First Mover Americas: Ether Holds Above $2K

Featured SpeakerJenny Johnson

President and CEOFranklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

Featured SpeakerJenny Johnson

President and CEOFranklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Ether is holding above $2,000 after it reached an 11-month high on Sunday of $2,141. The cryptocurrency’s upward movement comes after the Ethereum blockchain’s Shanghai software upgrade last week, although Simon Peters, an analyst at investment firm eToro, wrote in a morning note that the reaction to the upgrade was largely muted and that ether’s price jump was more of a response to macroeconomic conditions. Bitcoin, the world’s largest cryptocurrency by market value, lost 2% in the past 24 hours to fall below $30,000. Layer 1 network Avalanche’s AVAX led gains on Monday, up 7% in the past 24 hours. Last week, financial institutions T. Rowe Price, WisdomTree, Wellington Management and Cumberland joined Avalanche’s “subnet” called “Spruce” to make trade execution and settlements more efficient.

Basketball legend Shaquille O’Neal has been served in a class-action lawsuit against FTX founder Sam Bankman-Fried, a law firm for the plaintiffs tweeted on Sunday. “Plaintiffs in the billion $ FTX class action case just served @SHAQ outside his house,” a law firm led by Adam Moskowitz tweeted. Dubbed “Shaqtoshi” in an FTX commercial, O’Neal is one of several celebrities, including “Shark Tank” host Kevin O’Leary, football star Tom Brady and basketball player Steph Curry, who are facing a class-action lawsuit for promoting a “fraudulent scheme.” When crypto exchange FTX had collapsed O’Neal had said “I was just a paid spokesperson for a commercial.”

Bitcoin is closely following its early 2019 surge and its price could peak at around $45,000 next month, according to Vetle Lunde, a senior analyst at K33 Research. The cryptocurrency has soared 80% this year, beating traditional risky assets, including the tech-heavy Nasdaq index, by a wide margin. The rally comes after a 12-month decline when prices fell 76% and bottomed out in November 2022. The drop and subsequent recovery are analogous to the pattern seen in the 2018-19 bear market in terms of length and trajectory, according to Lunde. “Bottoms in both cycles lasted for approximately 370 days. And the peak-to-trough return after 510 days of both cycles reached 60%,” Lunde said in a note sent to clients last week. “In 2018, the bear market rally topped 556 days after the 2017 peak, on June 29, 2019, with a 34% drawdown from the peak.”

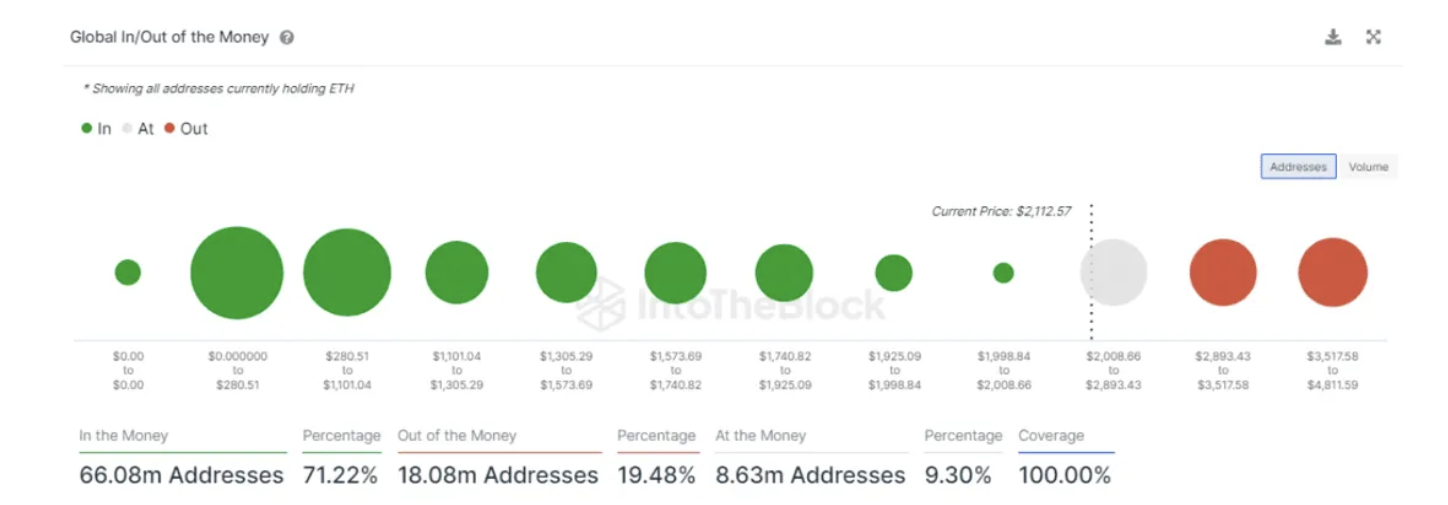

(IntoTheBlock)

-

The chart shows more than 70% of addresses holding ether are in the money, having acquired coins at an average price lower than the cryptocurrency’s going market rate of $2,090.

-

The focus now shifts to the $2,365-$2,430 price range, where many addresses have traded the cryptocurrency, according to Pedro Negron, a junior research analyst at IntoTheBlock.

-

Ether rose past $2,100 last week, hitting its highest point since May 2022.

Edited by Mark Nacinovich.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.