First Mover Americas: Crypto Trading Comes to Twitter

Featured SpeakerJenny Johnson

President and CEOFranklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

Featured SpeakerJenny Johnson

President and CEOFranklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

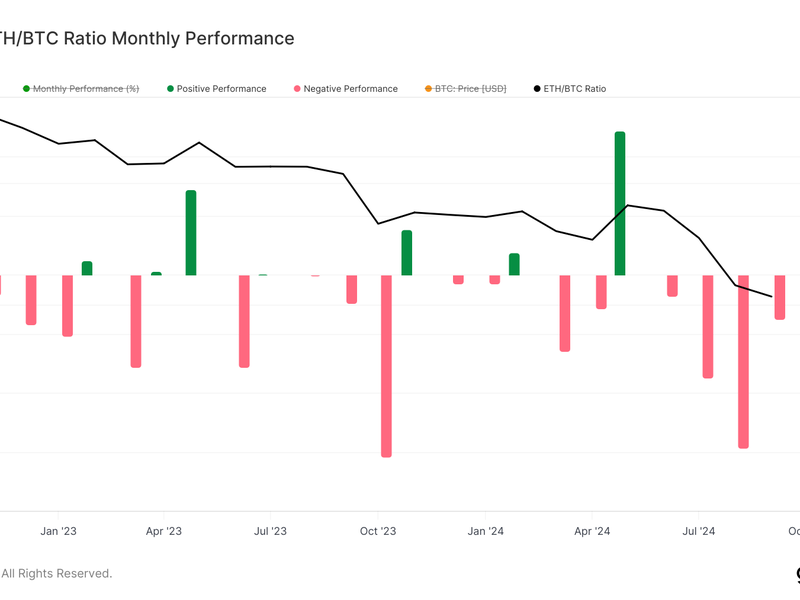

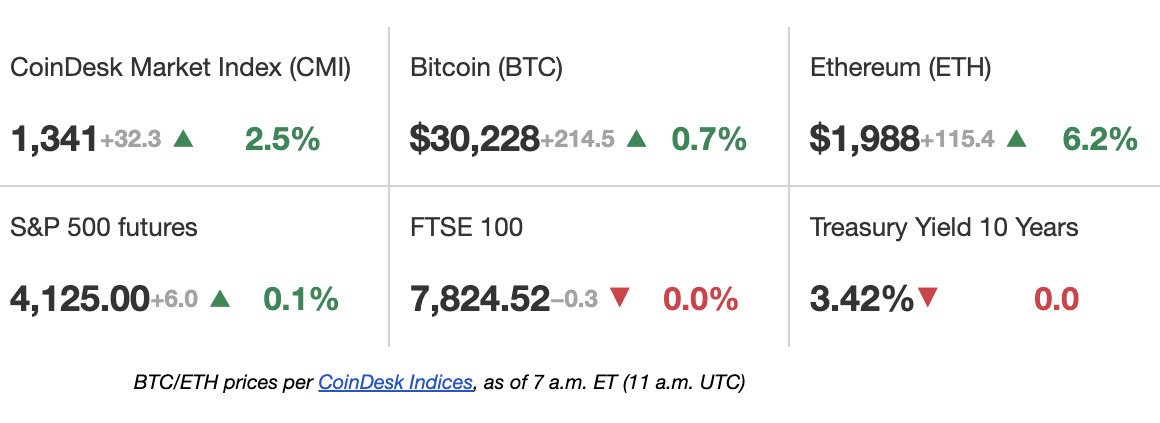

Following Ethereum’s Shanghai upgrade, which went live Wednesday evening, ether has gained just over 3%, approaching the $2,000 mark. Prices rose as deposits into the Ethereum network outpaced withdrawals, disappointing bears expecting a mass outflow of coins following the upgrade. The native token of Ethereum’s blockchain outperformed market leader bitcoin, having lagged in the lead up to the upgrade. “We’re seeing a ‘sell the rumor buy the fact’ redux,” Paradigm’s David Brickell said. Analysts were divided on potential price action in the days prior to the upgrade, with many predicting that fresh supply would increase sell pressure, with others anticipating a psychological battle of traders punishing the over-crowded short trade.

Crypto exchange Kraken led ether’s unstaking parade, making up 62% of the exit queue, according to on-chain data tracked by the Rated network explorer. The number of validators in the exit queue had surpassed the 15,000 mark at press time, per Parsec Finance. Kraken’s dominance of the unstaking queue is largely expected, given the legal issues it has faced with the U.S. Securities and Exchange Commission (SEC). In February, the SEC determined Kraken’s staking offerings – but not staking programs offered by competing exchanges – to be unregistered securities.

Trading platform eToro is set to offer trading services of crypto and other assets directly to Twitter users via a new partnership with the social media company, the firm announced Thursday. The new service – named “$Cashtags” – is available from Thursday and will see the social investing firm provide its users with real-time prices for cryptocurrencies, stocks and other assets while directing them to the eToro platform to make trades. The news was first reported by CNBC and then confirmed by eToro on its official Twitter account. $Cashtags aligns with Twitter owner Elon Musk’s plans to integrate financial services into the platform, as part of his intentions to create a “super app.” “The next bull market is going to be wild,” trader and analyst Alex Kruger, tweeted, referring to the eToro/Twitter tie-up.

-

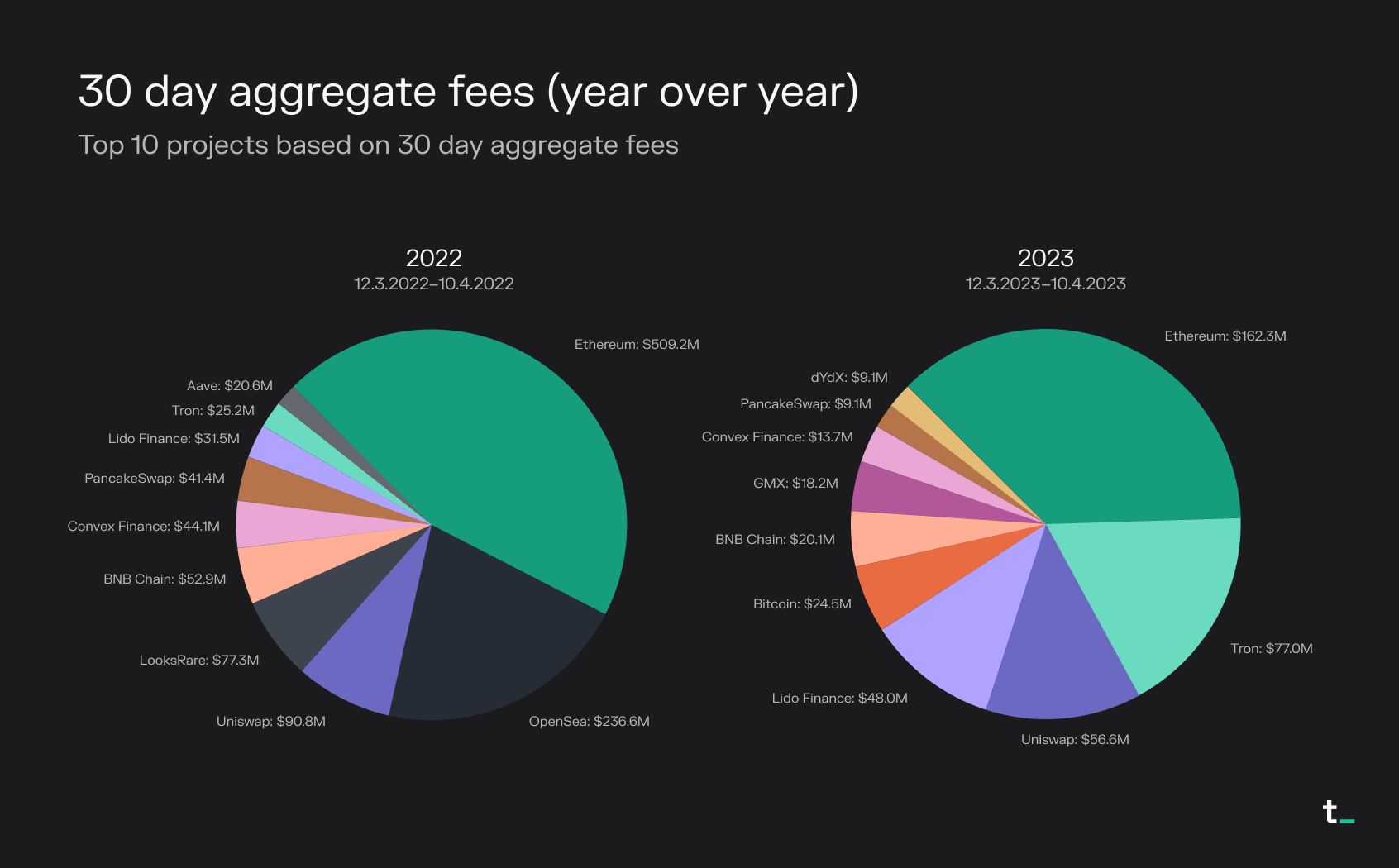

The chart shows the top projects in all crypto market sectors based on the total fee earned in the past 30 days and their year-on-year growth.

-

While Ethereum remains the top fee generation, its share of total fees paid in the market has gradually declined. Meanwhile, Ethereum’s competitor Tron has entered the top 10 list this year.

-

“Tron is now vying for market leadership, bolstered by its widespread adoption in emerging markets,” Token Terminal said in an email. Increased network usage often bodes well for native cryptocurrency.

Edited by Stephen Alpher.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.