First Mover Americas: Crypto ETPs Gained $2.2 Billion of Investment in 2023

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/HRGLXBUHGNERFP34DTL6RHXWHQ.png)

Top Stories

Investors poured over $2 billion into digital-asset investment exchange-traded products (ETPs) in 2023, making it the third-largest year for net inflows dating back to 2017, according to data provided by CoinShares. At $2.2 billion, inflows were more than double those of 2022. Most of the money hit in the final quarter, said CoinShares’ James Butterfill, as it became “increasingly clear that the SEC was warming up to the launch of bitcoin spot-based ETFs in the United States.” The final week of 2023 alone saw $243 million of net inflows into digital asset ETPs.

Ether (ETH) prices might gain in the coming weeks after crypto lender Celsius, which is restructuring in bankruptcy proceedings, said it will unstake its holdings of the second-largest cryptocurrency, removing a factor that may have contributed to the token’s underperformance in recent months. The company, which is converting to become a bitcoin miner, had previously said it would include staking in its activities. The firm has been selling staking rewards on the open market to cover costs associated with the reorganization plan. “Celsius will unstake existing ETH holdings, which have provided valuable staking rewards income to the estate, to offset certain costs incurred throughout the restructuring process,” the firm said in an X post. “The significant unstaking activity in the next few days will unlock ETH to ensure timely distributions to creditors.”

Celestia’s TIA token gained over 22% in the past 24 hours, bucking the muted broader market trend, as investor interest in staking the token gained momentum alongside rising hype for the blockchain’s underlying technology. TIA traded at just under $17 in the early Asian morning hours Friday before giving back some gains. It recorded nearly $800 million in trading volume in the past 24 hours, its highest to date, data from CoinGecko shows. Staking involves locking coins in a cryptocurrency network in return for rewards. Doing so with TIA on native platforms yields between 15% to 17% annually, minus fees, to users. The unusually high yield compared with the so-called risk-free rate of 4% offered by the U.S. 10-year Treasury note seems to be drawing demand for the cryptocurrency. As of Friday, the market capitalization of TIA is just under $2 billion – meaning as valuations likely grow further in a bull market, participants could make money from both the inflated value of rewards and the initial staked capital.

Chart of the Day

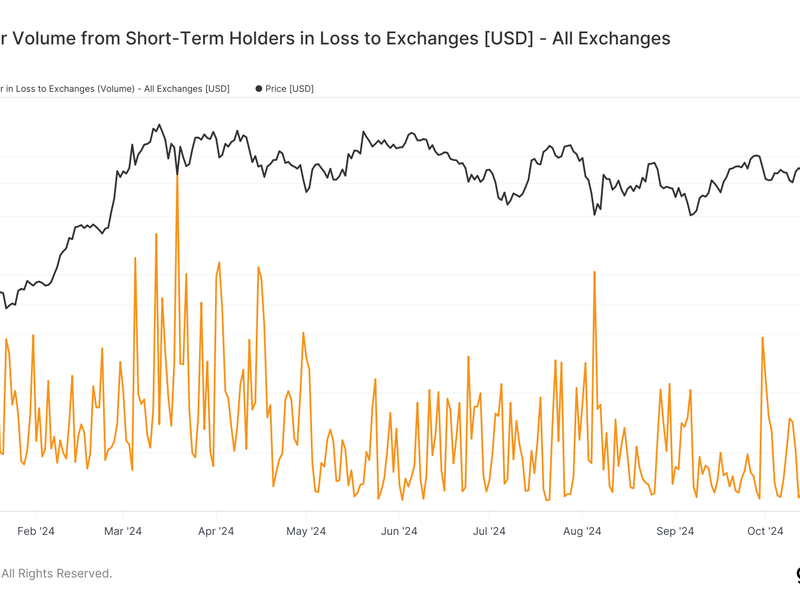

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/DX2JGGD5IVEKFF4LDELDCFJAWU.png)

-

The chart shows bitcoin’s 1% market depth, or collection of buy and sell orders within 1% of the mid-price – the average of the bid and the ask/offer prices.

-

The market depth, a gauge of assessing order book liquidity, shows how easy it is for traders to trade large quantities at stable prices.

-

While bitcoin rallied 60% in the final three months of 2023, the 1% market depth failed to recover from the dip brought by Alameda’s demise in late 2022.

-

Perhaps the situation will improve following the anticipated launch of spot ETFs, as some analysts project.

-

Source: Kaiko

Trending Posts

Edited by Sheldon Reback.