First Mover Americas: BTC Recovers From Friday’s Slide to Reclaim $68.5K

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

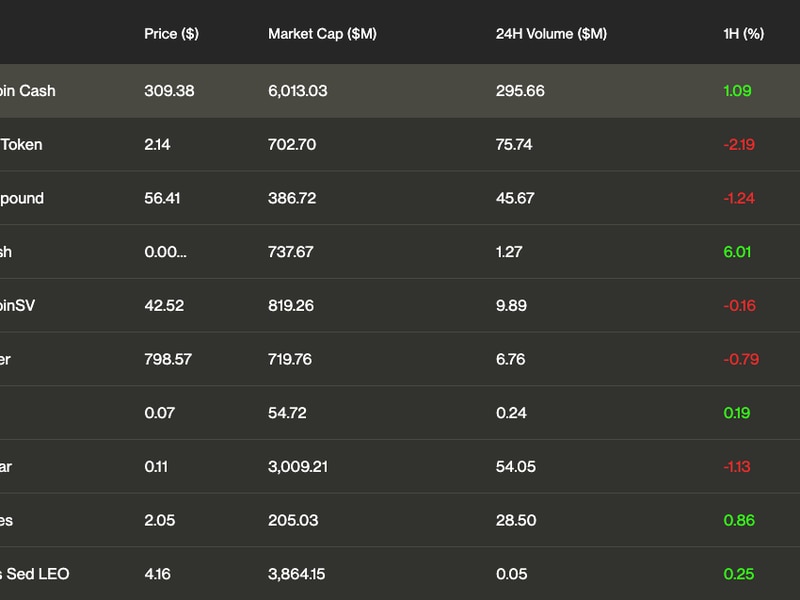

Latest Prices

00:52

Ether ETFs Saw Biggest Outflows Since July

01:01

Bitcoin Breaks $64K While Gold Soars

00:56

ETH/BTC Ratio Slid to Lowest Since April 2021

00:57

Is Bitcoin Losing Its Bullish Momentum?

CoinDesk 20 Index: 2,079.56 +2.23%

Bitcoin (BTC): $68,574 +2.37%

Ether (ETH): $2,527.30 +2.58%

Nikkei 225: 38,605.53 +1.82%

Top Stories

Bitcoin returned to $68,500 early in the European morning, continuing its rally that recommenced on Sunday. BTC fell as low as $65,700 late Friday after the – Wall Street Journal reported that the DOJ is probing Tether for violations of sanctions and anti-money laundering rules. Tether quickly denied the report, putting a floor under the cryptocurrency’s price. Bitcoin erased its losses over the course of the weekend, rising over 2.4% in the last 24 hours to trade at nearly $68,700. ETH and SOL have registered similar gains as the broader crypto market has climbed over 2%, as measured by the CoinDesk 20 Index. Memecoin DOGE has enjoyed the healthiest bounce, trading around 6% higher at over $0.145.

MicroStrategy’s premium to its BTC stash is unsustainable, according to a research report by Steno Research. The new provision for options on spot bitcoin ETFs will lessen demand for MSTR stock meaning the 300% premium will not last, the report said, adding that during the 2021 bull market, it was below 200% most of the time. MicroStrategy’s recent 10:1 stock split’s positive effects are also diminishing, analyst Mads Eberhardt wrote. As regulators become more favorable to bitcoin and crypto in general, investors may choose to hold bitcoin directly instead of MicroStrategy stock, according to the report. If Donald Trump is re-elected as president, this regulatory trend is expected to continue.

Hong Kong Exchanges and Clearing will launch a virtual asset index series on Nov. 15. The index will be administered and calculated by CCData, a UK-registered benchmark administrator and virtual asset data and index provider. CCData is owned by CoinDesk. The index series will include a reference index for bitcoin and ether, as well as a reference rate for bitcoin and ether. “By offering transparent and reliable real-time benchmarks, we seek to enable investors to make informed investment decisions, which will in turn support the development of the virtual asset ecosystem and reinforce Hong Kong’s role as an international financial center,” said HKEX CEO, Bonnie Y Chan.

Chart of the Day

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/IGPD7HSZRVBDHMWUV2YRQBLOTI.png)

-

The chart shows bitcoin’s price and the year-on-year growth in the aggregate M2 money supply of the four major central banks – U.S. Federal Reserve, European Central Bank, Bank of Japan, and People’s Bank of China.

-

The M2 grew 7.5% last month, the fastest since November 2021.

-

BTC’s previous bull runs have been characterized by faster growth in the M2.

-

Source: MacroMicro

Trending Posts

Edited by Omkar Godbole.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

have been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of

editorial policies.

CoinDesk has adopted a set of principles aimed at ensuring the integrity, editorial independence and freedom from bias of its publications. CoinDesk is part of the Bullish group, which owns and invests in digital asset businesses and digital assets. CoinDesk employees, including journalists, may receive Bullish group equity-based compensation. Bullish was incubated by technology investor Block.one.