First Mover Americas: Crypto Markets Stay Down Following SEC Suing Binance

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

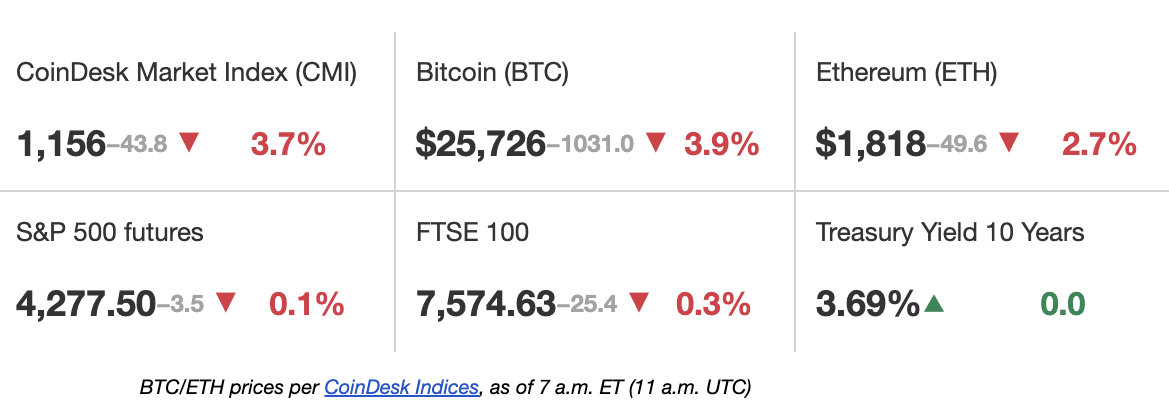

Crypto markets held Monday’s losses on Tuesday, the day after the U.S. Securities and Exchange Commission (SEC) sued crypto exchange Binance and its founder Changpeng “CZ” Zhao on allegations of violating federal securities laws. In the complaint, the SEC also alleged that a number of other tokens are securities. Of these, Decentraland’s MANA has lost the most ground, down 11% over the past 24 hours. Play-to-earn game Axie Infinity’s token AXS lost 10% and Binance’s BNB token fell 7% over the same period. Outflows from Binance across all protocols reached $719 million over the last 24 hours, according to data from Nansen.ai. During U.S. trading hours, net outflows hit $230 million after the SEC announced the suit. Seoul-based crypto analytics firm CryptoQuant pointed out that the withdrawals are well within historical norms.

U.S. Bankruptcy Court Judge Sean Lane extended a mediation period between crypto lender Genesis and its creditors at a Monday hearing as tensions flared over the role Genesis’ parent company, Digital Currency Group (DCG), would play in the lender’s restructuring. The period, slated to end last month, will now conclude on June 16. Judge Lane appointed a mediator to steer talks between the insolvent lender and its creditors on May 1 after discussions between the parties broke down earlier this year. “There’s lots of different kinds of conversations that have to happen in connection with [bankruptcies],” Lane said during the hearing. “The challenge always, of course, is that you can’t negotiate everything all at once.” Digital Currency Group is also the parent of CoinDesk.

The SEC’s lawsuit against Binance could be a preview of what may be coming down the road for rival crypto exchange Coinbase (COIN), Berenberg analyst Mark Palmer wrote in a note on Monday. “We observe that several of the details of the lawsuit that the commission filed against Binance echo those it previously filed against crypto exchanges Bittrex and Kraken, and we believe these cases in aggregate represent a preview of the action that is likely to be filed against COIN,” Palmer said. In March, Coinbase received a warning from the SEC that it may soon receive enforcement action tied to its listing of potential unregistered securities. “We estimate that at least 37% of COIN’s net revenue would be at risk if the SEC were to target the company’s crypto token trading and staking operations,” noted Palmer, who maintained a hold rating and $55 price target on the stock. Coinbase has 11 buy ratings, 7 holds and 6 sell ratings, according to FactSet data.

Edited by Sheldon Reback.