First Mover Americas: BTC Flirts With $68K Amid ETF Inflows

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

00:52

Ether ETFs Saw Biggest Outflows Since July

01:01

Bitcoin Breaks $64K While Gold Soars

00:56

ETH/BTC Ratio Slid to Lowest Since April 2021

00:57

Is Bitcoin Losing Its Bullish Momentum?

CoinDesk 20 Index: 2,056.00 +1%

Bitcoin (BTC): $67,818.38 +1.35%

Ether (ETH): $2,625.15 +0.85%

Nikkei 225: 38,981.75 +0.18%

Top Stories

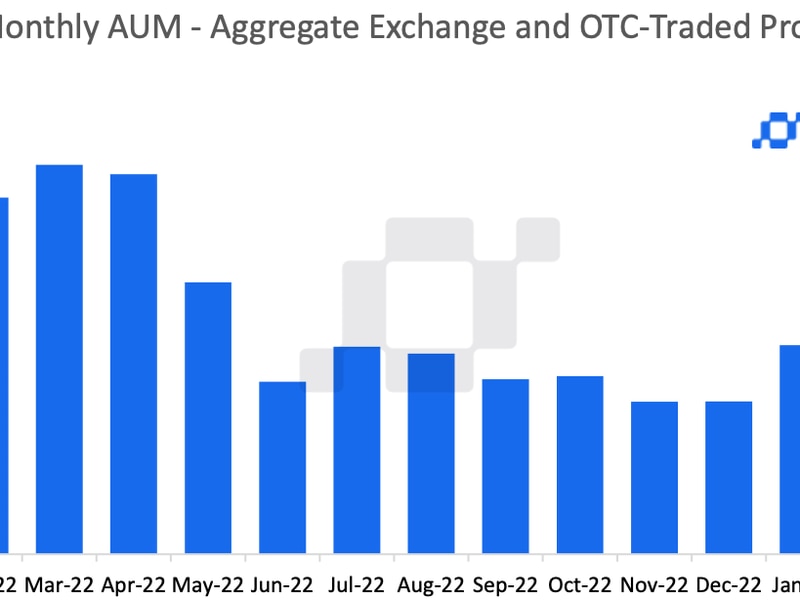

Bitcoin made another attempt to establish a foothold above $68,000 early in the European morning before pulling back and trading around $67,800. BTC has gained about 1.35% in the last 24 hours, outperforming the broader digital asset market, as measured by the CoinDesk 20 Index, which is just under 0.8% higher. Bitcoin has also risen nearly 9% this week, according to CoinDesk Indices, amidst strong uptake for spot BTC ETFs. The U.S.-listed funds have seen inflows of $1.86 billion since Monday, which, even with one day remaining, is their highest tally since the second week of March, according to data compiled by SoSoValue.

Globally, bitcoin ETPs have enjoyed their best week since July, according to bold.report. ETPs have registered a cumulative inflow of 25,675 BTC ($1.74 billion) in the last seven days, as investors worldwide have scrambled to gain exposure to bitcoin amidst its latest rally. The U.S.-listed ETFs’ inflows of nearly $1.9 billion are the equivalent of 21,450 BTC. To put this into perspective, the bitcoin ETF investors have purchased around 48 days of mined supply, as roughly 450 BTC get mined daily. These spot ETFs have now taken over $20 billion in net inflows since inception, an impressive feat as it took Gold ETFs about five years to reach the same number, according to Bloomberg’s ETF Analyst Eric Balchunas.

Dogecoin jumped late U.S. hours Thursday as entrepreneur Elon Musk further revealed plans for his proposed “Department of Government Efficiency” at a Pennsylvania town hall. The event encouraged early voting in the crucial state where Republicans and Democrats are in lockheads. DOGE has risen over 9% to over 13 cents for the first time since late July, beating the broader market and bitcoin’s 1% rise in the past 24 hours. It extended one-week gains to over 22%, the highest among all major tokens. Musk has emerged as a key backer of Republican Donald Trump’s presidential campaign in the past months. He has donated over $75 million to the American PAC since July and is scheduled for several campaign appearances in Pennsylvania this month.

Chart of the Day

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/R2BAFDJ3GZHCVJ6RLJJYIOEFVI.png)

-

The chart shows daily Bitcoin transaction fees in USD and BTC’s price.

-

Transaction fees spiked to $67,300 Thursday, the highest single-day tally since Aug. 22.

-

Renewed bullish price action in Bitcoin-based memecoins likely catalyzed the spike in transaction fees, according to IntoTheBlock.

-

Source: Artemis

Trending Posts

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

have been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of

editorial policies.

CoinDesk has adopted a set of principles aimed at ensuring the integrity, editorial independence and freedom from bias of its publications. CoinDesk is part of the Bullish group, which owns and invests in digital asset businesses and digital assets. CoinDesk employees, including journalists, may receive Bullish group equity-based compensation. Bullish was incubated by technology investor Block.one.