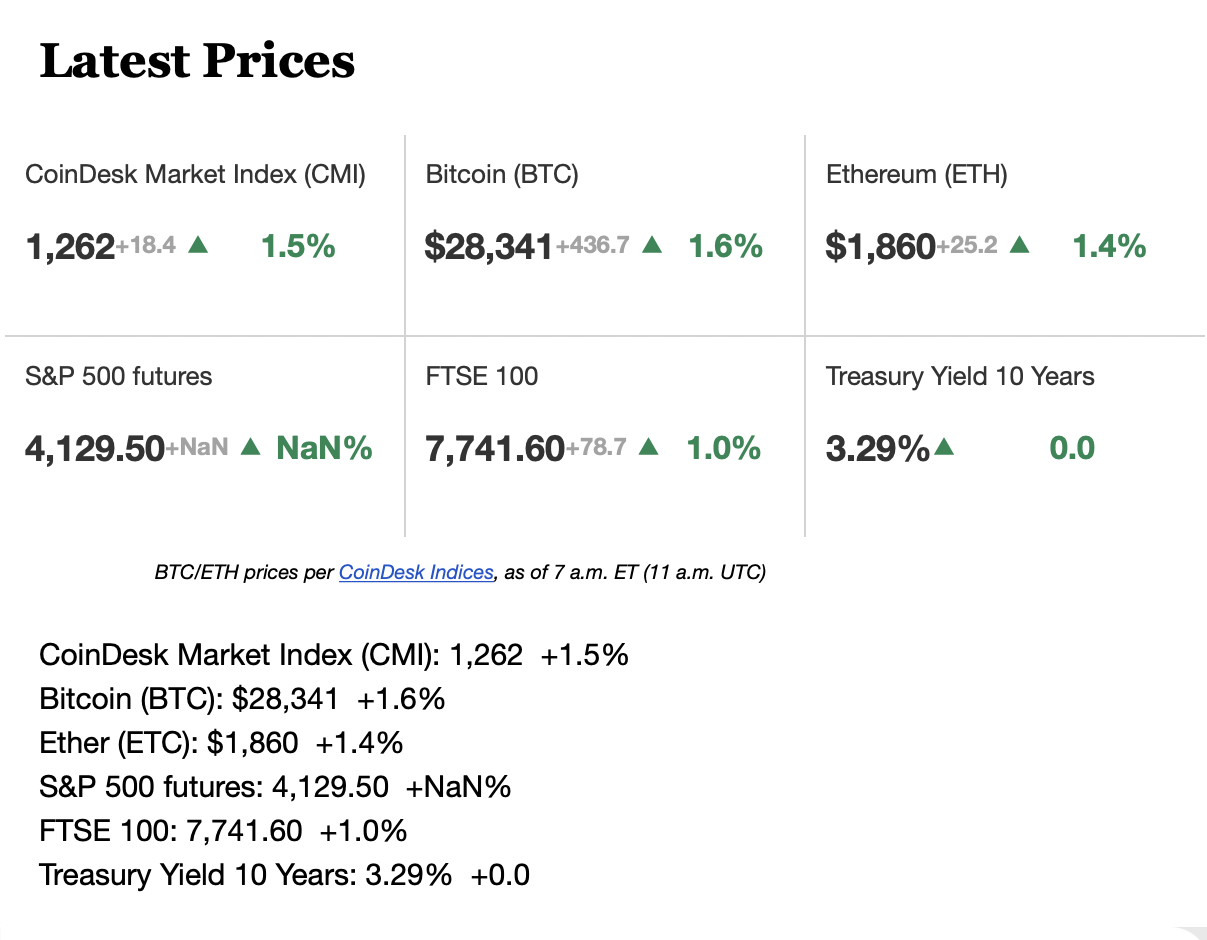

Ether options call-put skew showed both short-term and long-term bearish put options trading at a slight premium to bullish calls. The put bias shows lingering concerns that some “stakers” might rush to liquidate their tokens following Ethereum’s Shanghai upgrade on Wednesday, driving prices lower despite analysts suggesting otherwise. Skew measures the cost of calls relative to puts and reflects what people are willing to pay to acquire an asymmetric payout on either the upward or downward direction of the market. The Shanghai upgrade will open withdrawals of more than 18 million ETH staked in the Beacon Chain since December 2020. According to Galaxy Digital, 553,650 ETH might be sold over seven days following the upgrade, amounting to a per-day selling pressure equal to just 1% of Ether’s daily trading volume and is likely to have a big negative impact on the cryptocurrency’s price. Ether traded up 1.4% at $1,860 early Monday.

Crypto derivatives trading platform Bitget announced a $100 million Asia-focused Web3 fund on Monday, validating the narrative that the next wave of blockchain development will come from the East. The launch of the new fund is part of the exchange’s “go beyond derivative” strategy aimed at driving the adoption of crypto and Web3, Gracy Chen, Bitget’s managing director, told CoinDesk.

Security issues continue to haunt the crypto market even as token valuations recover from the 2022 crash. Decentralized exchange SushiSwap suffered an exploit on Sunday involving the ‘RouterProcessor2’ contract used for trade routing on the exchange and led to a loss of more than $3.3 million to a single user, @0xsifu, a popular pseudonymous trader in Crypto Twitter circles. The SUSHI token was volatile in the past 24 hours, clocking a high and low of $1.13 and $1.06, respectively. At press time, the token traded near $1.10, up 2.6% in the past 24 hours.

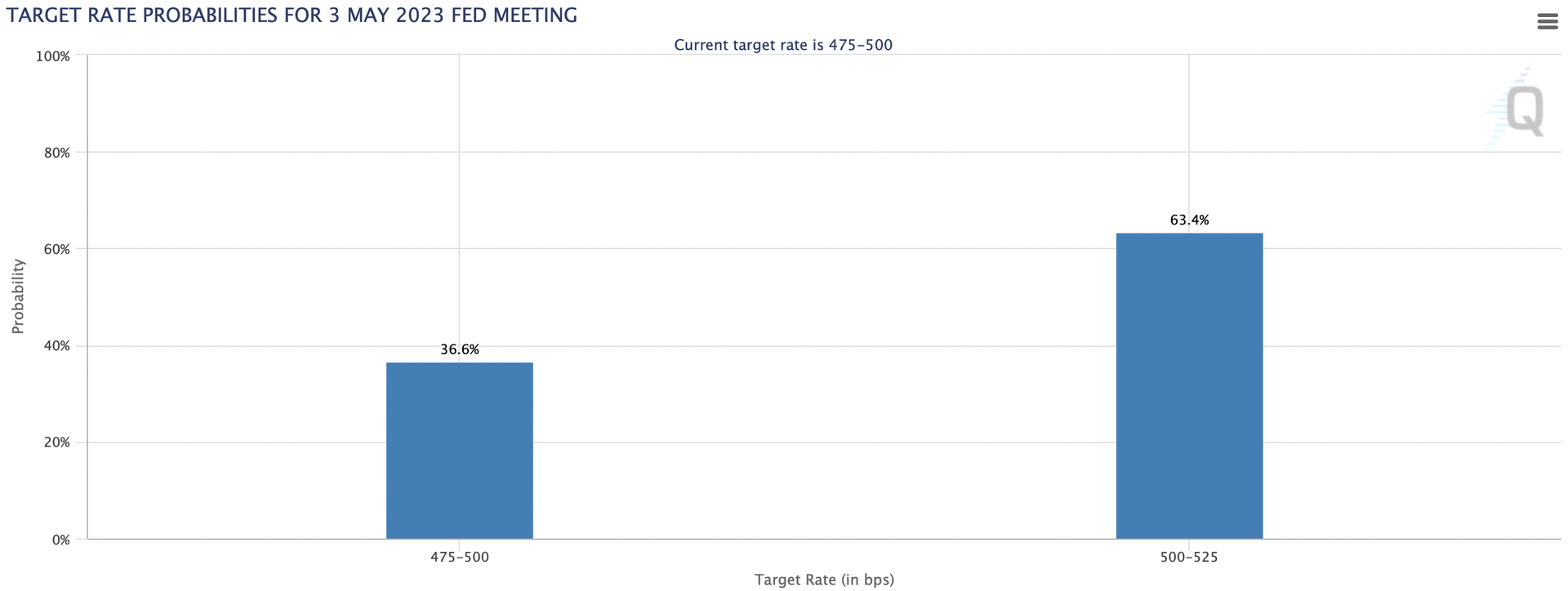

(Source: CME’s FedWatch tool)

-

Friday’s U.S. jobs report has raised bets that the Federal Reserve will increase rates next month, with markets pricing in a 63.4% chance of a 25 basis-point rate hike, according to the CME FedWatch tool.

-

The higher rate hike odds may put a floor under the dollar index and cap gains in risky assets, including cryptocurrencies.

Edited by Mark Nacinovich.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/jX7WPvpd1pYeRAy6SoZTU_N_Zl0=/arc-photo-coindesk/arc2-prod/public/ISMDW3SATBA25J4ZU65XNCUANE.jpg)

Omkar Godbole was a senior reporter on CoinDesk’s Markets team.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/jX7WPvpd1pYeRAy6SoZTU_N_Zl0=/arc-photo-coindesk/arc2-prod/public/ISMDW3SATBA25J4ZU65XNCUANE.jpg)

Omkar Godbole was a senior reporter on CoinDesk’s Markets team.