First Mover Americas: BTC Crosses $30K and Bitcoin Layer 2 Stacks Networks Gains 15%

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Bitcoin extended its rally on Thursday after surpassing the $30,000 mark for the second time this year the day before. Bitcoin rose almost 5% in the past 24 hours to $30,219. The cryptocurrency has been on an upward trajectory since last week after BlackRock announced it had applied to the U.S. Securities and Exchange Commission for a spot bitcoin exchange-traded fund (ETF). Amongst altcoins, Stacks (STX), the native token of Bitcoin layer 2 Stacks Network, gained 16% on the day. Some traders have been speculating that with the recent positive news for bitcoin from institutional players, other assets related to bitcoin have also performed well. For example, litecoin and bitcoin cash are also up on the week.

CACEIS, the asset servicing arm of banking giants Credit Agricole and Santander, has been registered by French regulators to provide crypto custody services. CACEIS Bank, which provides services to asset managers such as insurers, pension funds and private equity, was registered by the Financial Markets Authority (AMF) as of Tuesday, June 20, according to the regulator’s website. It joins other traditional finance firms such as Societe Generale’s Forge and AXA Investment Managers in being recognized under one of the most advanced crypto regulatory frameworks in Europe, as the European Union prepares to impose new crypto licensing rules known as MiCA as of 2024.

Three Arrows Capital (3AC) is stirring up the crypto community again, this time with a surprise comeback using the same name, only in the guise of a venture capital (VC) firm. On Wednesday, OPNX, the bankruptcy claims exchange co-founded by CoinFLEX executives and two people behind the defunct 3AC hedge fund, said it has a new partner: 3AC Ventures. The partners will “invest in projects building in the OPNX ecosystem and working toward a decentralized future,” OPNX tweeted. 3AC Ventures has a website that says the new firm “is focused on superior risk-adjusted returns without leverage.” Hedge fund 3AC collapsed last year after suffering heavy losses during the implosion of Terra’s LUNA stablecoin.

-

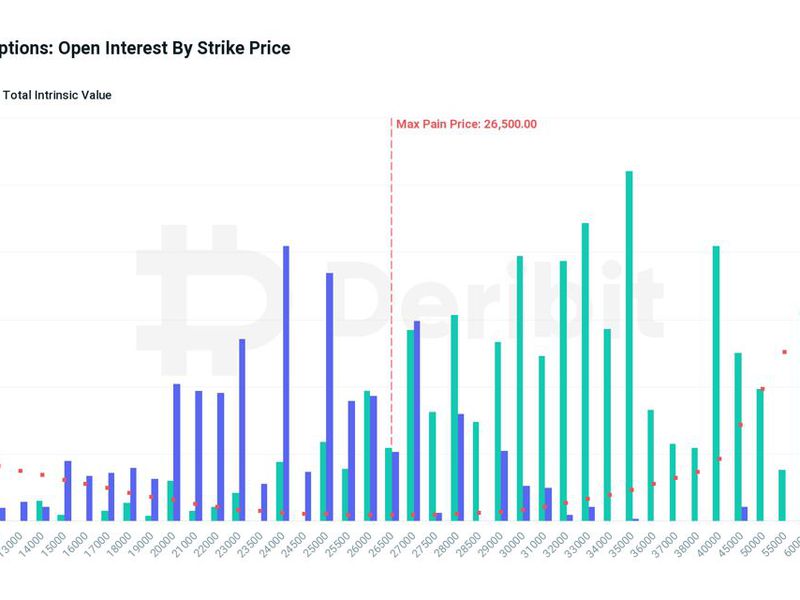

The chart shows changes in bitcoin’s price and the 12-, 26- and 50-day simple moving averages (SMA) of the cryptocurrency’s price since January.

-

“We are watching for the 12-day SMA to pass through the 26-day SMA…this cross has been a strong buy signal in the past,” over-the-counter liquidity network Paradigm said in a market note.

Edited by Sheldon Reback.