First Mover Americas: El Salvador Holds More BTC Than Expected

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

Top Stories

Bitcoin (BTC) fell to as low as $66,800 on Friday, dropping 8% in 24 hours after soaring above $70,000 earlier in the week. The CoinDesk 20 index, a measure of the largest and most liquid digital assets, fell 6%. Data from CoinGlass shows that over $100 million in long positions were wiped out over 12 hours, and $167 million in longs liquidated in 24 hours. Other assets like gold and Wall Street’s tech-heavy index Nasdaq also came under pressure this week. Some analysts described BTC’s pullback from record highs as a typical bull breather seen after sharp rallies. Adrian Wang, the founder and CEO of Metalpha, said the market could be adjusting to uncertainties ahead of the next month’s mining reward halving.

Bitcoin-forward Central American nation El Salvador this week moved $400 million of bitcoin (BTC) – “a big chunk” – into a cold wallet, President Nayib Bukele said in a post on X (formerly Twitter). Bukele referred to the new setup as “our first #Bitcoin piggy bank.” El Salvador stored the cold wallet “in a physical vault within our national territory,” he said, including a photo of a wallet that held 5,689.68 BTC, worth $411 million at Thursday’s prices. A bitcoin treasury of that size places El Salvador’s holdings far higher than previously thought. Even on Thursday, public trackers placed the nation’s trove at less than 3,000 BTC ($205 million). Earlier this week, Bukele teased that the country was not only buying BTC but also getting it by selling passports, through currency conversions for businesses, from mining and from government services.

Galaxy Digital (GLXY) should be a core holding for equity investors looking to gain exposure to the digital asset ecosystem, investment bank Stifel (SF) said in a research report on Wednesday. Stifel resumed coverage of Michael Novogratz’s crypto financial services firm with a buy rating and a price target of C$20. Galaxy closed 4.7% lower on Thursday at C$13.11. “The company offers an asymmetric return profile with significant principle exposure to bitcoin and ether; a diverse group of revenue-producing businesses across trading, investment banking and asset management; and longer-term outsized growth potential through its infrastructure solutions arms, which focuses on core technologies that power decentralized networks,” analysts Bill Papanastasiou and Suthan Sukumar wrote.

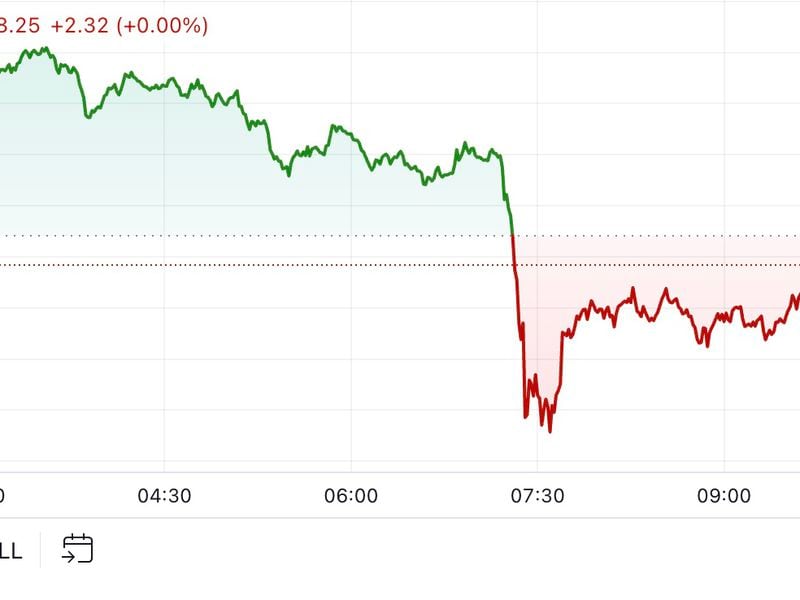

Chart of the Day

-

The chart shows the dollar value of the number of crypto perpetual futures positions liquidated across major exchanges in the past 24 hours.

-

Bitcoin’s overnight drop to $67,000 has liquidated over $800 million worth of positions.

-

These liquidations represent a healthy cleansing of over-leveraged positions, according to Swiss One Capital.

-

Source: CoinGlass

Trending Posts

Edited by Sheldon Reback.